Key Insights

- US layoffs rise sharply, weakening consumer spending and market confidence.

- Crypto market cap drops 8%, with forced liquidations hitting 1.34B in Bitcoin.

- Bitcoin shows strong correlation with S&P 500 and gold amid macro selloff.

What Sparks Recession Debate?

The US economy shows signs of stress, with rising layoffs and weak hiring fueling recession fears. In January 2026, companies reported over 108,000 job cuts, the highest since 2009. Meanwhile, vacancy opportunities declined to 6.9 million, which is significantly below the projections. Such a decline in jobs could decrease consumer expenditure, impacting economic growth and investor confidence in high-risk assets like cryptocurrencies.

Housing data also contributes to economic issues. The gap between the home sellers and buyers is at an all-time high of 530,000. Reduced housing demand also affects construction employment, bank lending, and general consumer confidence that can add even more strain on financial markets.

Tech Debt and Bond Market Pressures

Stress in the technology credit sector is intensifying. Tech loan distress reached 14.5%, while bond distress climbed to 9.5%, highlighting challenges in debt management. Around $25 billion in software loans are trading at deep discounts. Previously, crypto and stock markets operated independently, but the correlation between the two has increased in recent years, causing crypto to respond sharply to stock market declines.

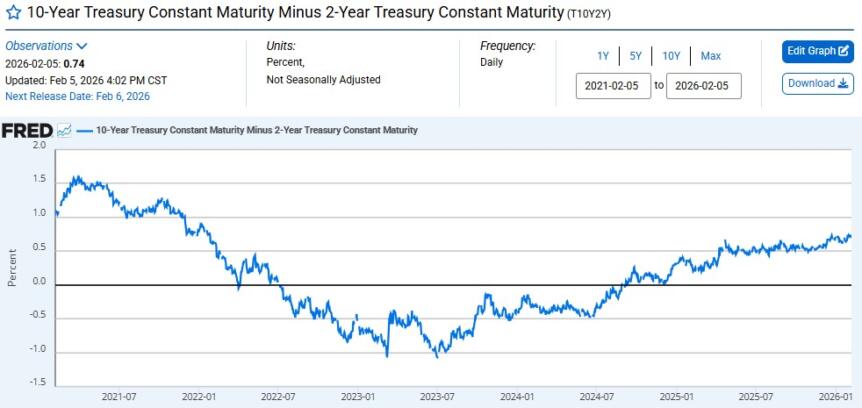

The bond market also signals caution. The 2-year versus 10-year Treasury yield spread moved to approximately 0.74%, known as bear steeping.

This trend, seen historically before recessions, indicates rising long-term yields relative to short-term rates, which can signal investor concern over future economic growth.

Crypto Market Reacts to Macro Risks

The crypto market tracked declines in traditional markets. The crypto market cap fell by 8% in 24 hours, to approximately $2.22 trillion. Trading volume rose more than 80% as liquidations increased. Bitcoin alone saw more than $1.34 billion of positions liquidated, while leading altcoins such as XRP and Solana posted sizable intraday losses.

Statistics show a 92% correlation between Bitcoin and the S&P 500 and an 80% correlation between cryptocurrency and gold, suggesting macroeconomic factors drove Bitcoin’s decline.

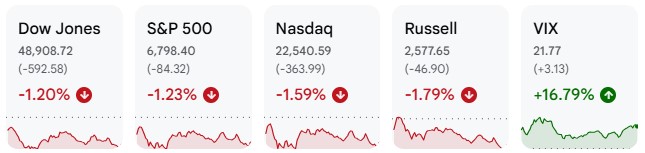

According to U.S. stock market data: S&P 500 fell 84.32 points to around -1.23%, Dow Jones dropped 1.20%, Nasdaq fell 1.59% to 363.99, and the Russell fell 1.79%.

Source: Google Finance

Analysts hope that any Federal Reserve open market operations or changes in rates would inject liquidity and take pressure off risk assets, potentially leading to a market recovery.