Recently, the native cryptocurrency of Binance’s BNB Chain has hit a remarkable milestone, reaching a new all-time high amidst ongoing network upgrades and positive market sentiment. As the broader crypto markets rally, BNB is strengthening its position, driven by increased institutional interest and strategic development plans aimed at enhancing blockchain performance and user experience.

- BNB token surged to a new record high of $1,111.90, reflecting a 7.4% increase in 24 hours and a 17.5% weekly gain.

- Market analysts forecast BNB’s price could reach $1,275 in 2025, supported by market momentum and strategic upgrades.

- BNB Chain’s total value locked (TVL) and network activity have significantly increased, indicating expanding adoption and usage.

- The network is preparing for further improvements, including increasing the block gas limit and implementing new scalability features.

- Major upgrades such as the Maxwell upgrade and Lorentz Hard Fork earlier this year have enhanced network speed and efficiency.

BNB Hits New All-Time High as Market Gains Continue

BNB, the native token of Binance’s BNB Chain, has soared to a fresh all-time high of $1,111.90, according to data from CoinGecko. The recent surge represents a 7.4% increase over the past day and a 17.5% climb over the week, signaling robust investor confidence amidst a broader crypto rally. The move comes amid growing strategic developments and increased institutional treasury holdings, which analysts believe are driving the rally. After achieving an all-time high in July, BNB benefits from ongoing token burns and rising adoption.

Standard Chartered analysts previously forecasted the token could reach at least $1,275 by 2025, reflecting expected gains aligned with Bitcoin (BTC) and Ethereum (ETH), as market dynamics and ecosystem upgrades continue to bolster its outlook.

The overall cryptocurrency market also experienced positive momentum, with total market capitalization rising 1.6% to about $4.2 trillion, fueled by gains across major assets like Bitcoin and Ether.

Growing Metrics and Use of BNB Chain

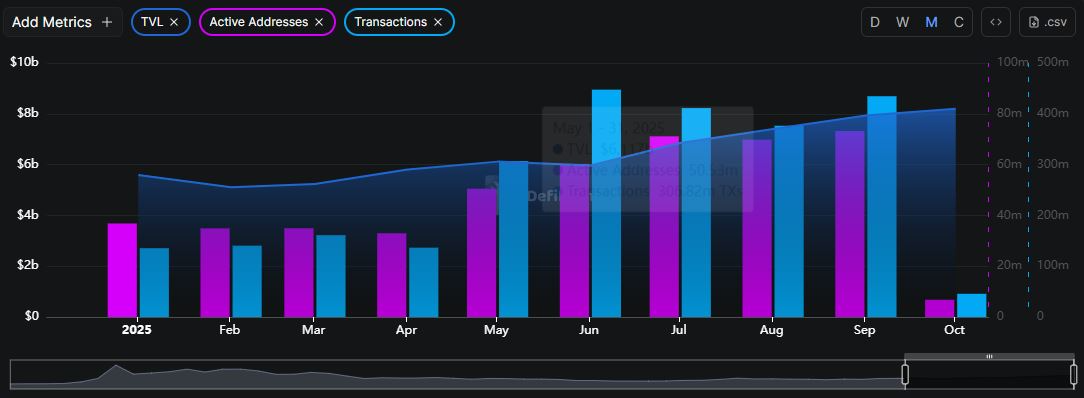

Alongside the price record, BNB Chain’s network activity has seen notable increases. Data from DefiLlama reveals that the total value locked (TVL) on the network grew by 2.5% in 24 hours, reaching approximately $8.23 billion. Recent statistics also show that the number of active addresses surged to over 73 million last month—the highest ever recorded—highlighting expanding user engagement and utility.

Transaction volumes have followed this trend, with the network processing 4.34 million transactions in September—the second-highest monthly total, after June. Despite its success, the network faced a recent security incident when the official BNB Chain’s Twitter account was compromised, highlighting ongoing challenges in crypto security.

Upcoming Upgrades and Roadmap

The BNB ecosystem is preparing for several key upgrades aimed at improving scalability and user experience. Recently, validators adopted a new minimum gas price of 0.05 gwei, promising faster, cheaper transactions—a move expected to make the platform even more appealing for decentralized finance (DeFi), non-fungible tokens (NFTs), and on-chain applications.

The BNB team announced plans to increase the block gas limit from 100 million to 1 billion to accommodate higher transaction throughput. They also project developing a blockchain architecture capable of processing 20,000 transactions per second with sub-150 millisecond confirmation times by 2026. Additional features such as native privacy enhancements and virtual machine upgrades are also on the horizon.

Earlier this year, the Maxwell upgrade and Lorentz Hard Fork boosted network speed and reliability, laying the groundwork for future scalability. These advancements aim to maintain BNB Chain’s competitiveness within the blockchain landscape, supporting decentralized applications and user adoption at scale.