Bitcoin moved under the $73,000 mark this week, with futures liquidations accelerating as a broader stock-market pullback tied to US corporate earnings took some steam out of risk appetite for digital assets. The first major test came as BTC traded to a fresh intraday low around $72,945, failing to hold the $80,000 zone that had been acting as a psychological anchor for bulls. The slide leaves the market with a year-to-date loss of roughly 15% and buys little time for optimism, given that the asset remains about 45% off its all-time high of $126,267 set during the late-2021 cycle. The price action reinforces lingering concerns that the long-awaited crypto cyclical bull market could be fading into a period of consolidation or renewed volatility.

Market action in traditional equities is a clear pressure point. The week has featured a broad risk-off stance as traders digest a wave of earnings reports from the Magnificent Seven and other blue chips, with the prospect of revenue downgrades weighing on investor sentiment. AI beneficiaries, including NVIDIA and Microsoft, were among the notable laggards as selling intensified across the tech complex. The morning narrative suggested a pivot away from high-growth expectations for now, even as investors weighed whether near-term demand would justify current valuations.

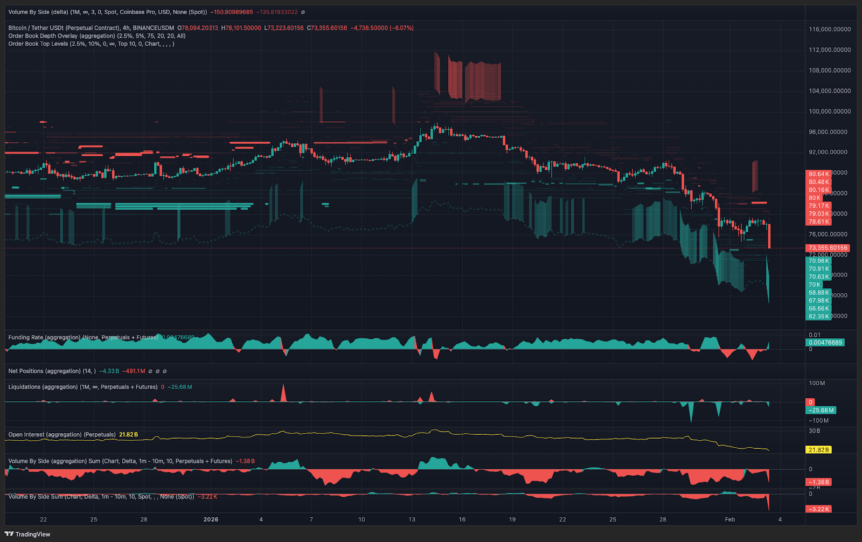

In parallel, the crypto-specific backdrop features a continuing wave of liquidations on leveraged bets. Data tracked across perpetual and cross-market venues show significant pressure from long positions getting force-closed, underscoring how quickly a risk-off mood can spill over into the digital-asset space. The liquidation totals in the latest session included substantial unwindings among BTC longs and ETH longs, underscoring traders’ willingness to lock in profits or cut losses amid volatile price swings.

On-chain and orderbook indicators offer a snapshot of where buyers and sellers might intersect next. Long positions on BTC and ETH have been pressured, with liquidity dynamics painting a mixed picture of potential capitulation versus a bid at lower levels. According to researchers and market observers, price action around the mid-70s thousand range has historically represented a level where dips attract a mix of retail and institutional buyers, but sentiment remains sensitive to broader macro cues and earnings results. A prominent market participant noted that BTC’s current drawdown aligns with historical volatility patterns, emphasizing that a downturn of this magnitude often signals a monetization cycle taking shape rather than a one-off deviation.

Within this environment, traders are watching bid support where buyers have historically re-emerged. The orderbook data suggests bids thickening as prices approach the $71,800 to $63,000 corridor, though the strength and durability of such bids depend on the next wave of macro news and the pace of realized volatility. The real question remains whether appetite will return to absorb further declines or if a fresh catalyst will re-ignite demand for risk assets across both crypto and broader markets.

As the week unfolds, the market is contending with an earnings season that could set the tone for risk appetite across asset classes. More than 100 S&P 500 companies are slated to report results, creating a backdrop where any surprises—positive or negative—could amplify moves across Bitcoin and Ethereum, as well as related crypto equities and investment products. In this context, the crypto market’s sensitivity to stock-market dynamics remains pronounced, reinforcing the view that BTC’s path will continue to ride the tide of macro momentum and investor framing of risk versus return.

Key takeaways

- Bitcoin traded to a 2026 intraday low near $72,945 after failing to defend the $80,000 level, signaling renewed downside pressure.

- Year-to-date performance sits around a 15% loss, with BTC still about 45% below its all-time high of $126,267, highlighting a challenging macro-backdrop for a renewed bull phase.

- Equity market weakness, driven by AI heavyweights and broad earnings concerns, contributed to the risk-off sentiment impacting crypto assets.

- On-chain liquidations remained a feature of the session, with BTC and ETH long positions seeing sizable closures as markets retraced.

- Liquidity in the BTC orderbook showed bids consolidating in the mid-to-lower price range, raising questions about the immediacy of a bounce and the sustainability of any dip-buying impulse.

Tickers mentioned: $BTC, $ETH, $AMZN, $NVDA, $MSFT

Sentiment: Bearish

Price impact: Negative. The continuation of a broad risk-off environment and ongoing liquidations point to further near-term downside risk for BTC and the broader crypto market.

