- Friday’s crypto crash caused a record $19 billion liquidation, with open interest on decentralized exchanges plummeting from $26 billion to under $14 billion.

- Despite the chaos, data suggests most of the liquidation was a controlled, organic process, not a market cascade.

- Market participants recorded a peak of $20 million in lending protocol fees in a single day, alongside a surge in weekly DEX volumes exceeding $177 billion.

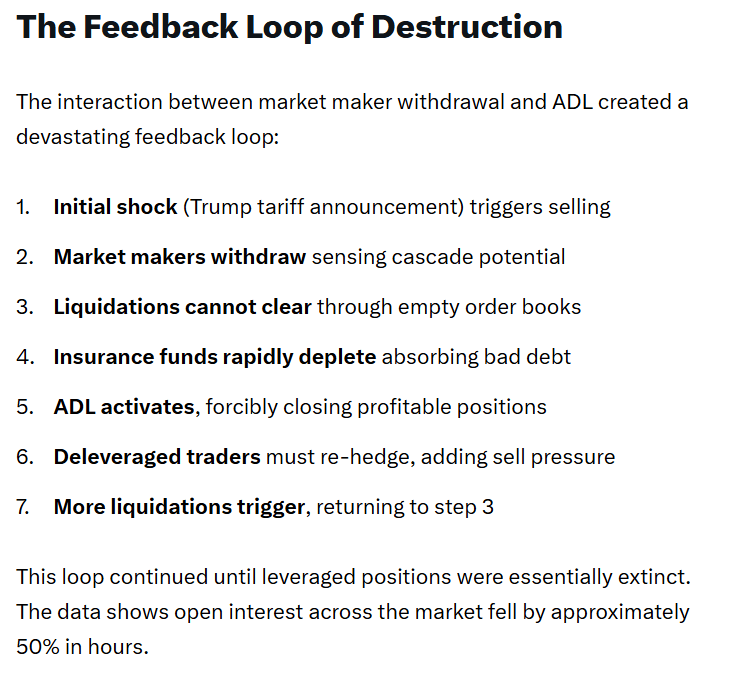

- Some analysts and blockchain data points indicate liquidity withdrawals by major market makers exacerbated the sell-off, creating a “liquidity vacuum.”

- Concerns about manipulation and withdrawal of liquidity persist, especially as some market makers reportedly abandoned their roles during critical moments.

Market Response to the Record Liquidation

Friday’s crypto market upheaval, marked by a $19 billion liquidation event, has left traders divided. Some allege that market makers deliberately pulled liquidity, creating a cascade that intensified the sell-off, while others argue the decline was part of a natural deleveraging cycle in volatile conditions.

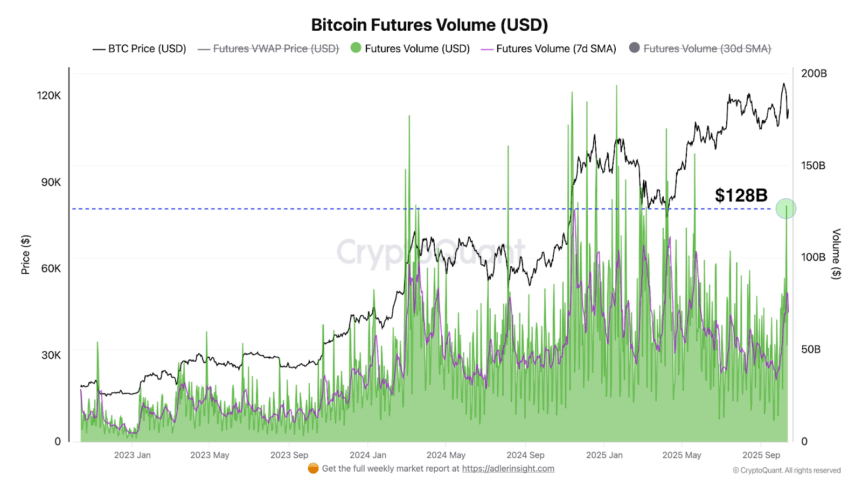

On the technical front, open interest for perpetual futures on decentralized exchanges (DEXs) fell sharply from $26 billion to below $14 billion, as reported by DefiLlama. Simultaneously, crypto lending protocol fees hit a record high of over $20 million, reflecting intense trading activity during the recovery phase. Weekly DEX volumes also surged past $177 billion, indicating heightened market engagement. Notably, overall borrowed funds across lending platforms declined below $60 billion for the first time since August, signaling a potential reduction in leverage.

Organic Deleveraging or Manipulation?

While some traders attribute the crash to external triggers and internal errors, blockchain data suggests much of the liquidation was driven by a natural process of market correction. According to Axel Adler Jr, an analyst at CryptoQuant, the bulk of the $14 billion decline in open interest represented controlled deleveraging, with only about $1 billion in long Bitcoin (BTC) positions liquidated. Adler called this a “very mature moment for Bitcoin,” implying strong resilience during the sell-off.

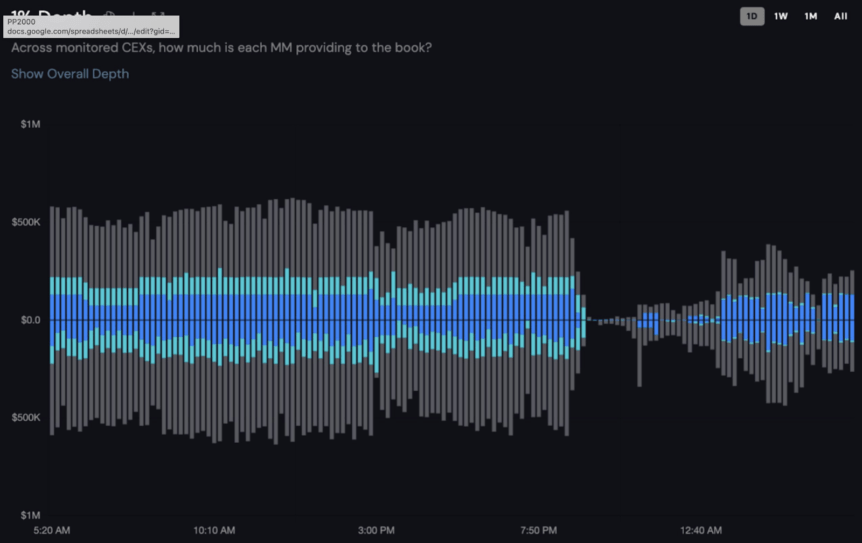

Despite these findings, skepticism remains. Several blockchain observers point to liquidity withdrawals by major market makers as signs of possible manipulation. Data from order books indicate that, starting at 9:00 pm UTC—shortly after U.S. President Donald Trump issued new tariffs—market makers withdrew significant liquidity, creating a “liquidity vacuum” and amplifying the sell-off. By 9:20 pm UTC, token prices bottomed out, and market depth on tracked tokens fell by about 98%, down to just $27,000, according to YQ, a blockchain sleuth.

Similarly, data from Coinwatch revealed a 98% collapse in market depth on Binance, the world’s largest crypto exchange. The platform’s analysis highlighted that liquidity was pulled by market makers when prices plummeted and was only gradually restored hours later, pointing to potential market manipulation during the chaos. One token worth over $5 billion saw two out of three market makers desert their roles for about five hours, further fueling concerns that some actors exploited the turbulence to their advantage.

Such withdrawals have raised alarms about potential market manipulation, especially as liquidity providers and institutional traders have been scrutinized for allegedly withdrawing during critical moments. Coinwatch reports ongoing discussions with market makers aimed at restoring their participation and stability to major trading venues.