Crypto markets find themselves at a pivotal crossroads as Bitcoin’s price action sparks diverging narratives among traders and analysts alike. After a volatile weekend, Bitcoin appears to be testing key support levels while market sentiment plunges into extreme fear. This uncertainty coincides with technical signals indicating potential bearish momentum, raising questions about the next move in the broader cryptocurrency environment.

- Bitcoin revisits its yearly open level, with traders split on the market’s near-term direction.

- The CME futures gap from April now looms as a potential target for price recovery.

- Major trend lines have been broken, fueling fears of a prolonged bear market.

- Crypto market sentiment hits 2025 lows, reflecting widespread investor anxiety.

- Bitcoin’s correlations with traditional risk assets are ebbing, revealing a unique risk profile.

Bitcoin’s Price Fluctuations and Market Sentiment

Bitcoin slipped back to its opening price for 2023 into Sunday’s weekly close, briefly dipping below $93,000, according to data from Cointelegraph Markets Pro and TradingView. The price action prompted a wide range of trader reactions—from outright bearish forecasts to cautious hopes of a rapid rebound.

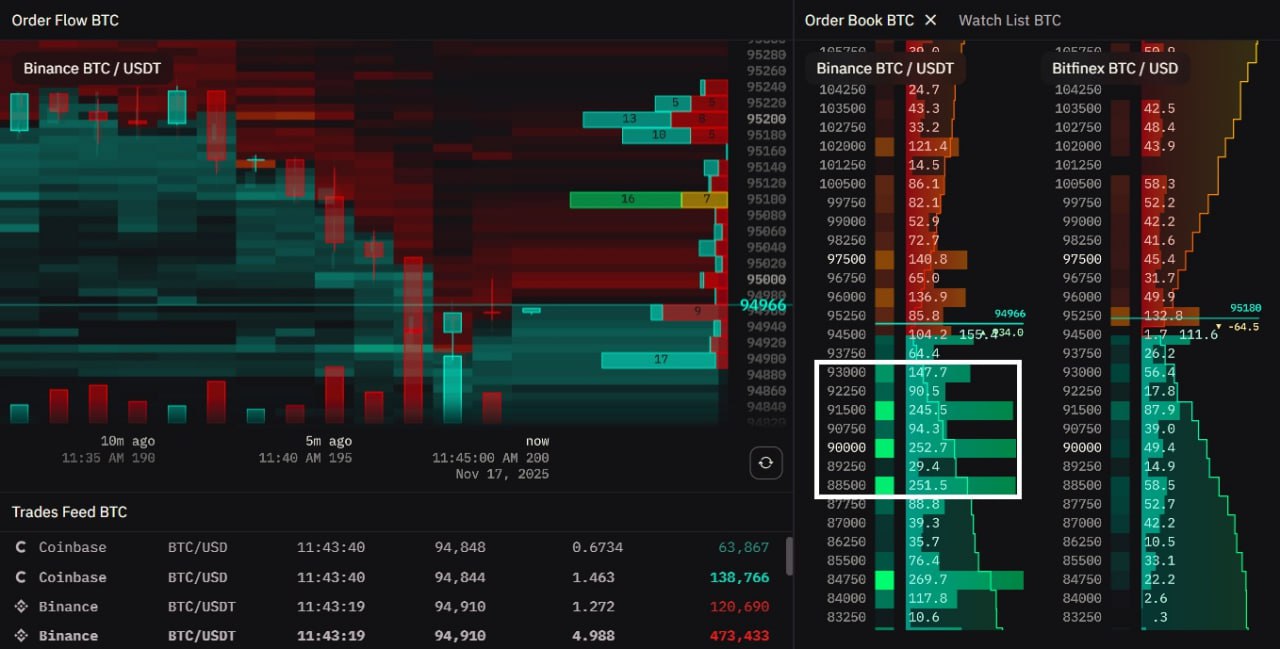

Market sentiment remains fragile, with some traders betting on a dip toward the $88,500-$92,000 zone, supported by notable buy orders from Binance whales, as highlighted by analyst BitBull.