Trading idea (Not Financial Advice): Hold. Given the current volatility and earnings-driven risks, traders may prefer waiting for clearer price signals and regime shifts before taking new positions.

Market context: The move comes amid a broader risk-off tone in equities and a focus on macro earnings, with crypto liquidity closely tied to stock-market flows and investor appetite for speculative assets. The environment remains sensitive to updated guidance on AI-related growth narratives and the sustainability of demand for high-priced tech infrastructure investments.

Why it matters

For investors, the ongoing pressure on Bitcoin illustrates the difficulty of predicting crypto cycles in an environment where traditional markets still dominate risk sentiment. The recent price action underscores the importance of liquidity and orderflow in shaping short-term moves, as leveraged positions are unwound and longer-term holders reassess entry points in a volatile landscape. The broad takeaway is that BTC is not immune to macro forces, even as narratives around digital scarcity and decentralized finance continue to persist in the longer term.

For traders, the signal is twofold: liquidity remains a critical driver of price action, and the balance between selloffs and bid support at specific price levels will determine whether a bottom forms or sells intensify. As long as earnings headlines and macro data continue to surprise to the downside, the risk of renewed drawdowns persists, even if a favorable demand side emerges at particular price anchors. Market participants will be watching bid depth around the $70k–$65k zone for signs of conviction, while also monitoring liquidity providers and derivatives liquidity to gauge the probability of a sharp reversal.

For developers and investors building in the space, the episode emphasizes the ongoing need for robust risk frameworks and transparent data sources to gauge liquidity, funding rates, and the health of leveraged markets. The intersection of traditional market volatility and crypto-specific liquidity considerations remains a critical area for tooling, analytics, and risk management as the sector matures toward broader adoption.

What to watch next

- Upcoming earnings releases from major indices and tech giants—watch for guidance that might shift risk sentiment and liquidity into or out of crypto markets.

- Whether BTC regains critical support near $73k or tests the lower bid corridor around $71,800–$63,000, and how quickly bids deepen at these levels.

- Changes in macro indicators (inflation prints, rate expectations) that could alter the pace of risk-on versus risk-off trading in both equities and digital assets.

- On-chain liquidity signals and funding-rate dynamics across major crypto platforms to anticipate potential reversals or further capitulation.

- Regulatory developments or shifts in ETF and product flows that could provide fresh catalysts for crypto liquidity or risk discipline.

Sources & verification

- BTC price action and intraday low around $72,945 on the referenced Tuesday.

- On-chain and liquidations data showing BTC and ETH long liquidations during the session.

- Orderbook dynamics and bid depth on BTC around the $71,800–$63,000 range via TRDR.io.

- Commentary from Strive’s Joe Burnett on BTC price action and volatility as a historical norm.

- Industry references to evolving sentiment during earnings week and market-wide risk-off conditions.

Rewritten Article Body

Bitcoin tests support as earnings risk and liquidations mount

Bitcoin (CRYPTO: BTC) slipped under the $73,000 threshold on Tuesday, carving a fresh intraday low near $72,945 as traders faced a surge in futures liquidations amid a broad stock-market pullback tied to US corporate results. The move retrenched a recent rally attempt and underscored how macro headwinds can seep into crypto liquidity. With BTC down roughly 15% year-to-date and roughly 45% off its all-time high of $126,267, the market is left pondering whether the cyclical bull narrative can re-emerge in a risk-off environment. The dynamics also highlight a market where crypto flows remain closely tethered to traditional-market sentiment, particularly as earnings season stirs volatility.

The overnight weakness in equities—led by tech and AI-heavy components—has amplified selling pressure across digital assets. AI juggernauts, including NVIDIA and Microsoft, posted softer-than-expected signals or faced macro headwinds that trimmed risk appetites. The response from investors was a broader rotation away from high-growth names, and crypto traders watched for similar risk-off cues to spill into the BTC/ETH markets. In this context, the crypto complex continued to grapple with the specter of demand weakness amid an earnings-heavy week that could set the tone for the months ahead.

Within the crypto arena, the hour-by-hour price action is being shaped by leveraged positions and the pace of liquidations. Data show that long positions across BTC and ETH have come under pressure as investors reassess risk exposure in a bearishly aligned macro backdrop. The liquidity picture reflects a tug-of-war between sellers looking to lock in gains and buyers waiting for a more compelling entry point. The market narrative has shifted from “discounted BTC” talk to a more cautious stance, as traders weigh the likelihood of a sustained downturn versus a durable bid at lower levels.

Market participants pointed to orderbook signals that suggest a potential bid at the lower bands, with bids thickening in the $71,800 to $63,000 region. While such dynamics offer the possibility of a bounce, the absence of a clear, persistent catalyst makes it difficult to call a definitive bottom. The question remains whether dip-buyers can absorb further selling pressure if the earnings season continues to deliver mixed results. The ongoing volatility underscores how quickly sentiment can flip when macro headlines or earnings surprises hit, and how this, in turn, shapes the pace of BTC’s next moves.

Despite the volatility, some analysts stressed that the current price behavior fits historical volatility patterns, suggesting the market is not necessarily breaking a long-term cycle but rather transitioning through a phase where price discovery remains fragile. The broader takeaway is that BTC’s trajectory over the near term will likely hinge on how quickly macro risk appetite returns and whether a credible bid surface emerges in the mid-to-lower ranges. The market will remain highly sensitive to liquidity dynamics, which can, at times, override even strong fundamental narratives in the crypto space.