As Bitcoin approaches a major options expiry, traders are closely monitoring market sentiment to gauge potential price movements. With nearly $23 billion in open interest set to expire, this event could significantly influence Bitcoin’s short-term trend. Despite an optimistic tilt among traders, broader macroeconomic factors and market uncertainties continue to cast a shadow over any clear directional bias.

Approximately $22.6 billion in Bitcoin options are due to expire, intensifying market focus on short-term price action.

Deribit dominates the options market, with bullish call options outnumbering puts, signaling prevalent trader optimism.

Key support level at $112,000 appears crucial; holding above this may favor further bullish momentum.

Market sentiment remains cautiously optimistic, but macroeconomic data releases could sway the outcome.

The upcoming September Bitcoin options expiry represents a pivotal point for traders, with a colossal $22.6 billion set to be settled on Friday. This event follows recently observed rejection at $117,000, emphasizing the significance of support levels. As long as Bitcoin sustains above $112,000, bullish strategies seem better positioned, although downside risks linger amid prevailing macroeconomic uncertainties.

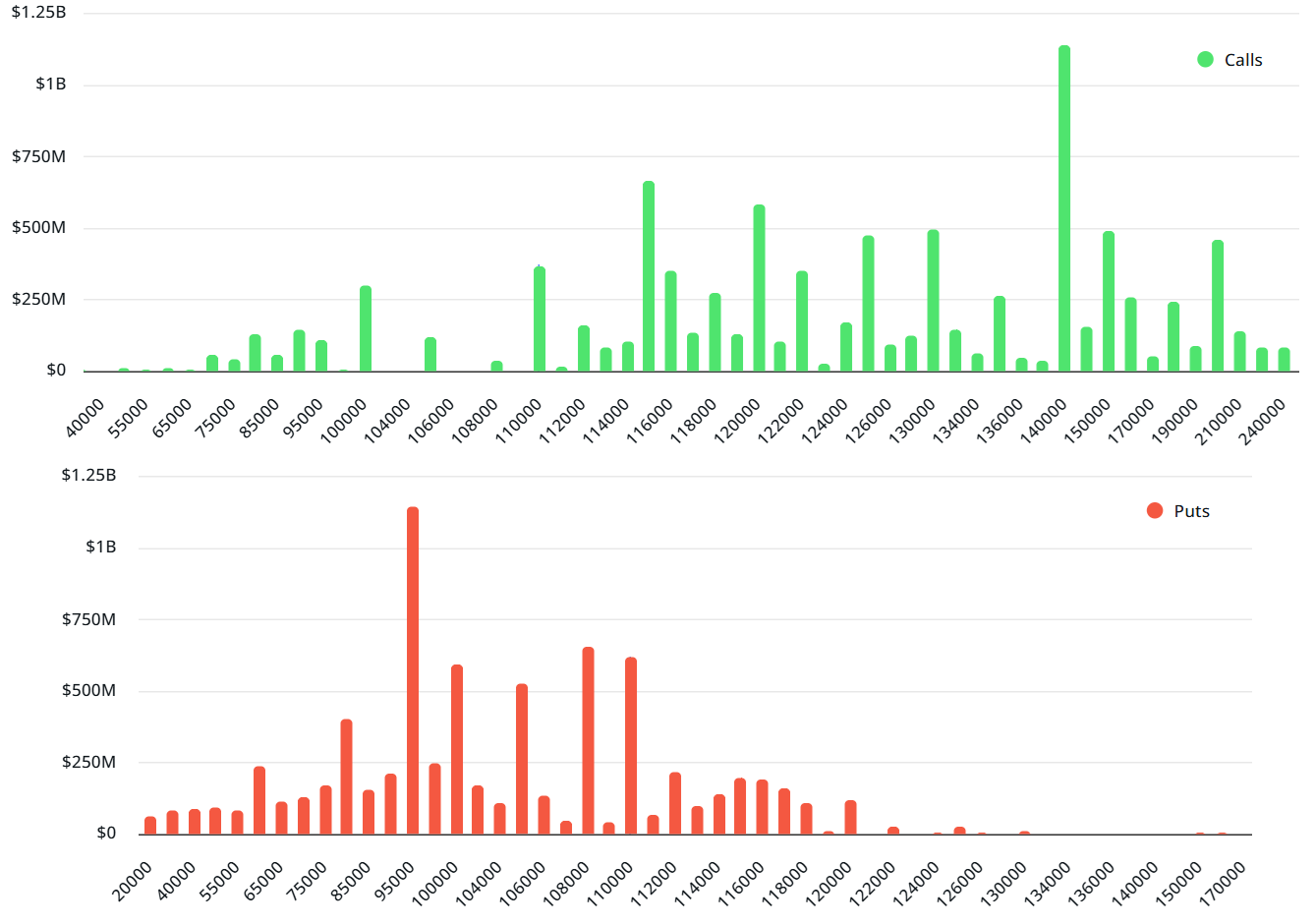

Deribit continues to lead the market, with $17.4 billion in open interest for Friday’s Bitcoin options, followed by OKX and CME, each hosting roughly $1.9 billion. The prevalence of call options over puts underscores ongoing trader optimism about Bitcoin’s near-term outlook.