“I know a lot of people are calling for a local bottom, but BTC could sweep the $88K-$90K zone,”

Overall liquidity conditions suggest that traders are positioning for the next significant move, with many watching the accumulation of bid orders in key support zones.

Commenting on liquidity levels, analyst Michaël van de Poppe emphasized the importance of a swift upward move, noting that a higher low would set the stage for shorts to be wiped out in the thousands of trillions.

“Ideally, I want to see a fast move back up on BTC,”

Meanwhile, optimistic traders like Crypto Tony see signs of recovery, eyeing levels around $106,000 to $108,000 for potential short entries after the recent bounce.

“The next key level for Bitcoin to reclaim is $98,000 as it’ll increase the chances of a local bottom,”

The CME Futures Gap: A Short-Term Magnet

A key focus remains on the unfilled CME Futures gap from April, located just below current lows, around $91,800–$92,700. This gap has attracted attention as a possible target for short-term price action, given historical tendencies for markets to fill such gaps.

Market strategist Hardy noted, “Whales want their orders filled before the next leg. Expect the dip, embrace the volatility, and prepare for the bounce once that gap is filled. It’s a textbook move.”

Historical data shows that futures gaps tend to act as magnets for price, and the longstanding April gap remains an anomaly, offering a potential bounce zone for short-term traders.

QCP Capital suggests that testing the $92,000 region could trigger a technical rebound, yet warns that substantial overhead supply might limit the strength of any rally.

Bear Market Confirmations and Technical Breakdown

Adding to bearish outlooks, Bitcoin recently lost support from its 50-week simple moving average (SMA), which sits at approximately $102,850. The weekly candle close below this key support level is unprecedented in Bitcoin’s recent history and signals potential return to prolonged bear territory.

The unusual breakdown was highlighted by analysts as a significant departure from Bitcoin’s usual support behavior. Historically, this moving average has held firm during bull cycles, losing stability only during major market downturns, reinforcing the current bearish momentum.

QCP Capital added that further support levels at $88,000 and $74,500 would be necessary to confirm a bearish reversal, though short-term attempts at a bounce remain possible.

Similarly, traders pointed out the breach of the exponential moving average (EMA) cluster that coincides with the 50-week SMA, marking a technical breakdown and signaling a potential shift into a sustained bear market.

Crypto Markets Diverge from Traditional Risk Assets

Amid macroeconomic shifts, crypto continues to diverge from traditional risk assets such as stocks and gold. Despite news of global liquidity injections, US stock futures remained positive, while Bitcoin and altcoins plummeted, reflecting a largely leveraged and liquidation-driven decline.

The Kobeissi Letter observed that crypto’s recent downturn is unique, asserting that Bitcoin has become more correlated with large-cap tech stocks than with gold. The 30-day correlation with the Nasdaq 100 recently reached approximately 0.80, the highest since 2022, indicating a strong link to risk sentiment in traditional markets.

Meanwhile, the Fed’s future interest rate moves remain uncertain, with market expectations showing reluctance for a rate hike in December, adding further macro uncertainty.

Market Sentiment: Extreme Fear Takes Hold

Crypto investor sentiment has darkened significantly, with the Crypto Fear & Greed Index plunging to its lowest level since late February, at just 10/100—deep within the “extreme fear” zone. This shift echoes sentiments seen during previous market crashes, including the FTX fallout in 2022.

Analyst Daan Crypto Trades likened the current environment to past market panics, noting that such metrics can change rapidly, especially in crypto, where volatility reigns supreme.

However, Santiment’s social dominance data suggests that Bitcoin’s surges in social media attention could be precursors to potential bullish reversals, especially if retail capitulation intensifies in the coming weeks.

This week’s developments underscore the cautious yet volatile nature of the crypto markets as traders weigh technical signals against macroeconomic factors, with sentiment and support levels likely to influence Bitcoin’s next move.