Bitcoin Magazine

Bitcoin Price Prepared for Significant Movement as Volatility Decreases

Bitcoin seems to be on the edge of a significant price shift, with recent data indicating that volatility may make a substantial comeback. Analyzing the key indicators is crucial in grasping the scale and direction of the forthcoming price action, especially as Bitcoin’s price has remained relatively stagnant in recent weeks.

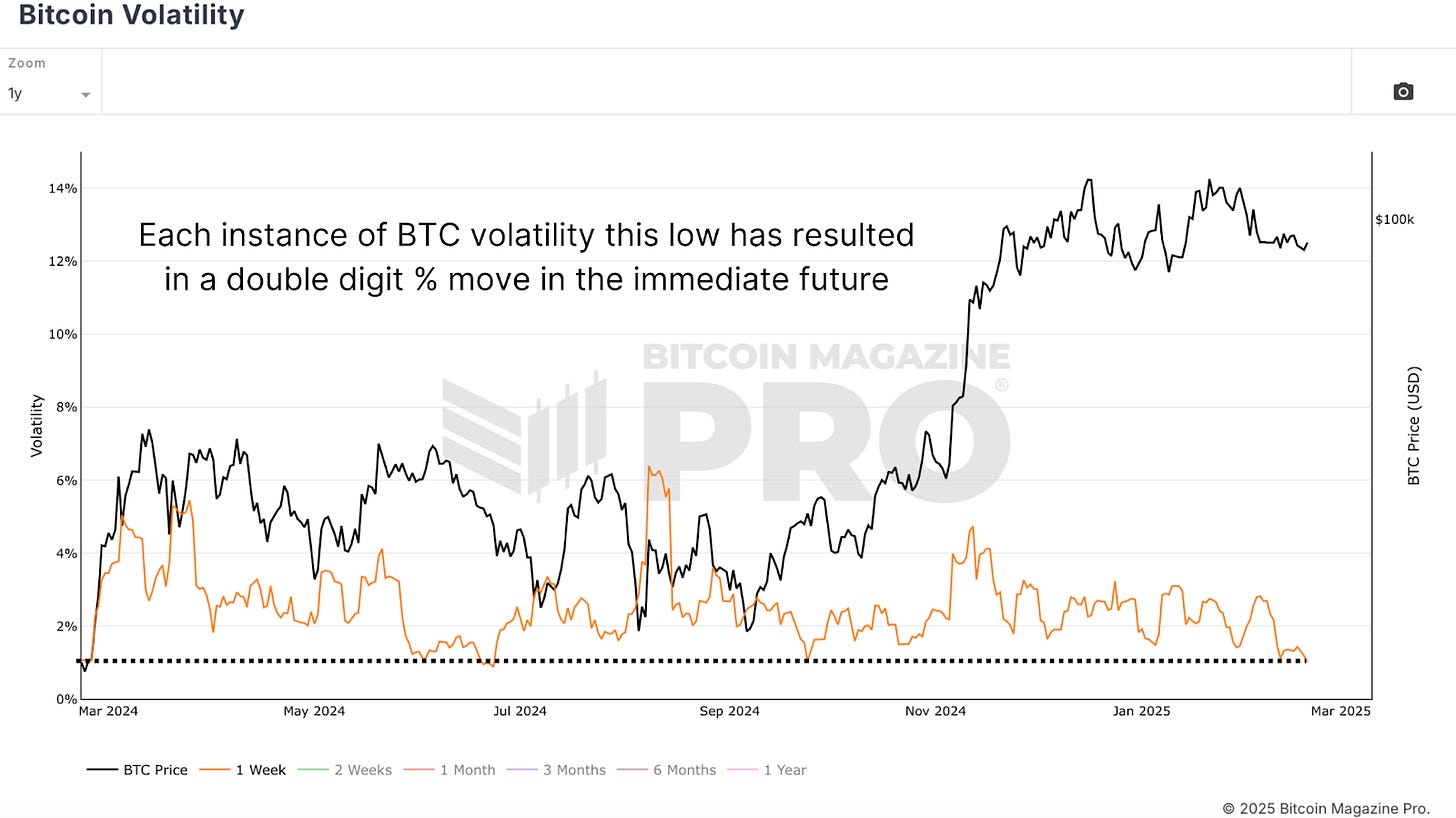

Current State of Volatility

To begin, we can look into Bitcoin Volatility, which meticulously tracks both price movements and volatility trends over time. Recent data focused on weekly volatility shows that Bitcoin’s price has stabilized, averaging around the $90,000 mark. This extended period of horizontal price action has led to a significant drop in volatility—Bitcoin is currently exhibiting some of its most stable price behavior observed in recent history.

Historically, it is uncommon for volatility to reach such low levels, and when it does, it is typically for short durations. Reviewing previous instances of similarly low volatility reveals that Bitcoin often follows with significant price movements:

– An increase from $50,000 to a then all-time high of $74,000.

– A decline from $66,000 to $55,000, succeeded by another surge to $68,000.

– A stagnation period around $60,000 prior to a jump to $100,000, its current record high.

In the past, whenever volatility has dipped to this level, Bitcoin has recorded price fluctuations of at least 20-30% in the subsequent weeks, if not more.

Bollinger Bands Analysis

In support of this notion, the Bollinger Bands Width indicator—an essential tool assessing volatility through price deviations from a moving average—also indicates that Bitcoin is positioned for a notable move. Currently, the quarterly Bollinger Bands are at their narrowest since 2012, suggesting extreme price compression. Last time this occurred, Bitcoin witnessed a remarkable 200% price increase within weeks.

By examining historical examples of similar tight Bollinger Band configurations, we find notable occurrences:

– In 2018, a drastic 50% drop from $6,000 to $3,000.

– In 2020, a breakout from $9,000 to $12,000, eventually leading to a rally up to $40,000.

– In 2023, a slow accumulation around $25,000 followed by a rapid rise to $32,000.

