Cryptocurrency markets continue to experience dynamic shifts amid fluctuating investor sentiment and evolving institutional interest. Despite some recent optimism, Ether (ETH) faces challenges maintaining its key support levels, with significant liquidation risks looming should prices approach critical thresholds. Meanwhile, institutional players expand their Ethereum holdings, and demand for ETH-based investment products persists, highlighting its ongoing relevance within the wider blockchain ecosystem.

If ETH reaches $4,350, over $1 billion in short positions could be liquidated, indicating increased market sensitivity.

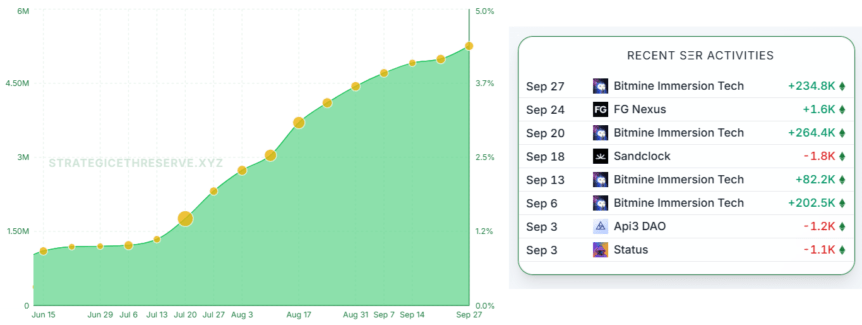

BitMine Immersion has increased its Ether holdings to over $10.6 billion, aiming to secure 5% of the total ETH supply.

Ethereum ETFs attracted $547 million in net inflows, underscoring institutional interest despite declining onchain activity.

Ether (ETH) struggled to stay above the $4,200 mark on Tuesday, reflecting a cautious market environment despite strong enthusiasm for spot Ethereum ETFs. Weaker activity on the blockchain may be dampening investor sentiment; however, corporate reserves continue to grow, signaling a longer-term bullish outlook from institutional holders.

Traders are now watching closely to see if ETH can regain its recent high of $4,800, last touched on September 13.

On Monday, spot Ethereum products recorded a robust $547 million in net inflows, reversing prior week’s decline and signaling renewed investor confidence. Concerns around a potential U.S. government shutdown or a slowdown in the AI sector sparked worries about digital asset demand; however, these fears eased as partial agency closures appeared manageable, with government operations likely resuming normally.

In tandem, enthusiasm for technology stocks increased following new partnerships between OpenAI, Nvidia, and Oracle, broadening risk appetite. As investors became less risk-averse, demand for cryptocurrencies regained momentum, supported further by strategic corporate acquisitions of ETH.

Notably, BitMine Immersion expanded its Ether holdings by purchasing 234,800 ETH, now totaling over $10.6 billion in reserves. The company’s chairman, Tom Lee, reaffirmed plans to acquire 5% of the entire ETH supply as part of its long-term strategy. Additionally, a new partnership between Consensys and SWIFT aims to develop a cross-border payment prototype, enhancing interoperability for tokenized assets—indirectly bolstering ETH’s credibility and sustaining its price above key support levels.

Ether Faces Downward Pressure from Diminished Network Activity

Despite accumulation by institutional investors, Ethereum’s onchain metrics suggest waning activity, with network fees and transaction counts declining over the past month. According to data from Nansen, Ethereum fees dropped 12%, while transaction volume fell 16%. Meanwhile, rival networks like BNB Chain and HyperEVM saw fees grow substantially, indicating shifting user activity and market interest.

Looking ahead, Ether traders are eyeing the upcoming $1.6 billion payout from the FTX Recovery Trust; some expect recipients to reinvest in cryptocurrencies, potentially providing a short-term boost. The payout, scheduled for Tuesday, may take several days to materialize in bank accounts but remains an important catalyst for market sentiment.

CoinGlass reports that Ether’s price approaching $4,350 could trigger nearly $1 billion in short position liquidations, highlighting the market’s heightened sensitivity. With ETF holdings worth over $22.8 billion and futures open interest at $55.6 billion, ETH remains a dominant institutional asset—yet external macroeconomic influences, such as U.S. economic data, continue to influence short-term momentum.

Fundamentally, ETH’s prospects remain robust, especially amid ongoing corporate reserve accumulation and growing spot ETF demand. However, market momentum hinges on external factors and broader economic conditions, maintaining an uncertain near-term outlook for ETH’s price trajectory.

This article is for general informational purposes only and should not be taken as legal or investment advice. The views expressed are solely those of the author and do not necessarily reflect the opinions of third parties or industry standards.