- Bitcoin surged 14% over the past week, approaching $124,000 amid ongoing macroeconomic and political uncertainties.

- Onchain data indicates increased buying pressure, with a $1.6 billion volume spike and US demand reflected by a Coinbase premium gap of nearly $92.

- Market analysts suggest resistance at around $130,000, with potential for new price discovery next week.

- The US government shutdown has paradoxically fueled Bitcoin’s rally as investors seek safe-haven assets amid data delays.

- Momentum appears supported by favorable macro conditions, with inflation easing and dovish Federal Reserve signals boosting risk appetite.

Bitcoin (BTC) has demonstrated a robust rally over the past week, climbing approximately 14% from a low of around $108,600 last Friday to nearly $124,000. This surge has positioned Bitcoin on the cusp of entering uncharted price discovery territory beyond $125,500, amid a broader crypto market capitalization that surpassed $4.21 trillion — a reflection of widespread market strength and renewed investor confidence.

A contrarian catalyst behind this bullish wave is the ongoing U.S. government shutdown, which appears to have had little negative impact on Bitcoin. Despite widespread economic uncertainty and potential delays in official data releases, Bitcoin’s price has climbed 8% since the shutdown began. Investors are reportedly favoring crypto as a safe haven amid the lack of clear policy direction, with many traders positioning themselves ahead of forthcoming macroeconomic updates. The shutdown has also complicated decisions for the Federal Reserve, with postponed inflation and employment data intensifying speculative flows into Bitcoin and other cryptocurrencies.

Bitfinex analysts commented, “Bitcoin’s movement toward a new all-time high appears genuinely organic. A potential stimulus plan announced by the government might further fuel the rally, similar to the effects seen following COVID-19 stimulus checks. Additionally, steady inflows into ETFs also provide a strong tailwind.” They further explained that U.S. macroeconomic conditions remain conducive for continued growth, with easing inflation and a dovish Fed stance boosting risk appetite. As long as inflows stay stable and macro data doesn’t surprise to the upside, analysts believe the next quarter could see Bitcoin reaching new heights.

Onchain BTC buying pressure mounts

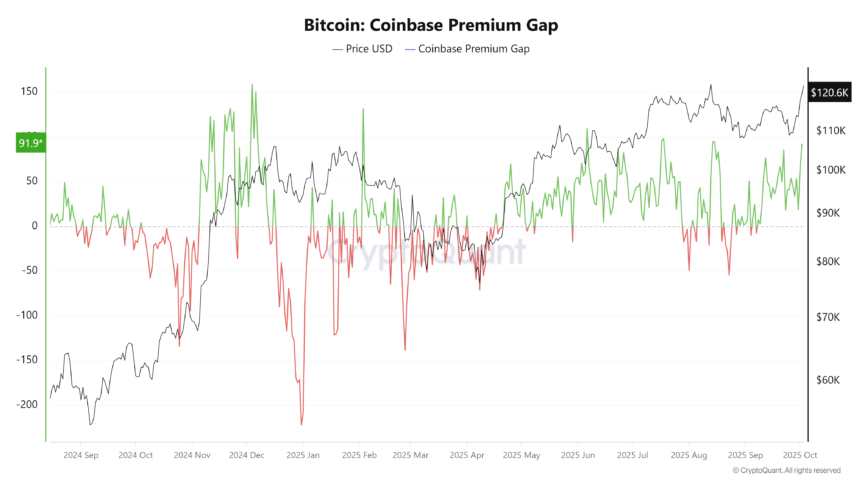

Onchain analytics confirm rising demand with Maartunn noting a spike of over $1.6 billion in hourly taker buy volume across all exchanges, signaling strong buyer interest. Meanwhile, the Coinbase Premium Gap — a key indicator measuring price differences between Coinbase and Binance — increased to $91.86, indicating US investor inflows and heightened demand for Bitcoin on Coinbase. Analyst Burak Kesmeci highlighted that US-based traders are paying nearly $92 more per Bitcoin on Coinbase, reaffirming US-led demand’s central role in recent price dynamics.

However, this premium level — the highest since mid-August — has historically signaled that bullish momentum often stalls or cools off. As traders await critical price levels, the market’s focus shifts to potential resistance zones around $130,000, where selling pressure could intensify.

Price discovery outlook for next week

Market experts anticipate further price discovery as Bitcoin nears record highs. Crypto trader Jelle commented, “$120,000 is now support. Holding above this level over the weekend could set the stage for a breakout next week.” Rekt Capital described the current phase as “Phase 3 Price Discovery” within the ongoing cycle, where new highs are likely to be established. Meanwhile, Skew pointed out that significant sell orders cluster around $130,000, making this the key resistance level to monitor. The upcoming daily closes will be critical in confirming whether Bitcoin can sustain its upward momentum. Market activity on Binance also indicates a “risk-on” environment, further fueling optimism for continued gains in the weeks ahead.

As the leading cryptocurrency approaches significant resistance levels, traders and analysts alike will be watching closely. Continued inflows and a clear macroeconomic backdrop could push Bitcoin towards new all-time highs, reaffirming its role as a dominant asset in the evolving blockchain and crypto markets landscape.