Bitcoin experienced a notable downturn this week, slipping below the $100,000 threshold for the first time since June amid a significant sell-off. Long-term holders offloaded roughly $45 billion worth of BTC, reflecting increasing risk aversion in the broader crypto markets. The decline coincides with sharp drops in AI-related stocks, fueling a risk-off sentiment across traditional financial markets. Despite the correction, some indicators suggest Bitcoin can still avoid a prolonged bear market if certain support levels hold.

- Bitcoin dropped over 8% this week, breaking below $100,000 for the first time since June, as investors liquidate holdings amid broader market declines.

- Long-term Bitcoin holders have sold approximately $45 billion worth of BTC, contributing to the recent sell-off.

- The correction is linked to declines in AI stocks, indicating a shift toward risk-off sentiment across markets.

- Despite the correction, Bitcoin remains supported by key technical levels, including its 200-week exponential moving average.

- Analysts suggest US fiscal policy, including potential “stealth QE,” could support crypto markets amid ongoing market volatility.

Market volatility surged this week as Bitcoin’s price slid below key support levels, with BTC dropping over 8% and falling below the $100,000 mark for the first time since June. This decline was amplified by a massive liquidation event where long-term holders offloaded an estimated $45 billion worth of BTC, signaling a shift in investor sentiment amidst turbulent financial conditions.

The sell-off was driven partly by declines in AI-related stocks, which contributed to a broader risk-off environment. Data from The Kobeissi Letter confirmed that Bitcoin has “officially entered a bear market territory” after a roughly 20% correction from its October 6 high, adding to concerns over the impending downside for crypto markets.

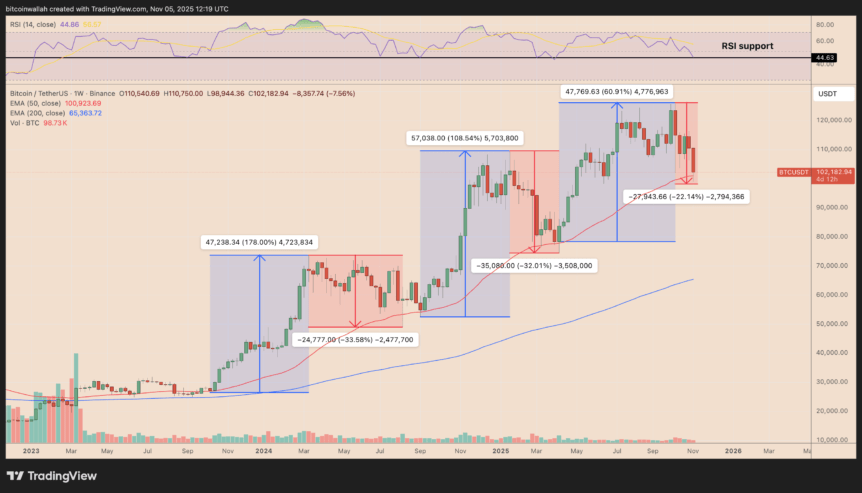

Nevertheless, some technical indicators suggest that Bitcoin could still maintain its long-term bullish trend if certain levels remain intact. Notably, BTC continues to trade above its 200-week exponential moving average (EMA), currently near $100,950. Historically, this level has served as a critical support during major corrections since late 2023, with rebounds often following tests of this support.

Additionally, the weekly relative strength index (RSI) remains near a support zone around 45, historically a precursor to bullish reversals. As long as Bitcoin sustains above this EMA and RSI support, the market retains a structurally bullish outlook. However, a breakdown below both could accelerate downside momentum and deepen the correction.

US Federal Reserve’s Potential “Stealth QE” Could Bolster Bitcoin

Former BitMEX CEO Arthur Hayes predicts that the U.S. Federal Reserve may soon expand its balance sheet again through what he describes as “stealth quantitative easing” (QE). The U.S. is currently running annual deficits nearing $2 trillion, financed predominantly by Treasury debt, with traditional buyers such as foreign central banks and U.S. households not absorbing the growing supply, leaving hedge funds as marginal buyers.

Hayes notes that these hedge funds rely heavily on overnight repo loans—a form of borrowing secured by Treasurys. When liquidity tightens, the Fed’s Standing Repo Facility (SRF) steps in to lend more money, effectively creating new dollars behind the scenes and mimicking a form of QE.

“If the Fed’s balance sheet grows, that is dollar liquidity positive, and ultimately pumps the price of Bitcoin and other cryptos.”

This “stealth QE” could support risk assets and crypto markets, especially as deficits increase and the Fed’s interventions stay covert. Hayes suggests that once liquidity conditions improve, a strong rally for Bitcoin might be on the horizon.

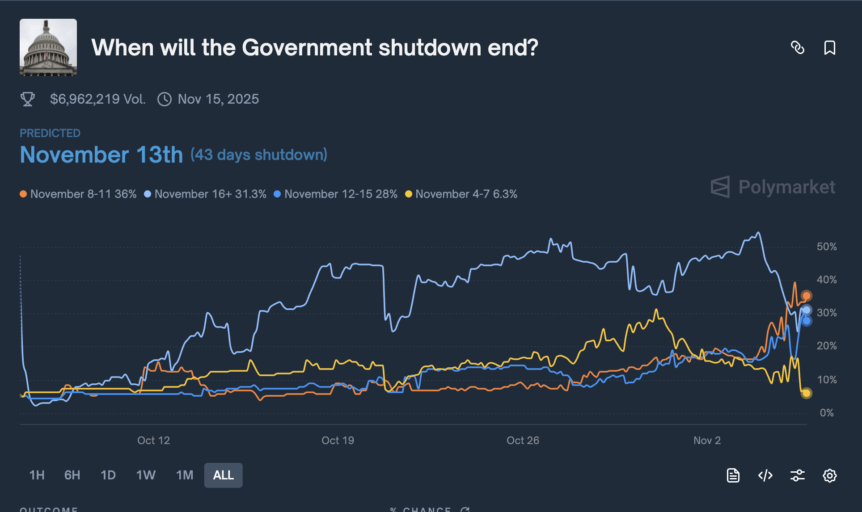

Market Uncertainty Persists Until U.S. Government Shutdown Is Resolved

However, ongoing political deadlock and the potential U.S. government shutdown continue to create market volatility. The shutdown’s resolution is expected in the coming days, with increasing odds suggested by betting markets that it could be resolved as early as next week. These developments impact liquidity and coin prices, with Treasury debt issuance further draining dollar liquidity for the time being.

As the government delays replenishing its accounts, Bitcoin’s recent decline is partly attributed to this liquidity squeeze. Hayes warns traders not to mistake this ongoing stagnation for market top, as the underlying dollar plumbing suggests an impending liquidity surge that could propel Bitcoin higher once political uncertainties are cleared.

“The system only has two modes,” Hayes concludes. “Print money or destroy money. Right now, it’s the latter—but not for long.”