Demand for neutral-to-bullish Bitcoin positions dominates

The September expiry is consistent with previous months, where open interest in put options remains about 20% lower than that of calls, which totals around $12.6 billion. The ultimate outcome hinges on Bitcoin’s price at 8:00 am UTC on Friday—particularly whether it remains above the critical $112,000 threshold.

Trader positioning at Deribit indicates that bets aimed at the $95,000 to $110,000 level are declining in likelihood, with most open interest concentrated above $120,000. About $6.6 billion worth of call options are stacked at $120,000 and higher, with only $3.3 billion in realistic play at those levels. Meanwhile, 81% of put options are set at or below $110,000, amounting to just $1.4 billion in active contracts.

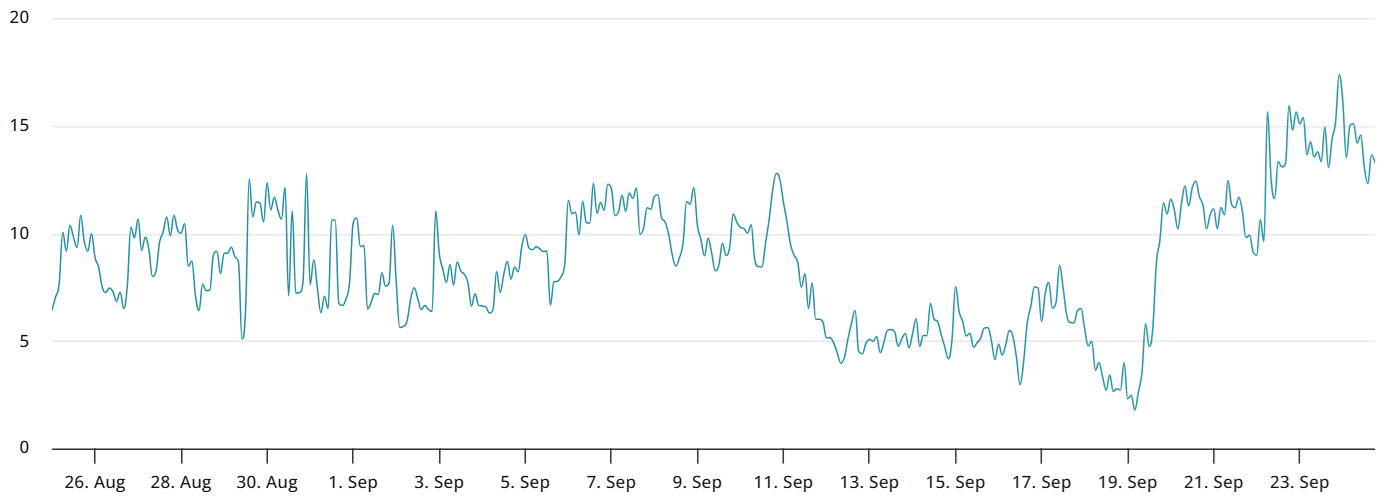

Market sentiment also reflects cautious optimism, as shown by the options skew metric. A moderate fear indicator at 13% signals that traders and market makers remain wary of potential downside risk at current levels, despite the bullish tilt.

Looking ahead, three scenarios based on current trading levels highlight the importance of the $112,000 support. If Bitcoin trades between $107,000 and $110,000, traders see a tilt toward puts, with $2 billion more in options betting against further upside. Conversely, above $112,000, call options take precedence, offering a more bullish outlook. The market expects that upcoming macroeconomic data, including U.S. GDP figures and employment reports, will influence traders’ sentiment and potentially alter the current outlook.

Despite concerns over a fragile economic backdrop, measures such as potential interest rate cuts by the Federal Reserve could bolster risk assets, including cryptocurrencies. However, lingering worries about the labor market further add to market volatility, emphasizing the need for cautious optimism as the options expiry approaches. While the odds currently favor a bullish outcome, traders must remain vigilant about the potential for a decline below $112,000.

This article is for informational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of the publication.