The launch of Spot Bitcoin exchange-traded funds (ETFs) in the United States was a significant moment for the cryptocurrency market. These ETFs, which became available in the US on January 11, 2024, have seen remarkable success in just one year, making them the most successful ETF launch in history.

Currently, US-based Spot Bitcoin ETFs have emerged as major drivers of Bitcoin’s price surge and played a crucial role in pushing Bitcoin beyond $100,000. Additionally, these US-based Spot Bitcoin ETFs now collectively hold the largest amount of Bitcoin, making them significant players in the market.

Performance Metrics Of US-Based Spot Bitcoin ETFs

After years of resistance from the US Securities and Exchange Commission (SEC), the approval of Spot Bitcoin ETFs in January 2024 marked a turning point for the crypto industry. The SEC gave the green light to the first 11 Spot Bitcoin ETF applications on January 10, 2024.

All Spot Bitcoin ETFs, except for Grayscale’s GBTC, have shown positive performance in their first year. The launch of these ETFs generated record-breaking enthusiasm, with the highest trading volumes for any ETF launch in history during their initial days of operation.

In addition to attracting traditional investors to the Bitcoin market, many large Bitcoin holders saw the ETFs as a secure and regulated way to invest in cryptocurrencies.

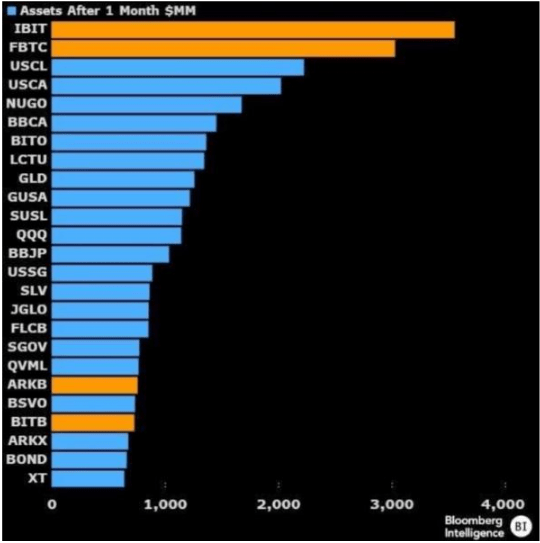

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Fidelity Wise Origin Bitcoin Fund have led the way with significant inflows throughout the year, establishing themselves as key players in the market.

Currently, US-based Spot Bitcoin ETFs collectively hold about $107.64 billion in Bitcoin assets, approximately 5.75% of the total Bitcoin market cap, according to data from SoSoValue. These ETFs have seen a total net inflow of $36.22 billion since their inception one year ago.

IBIT has recorded the highest cumulative net inflow of $37.67 billion, followed by FBTC with $12.16 billion. These inflows have offset the $21.57 billion net outflows from the previously existing Grayscale Bitcoin Trust, which converted into a Spot Bitcoin ETF.

Other ETF providers, such as ARK 21Shares Bitcoin ETF and Bitwise Bitcoin ETF, have also seen significant cumulative net inflows. However, seven ETF providers have yet to reach the $1 billion threshold in cumulative net inflows, indicating varying levels of investor interest across the industry.

Future Outlook for Spot Bitcoin ETFs

The future looks bright for Spot Bitcoin ETFs, particularly on a longer-term horizon in 2025 and beyond. Crypto investors are hopeful for a significant increase in capital flowing into these ETFs in anticipation of favorable crypto policies under the incoming Trump administration.

At the time of writing, Bitcoin is trading at $94,057.

Featured image from Pexels, chart from TradingView