Founders: Jesse Shrader and Anthony Potdevin

Founded: March 2021

Headquarters: Nashville, TN

Employee Count: 10

Website: https://amboss.tech/

Business Type: Private

Jesse Shrader envisions a pivotal year ahead for the Lightning Network.

With Bitcoin’s value steadily increasing and Tether (USDT) integrating into the Lightning ecosystem, Shrader believes that a growing number of businesses and institutions will recognize Lightning as a viable payment solution in the coming year.

His company, Amboss, is well-equipped to facilitate this transformation.

“Our goal is to expand Bitcoin as a payment solution while leveraging Lightning to achieve that,” Shrader shared with Bitcoin Magazine. “We aim to establish Lightning as a highly efficient and powerful system.”

Amboss has developed a comprehensive array of tools and services designed to onboard the next generation of institutional users to the predominant permissionless payment network, particularly with the addition of USDT on Lightning.

Overview of Amboss Services

Amboss specializes in providing advanced payment infrastructure tailored for digital transactions via the Lightning Network.

“Our mission is to provide insights that allow users to enhance their payment efficiency on the network,” explained Shrader.

To achieve this, Amboss offers several innovative products and services.

A standout offering is Amboss Space, a Lightning Network explorer that utilizes machine learning to assist users in retrieving information or establishing connections with any node within the network.

In addition to their analytical tools, Amboss provides features aimed at improving liquidity conditions on Lightning.

For instance, Magma Marketplace enables users to trade liquidity on the Lightning Network. With Magma, users can supply liquidity—retaining custody of their Bitcoin—while earning a yield.

In complement, Hydro builds upon Magma, allowing users to automate liquidity purchases to enhance payment success rates.

(Amboss also features Reflex, a compliance suite designed for corporate clients with anti-money laundering (AML) reporting needs.)

The analytical solutions and tools provided by Amboss are crafted for managing high-volume transactions, which are increasingly feasible on Lightning.

“We simulate the payment capabilities of businesses,” Shrader detailed. “This allows enterprises to visualize their reach across the network when attempting payments.”

Current Landscape of Lightning

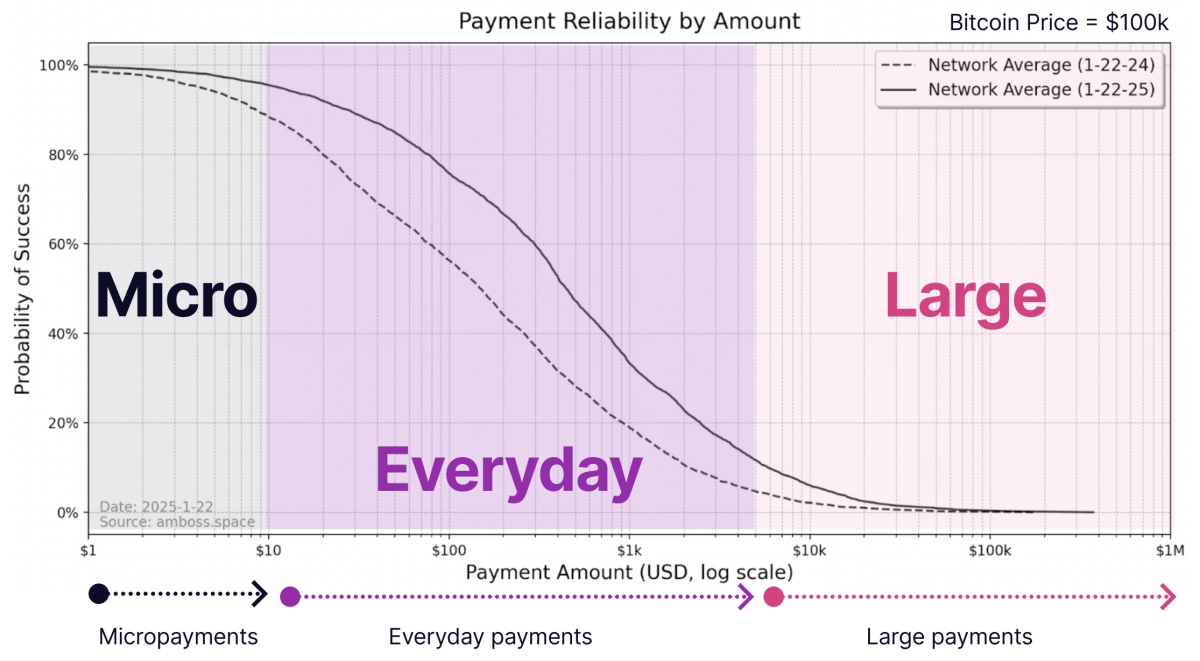

Shrader holds an optimistic stance on the expansion of the Lightning Network. Users are now utilizing the network for transactions beyond mere micropayments.

“We have been successfully facilitating everyday transactions on Lightning, specifically those ranging from $10 to $4,000,” Shrader noted. “We continue to enhance the network’s capabilities, focusing on decentralization.”

Transactions exceeding $4,000 remain challenging, and Shrader pointed out that additional capital is essential for processing larger payments effectively.

Nonetheless, he observed that the recent surge in Bitcoin’s price has contributed to easier processing of substantial payments.

“The recent rise in Bitcoin’s price has improved settlement capabilities across all Lightning channels,” said Shrader. “As these channels are Bitcoin-denominated, it’s akin to having larger conduits.”

