The cryptocurrency market experienced a significant shift in sentiment over the weekend as Bitcoin’s price rallied sharply, pushing the overall market mood from fear to neutrality. This turnaround is reflected in the Bitcoin Fear & Greed Index, which has rallied from risky lows, signaling a potential easing of selling pressure and possible bullish momentum ahead. As investors reassess risk levels amidst expectations of a U.S. Federal Reserve rate cut, the market appears poised for potential growth, with increased interest from both traders and institutional players.

- Bitcoin’s Fear & Greed Index has moved from fear to neutral, indicating a more balanced market sentiment.

- The index rose from 40 to 51, suggesting reduced panic and increasing investor confidence.

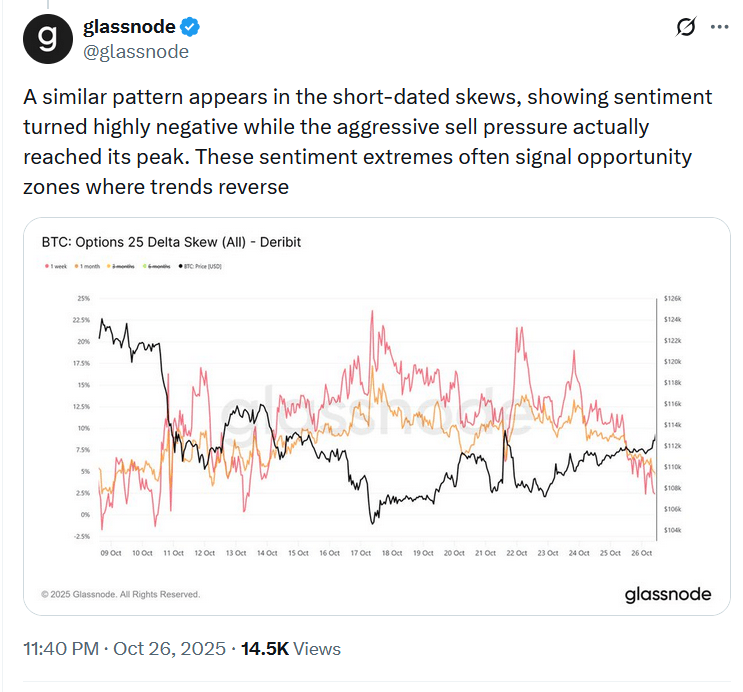

- Recent declines in Bitcoin selling pressure point toward a potential trend reversal, according to analytics firm Glassnode.

- Market participants are eyeing an upcoming Federal Reserve rate cut, which could further bolster crypto markets.

- Bitcoin’s recent price movements and market data hint at a stabilization conducive to bullish prospects.

The Market Sentiment Turns a Corner

The Bitcoin Fear & Greed Index, a popular gauge of market sentiment, has climbed out of the “fear” zone for the first time in over two weeks, now standing at a neutral level of 51 out of 100. This marks a notable recovery from the fearful 40 points recorded on Saturday. The index had plunged to a yearly low of 24 earlier this month following China’s tariffs announcement, which triggered a wave of liquidations and heightened market volatility.

The recent upward movement coincides with Bitcoin’s surge to approximately $115,000, reflecting renewed optimism among traders despite lingering uncertainties in the broader crypto markets.

Decreasing Selling Pressure and Cautious Trading

According to data from Bitcoin analytics platform Glassnode, aggressive selling pressure is waning. On Sunday, insights from the firm’s Twitter post indicated a potential trend reversal, as both spot and futures markets show signs of stabilization. Bloomberg’s Cumulative Volume Delta (CVD) metrics have flattened after a period of sharp declines, suggesting that sellers are less active.

“Funding rates remain below the neutral level of 0.01%, indicating no excessive long positioning or froth. In fact, we can see that funding flipped very negative several times over the last 2 weeks, suggesting participants are leaning toward caution.”

This moderation in selling activity could open the door for a more sustained rally, especially with institutional traders demonstrating a more cautious stance after recent volatile moves.

Looking Ahead: The Potential for Bullish Momentum

Market watchers are also eyeing an anticipated interest rate cut by the U.S. Federal Reserve, which could serve as a catalyst for further gains in cryptocurrencies like Bitcoin and Ethereum. Data from CME Group’s FedWatch tool shows a 96.7% probability that the Fed will cut interest rates by 0.25% during its meeting scheduled for October 29. Such a move could bolster cryptocurrency markets by reducing traditional financial market volatility and boosting investor appetite for risk.

With crypto markets displaying signs of stability and cautious optimism, traders are increasingly considering the potential for upward price movement, especially if macroeconomic conditions remain favorable for risk assets. The coming weeks could be crucial in determining whether the current trend will accelerate into a more sustained rally or if volatility will return.