Bitcoin ETFs continue to face significant outflows in November, with redemptions nearing $3 billion — the worst month on record — as investor confidence wanes amid market volatility. Despite traditionally strong seasonal performance for Bitcoin, recent selling pressures highlight ongoing uncertainties in the crypto markets.

- November Bitcoin ETF outflows are nearing $3 billion, marking a historic decline.

- BlackRock’s iShares Bitcoin Trust (IBIT) experienced its largest daily redemption since launching in January 2024.

- Despite positive seasonal trends for Bitcoin, ETF investor sentiment remains pessimistic amid macroeconomic concerns.

- Altcoin ETFs show mixed signals, with Ethereum experiencing outflows and Solana seeing inflows.

- Falling odds of rate cuts and technical indicators suggest continued short-term downside risks for Bitcoin.

Bitcoin exchange-traded funds (ETFs) are facing mounting redemptions in November, approaching $3 billion in net outflows — their worst performance ever — with BlackRock’s flagship fund experiencing its largest single-day exit to date. The sector’s five-day losing streak continues, as recent data reveals another $372 million pulled from Bitcoin ETFs, according to Farside Investors. This ongoing trend underscores a shift in investor sentiment, even as Bitcoin’s seasonal strength historically favors rallies during this period.

BlackRock’s iShares Bitcoin Trust (IBIT) saw $523 million in outflows last Tuesday, the biggest daily redemption since its launch in early 2024. With total withdrawals for the month nearing $2.96 billion, this makes November the second-worst month for spot Bitcoin ETF flows, with BlackRock accounting for the lion’s share at $2.1 billion. If current trends persist, redemptions could surpass the $3.56 billion experienced in February, marking a challenging month despite Bitcoin’s usual strong performance in November, when it averaged a 41.22% rally, highlighting a disconnect between sentiment and seasonal patterns.

While ETF outflows dominate the headlines, Bitcoin’s momentum in 2025 has largely been driven by positive inflows into spot Bitcoin ETFs, which remain crucial to market dynamics. Geoff Kendrick, Standard Chartered’s global head of digital assets research, recently emphasized that ETF flows are key to Bitcoin’s upward trajectory this year.

“Despite the current outflows, the historic trend shows November typically delivers strong returns for Bitcoin, and investor interest could reawaken if macroeconomic conditions stabilize,” Kendrick stated.

Meanwhile, other crypto assets exhibit varied fund flows. Ethereum ETFs experienced $74.2 million in outflows, whereas Solana ETFs attracted $26.2 million in inflows, bringing Solana’s total ETF investments since launch to over $421 million, according to Farside Investors. These shifts reflect nuanced investor strategies amid broader market uncertainties.

Falling Rate Cut Odds and Market Sentiment

Last week, Bitcoin printed its fourth “death cross,” a bearish technical pattern where short-term momentum falls below long-term support — a warning sign for traders. However, some analysts suggest this pattern may signal a macro bottom rather than an impending decline, given the current economic context. According to Lacie Zhang at Bitget Wallet, “This signal comes at a time when liquidity is only beginning to stabilize, and the odds of a December rate cut have fallen sharply, raising questions about near-term risk.”

Further complicating the outlook, two major market makers face mounting financial stress, according to Tom Lee, chairman of Bitmine Immersion. Currently, the market assigns a 46% probability to a 25 basis point rate cut during the Federal Reserve’s December 10 meeting, down from over 93% last month, as per CME Group’s FedWatch tool. This shift indicates increased caution among traders, who are adjusting positions accordingly.

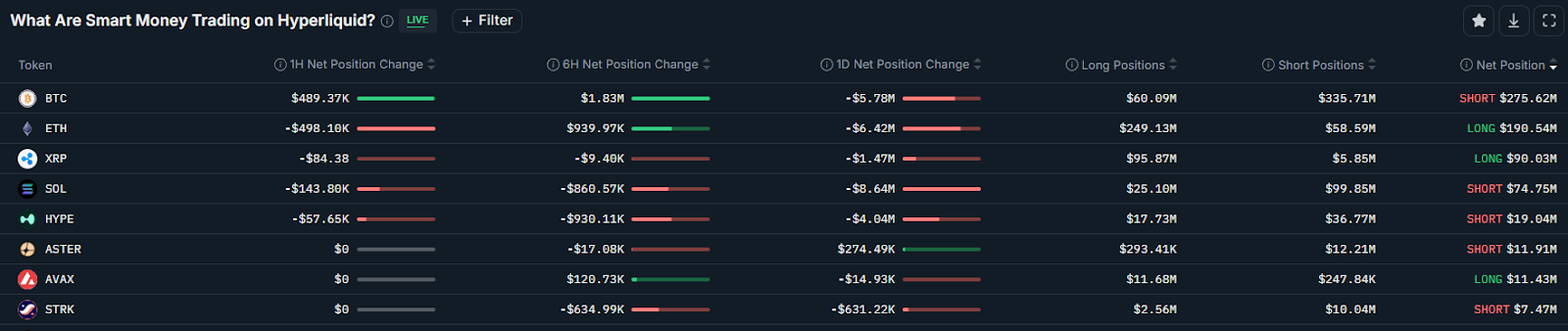

Blockchain analytics further reflect this caution, with smart money traders adding $5.7 million in short positions over the past 24 hours, indicating a renewed expectation of downside. Nansen’s data shows that institutional traders are net short on Bitcoin for approximately $275 million, signaling a risk-off sentiment amid macroeconomic headwinds.

Additional insights and future outlooks on Bitcoin’s potential move to $150K and Ethereum’s pressure build-up can be explored in industry analyses and expert commentary.