Shrader is confident that these larger conduits will enable increased throughput, and he believes that Tether’s integration into Lightning will draw even more liquidity to the network.

USDT’s Integration with Lightning Network

Recently, Lightning Labs announced the incorporation of USDT into Bitcoin and the Lightning Network using the Taproot Assets protocol.

This enhancement simplifies the process for Bitcoin service providers to integrate and accept USDT, a development that Shrader regards as highly beneficial for the Lightning ecosystem.

<p“It's evident that Tether has established product-market fit,” said Shrader.

“Last year alone, it facilitated $10 trillion in payments, surpassing both Visa and MasterCard,” he added.

“This clearly illustrates the global demand for U.S. dollars.”

While Shrader empathizes with Bitcoin purists who may be concerned about USDT’s presence on Bitcoin and Lightning, he believes that the advantages far outweigh the disadvantages. Many individuals remain unaware of Bitcoin’s potential or are hesitant to accept its volatility.

“A significant number of people haven’t embraced the advantages Bitcoin offers,” he elaborated.

“I firmly believe in the power of Bitcoin and wish to share its benefits on a larger scale. There are myriad issues with conventional payment systems, and Bitcoin provides a secure, auditable alternative that can be implemented broadly.”

“While the price dynamics of Bitcoin are favorable for me, many remain wary of market fluctuations. Having a low-volatility asset such as USDT on secure, trusted platforms is a tremendous advancement.”

Addressing Challenges with USDT on Lightning

Shrader recalled the first Bitcoin-related conference hosted by MicroStrategy, aptly named “Lightning for Corporations.” During this event, firms were urged to begin compensating employees in Bitcoin via Lightning, often without acknowledging the potential complications.

“What many employers discovered is that handling 1099s for employees was a cumbersome task,” said Shrader. “Moreover, there was considerable regulatory complexity to navigate.”

Shrader emphasized that compensating employees in USDT through Lightning can streamline accounting processes and regulatory compliance while minimizing counterparty risks associated with traditional banking—an issue he is acutely aware of.

“Our payroll once went through Silicon Valley Bank,” said Shrader.

“At one juncture, my payroll provider requested that I resend my mid-month payroll after I had already attempted payment. To make matters worse, this resulted in a loss of half a month’s runway due to Silicon Valley Bank’s insolvency,” he recounted.

“Thus, avoiding counterparty risk in the financial ecosystem by embracing Bitcoin and Lightning significantly enhances our position.”

[Author’s note: While using USDT mitigates certain risks, some level of counterparty risk remains as users must trust Tether holds genuine U.S. dollars to back the tokenized assets it issues.]

Potential Risks

Shrader acknowledges various risks associated with USDT on Bitcoin and Lightning, yet he does not appear overly concerned about them.

“There are some MEV risks when non-native blockchain assets are traded on-chain,” he noted. “However, Bitcoin already includes Ordinal inscriptions that represent alternative assets, meaning this issue has been present previously.”

He remained unfazed when discussing the risk that a Bitcoin fork could render USDT on that particular chain worthless, nor did he perceive significant risk due to larger economic entities in the Bitcoin ecosystem, such as Coinbase, which manages Bitcoin for U.S. spot Bitcoin ETFs supporting a “Tether fork” alongside other upgrades potentially detrimental to Bitcoin’s integrity.

“The consensus of Bitcoin cannot be swayed by the custody of Bitcoin,” Shrader stated. “While significant players like Coinbase may endorse various changes or initiatives, such endorsements do not ensure the implementation of protocol modifications.”

Rather than fixating on the risks posed by USDT within the Bitcoin network, Shrader emphasizes the opportunities this integration unlocks.

“What’s intriguing are the possibilities that arise from these assets, enabling actual arbitrage opportunities with Bitcoin itself,” Shrader remarked.

“As every node can transact in both USDT and Bitcoin—and seamlessly exchange between them on Lightning—you can send Bitcoin from one Lightning channel and receive USDT in another,” he elaborated.

“This can simply involve generating a USDT invoice and paying it with BTC, allowing for instant rebalancing of holdings.”

Looking Ahead to 2025: The Year of Lightning

In closing, Shrader shared two compelling reasons why he believes 2025 will be transformative for the Lightning Network.

Firstly, acquiring Bitcoin will no longer be a prerequisite for utilizing Lightning.

“Up until this year, individuals or businesses wishing to migrate to Lightning needed Bitcoin first—a substantial obstacle,” explained Shrader. (He added that outside the United States, accessing USDT is relatively straightforward and common.)

“The market for Bitcoin-only payment processing is significantly limited. However, this year we’ve eliminated that barrier, enabling consumers to transact using alternative assets such as USDT. This market is already sizable,” he noted.

(Shrader further pointed out that while USDT functions on Lightning, the Bitcoin ecosystem benefits as USDT is converted to Bitcoin during its passage through the network. He also mentioned that “the increased Bitcoin circulation on Lightning incentivizes running a Lightning node.”)

Additionally, Shrader indicated that Lightning users will incur minimal transaction fees compared to traditional financial systems.

“We’re providing liquidity at under 0.5%,” he said.

“As a user of major credit card networks, I’m typically charged around 4% for payment processing, with funds delayed for days or even weeks,” he added.

“With Lightning, processing fees can be reduced by nearly tenfold.”

Considering Shrader’s insights, it’s difficult to envision 2025 being anything less than a monumental year for the Lightning Network.