Anticipated Direction

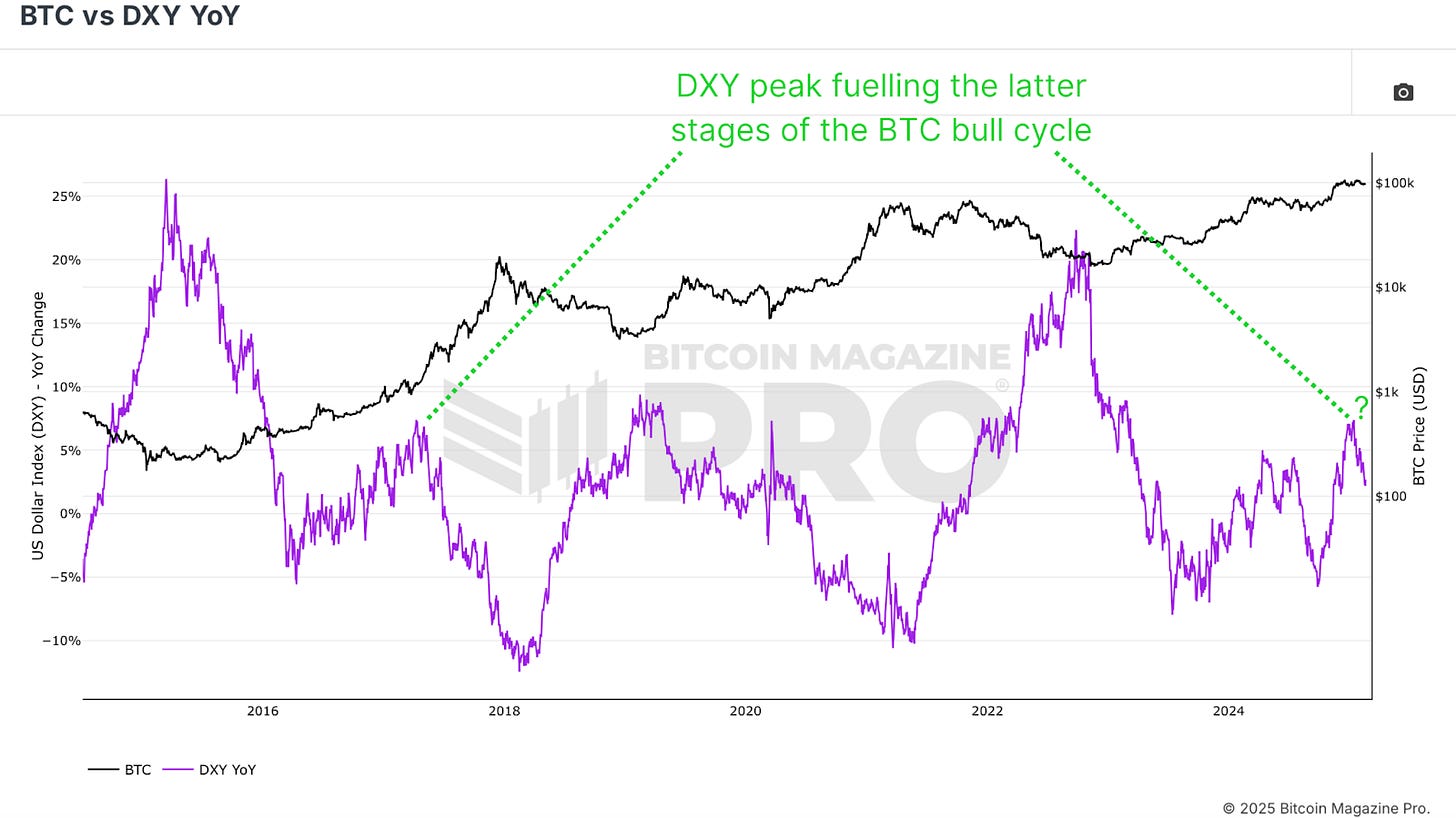

While predicting direction is more complex than forecasting volatility, certain indicators provide insights. A significant clue is the US Dollar Strength Index (DXY) Year-Over-Year, which has historically shown an inverse relationship with Bitcoin’s price. Recently, the DXY saw substantial gains, yet Bitcoin remained resilient, suggesting inherent strength amidst challenging macro conditions.

Moreover, political dynamics could influence Bitcoin’s trajectory. When Donald Trump assumed the presidency in 2017, the DXY decreased, correlating with Bitcoin’s explosive rise from $1,000 to $20,000. A similar scenario may unfold in 2025, potentially replicating this trend.

