Bitcoin’s price stayed subdued on December 25 as renewed activity from large holders, including whale transfers to exchanges, combined with continued outflows from US spot Bitcoin ETFs, unsettled market sentiment, raised concerns about potential sell pressure, and left traders cautious despite BTC holding above key technical support levels overall market.

Bitcoin ETFs See Continued Outflows, Weak Demand

A long-inactive Bitcoin whale and asset manager BlackRock moved large sums of BTC to centralized exchanges on the day according to blockchain analytics firm Onchain Lens.

BlackRock had invested 2,292 BTC that had a value of about 199.8 million dollars in Coinbase. In another transaction, a whale wallet that was dormant in eight years transferred 400 BTC, worth about 34.92 million, to the OKX exchange.

Traders keep a close eye on such transfers, which massive deposits to exchanges would typically suggest to them that there is sell-side pressure.

No direct spot selling was established, but the flows were sufficiently sufficing to place market participants on their toes.

The warning sound was supported by the ongoing weak institutional flows. According to the data provided by SoSoValue, U.S. spot Bitcoin ETFs experienced their fifth day in a row of net outflows. The continual withdrawals were an indication that the institutional demand was still weak despite the fact that Bitcoin was trading above key technical support levels.

- Source: SoSoValue

Bitcoin Leverage Declines as Traders Reduce Risk

Meanwhile, there was an overall fall in leverage in the derivatives market. BTC was trading around $87,700 at press time, falling about 0.35% on the day. According to CoinGlass, open interest was dropped at 0.99% to $57.42 billion, which means that traders were not taking on risk as they were not aggressively positioning themselves to expect a price breakout.

- Source: Coinglass

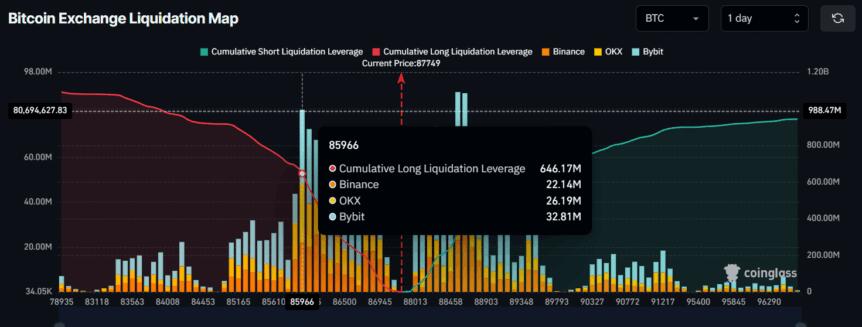

Positioning information suggested areas of bullish conviction in spite of the leverage pullback. The Liquidation Map of CoinGlass indicated that its largest concentration of leverage was on the downside and on the upside to $85,966 and 88,636 respectively.

The long leveraged positions (of a total of around 646.17 million) were concentrated nearer to the bottom whereas the short leveraged positions (of the total of around 422.42 million) were concentrated above the Bitcoin price, indicating that the traders were generally confident that BTC would be above the zone of support of 85,966.

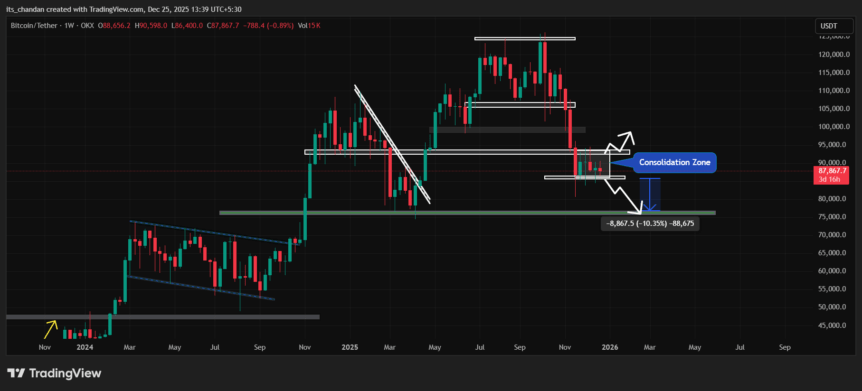

In a larger technical context, BTC is stuck in a range of consolidation. The weekly chart analysis indicates that BTC has been trading at an average bottom of about $86,000 to a top of about $93,500 since mid-November. Such long periods of steady consolidation are, in the past, usually followed by sharp swings in one way or the other.

- Source: Tradingview

Since Bitcoin has been fluctuating around the lower part of this range, there has been an increased fear of a possible breakdown. Technical analysts believe that a daily close below the support of the $86,000 may open up to further decline.

On the contrary, the bearish view would be nullified in case BTC were to advance beyond the upper resistance at about 93,500 mark and herald another bullish breakout.

Whale action, ETF outflows, and to a certain extent, thinning leverage have so far joined hands to hold the Bitcoin traders squarely on the defensive side.