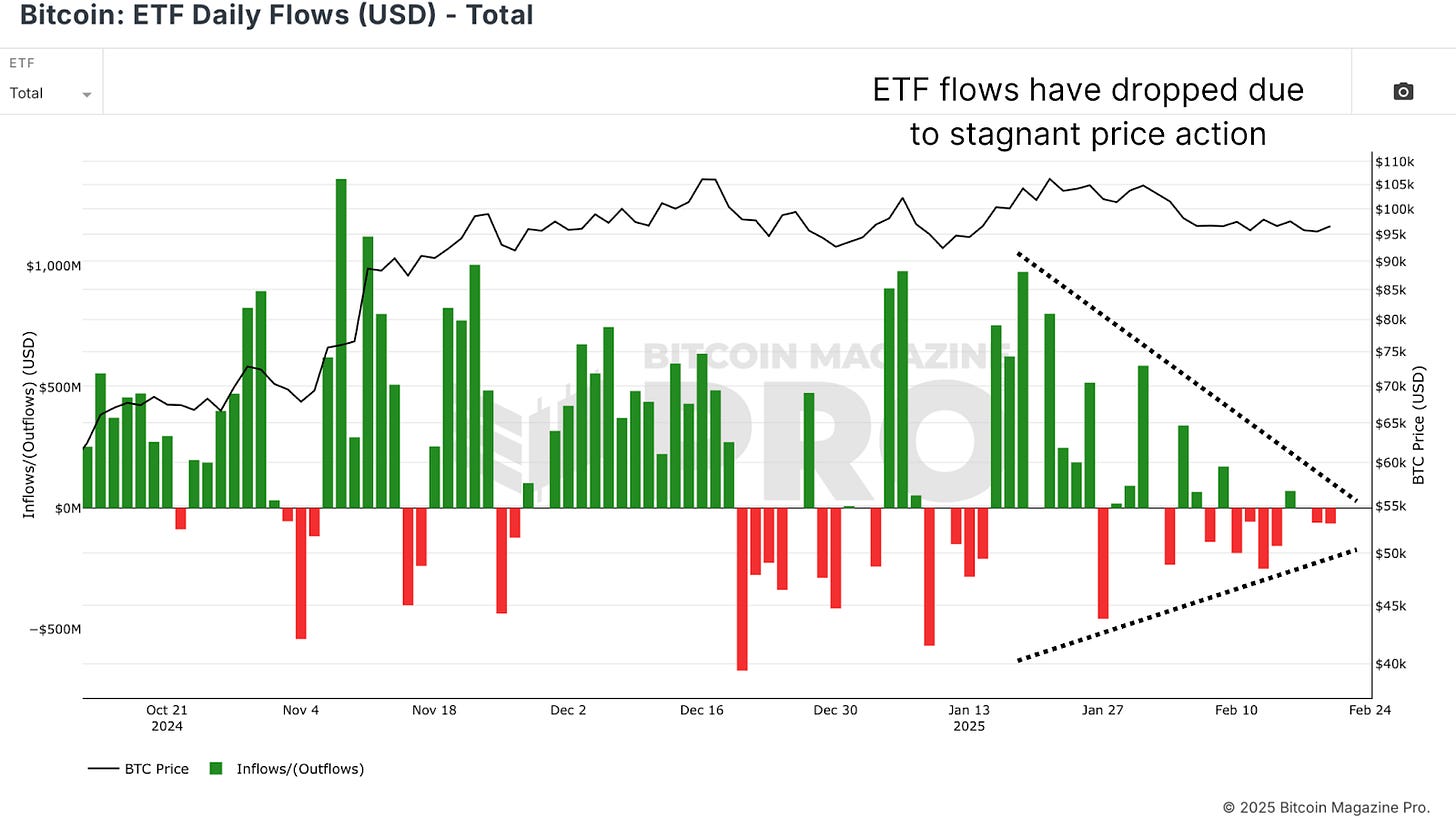

Impacts of ETF Inflows

In addition, Bitcoin ETF inflows, which serve as an indicator of institutional demand, have noticeably decreased during this low volatility phase. This suggests that large investors may be awaiting clear signals of a breakout before increasing their positions. If volatility makes a comeback, renewed institutional interest could propel Bitcoin’s price to new heights.

Final Thoughts

The current state of Bitcoin’s volatility is among the lowest recorded historically, and such conditions rarely persist for extended periods. Extensive volatility compression typically sets the framework for dramatic market shifts. Although data indicates that a significant price movement is on the horizon, whether it trends bullish or bearish is contingent upon macroeconomic factors, investor attitudes, and institutional inflows.

For comprehensive Bitcoin analysis, and to gain access to advanced features like live charts, custom indicator alerts, and detailed industry insights, visit Bitcoin Magazine Pro.

Disclaimer: This article is intended for informational purposes only and should not be interpreted as financial advice. Always conduct your own research before making investment choices.

This post Bitcoin Price Prepared for Significant Movement as Volatility Decreases was originally published on Bitcoin Magazine and authored by Matt Crosby.