Bitcoin Clashes with Thin Demand Despite Recent Surge Above $90,000

Bitcoin recently retook the $90,000 mark, but underlying on-chain data suggests that the rally may lack sustainable support. Despite a heavy accumulation around the $84,000 cost basis, market participation beneath this level remains weak, raising concerns about the sustainability of the recent price movement.

Key Takeaways

- Over 400,000 BTC are entrenched in the $84,000 cost-basis zone, forming a significant on-chain support level.

- Spot demand above this firm footing remains shallow, with order books thin and prices moving through low-engagement areas.

- Liquidity signals mirror early 2022 weakness, with recent flows dominated by losses rather than new buying activity.

- Recent futures activity has primarily involved shorts covering rather than new longs entering the market.

Market Support Faces Challenges Without Increased Demand

Bitcoin’s recent rally was driven largely by short covering within a dense cost-basis cluster around $84,000. This zone has historically served as a strong support level, as evidenced by the accumulation of more than 400,000 BTC. However, the lack of active demand above this base suggests potential vulnerability, especially as prices push toward $90,000.

Market depth remains fragile, with order books showing limited buy-side liquidity as prices test higher levels. For Bitcoin to establish a durable move beyond $90, active participation and fresh buying above the $84,000 support must materialize from traders and institutional investors alike.

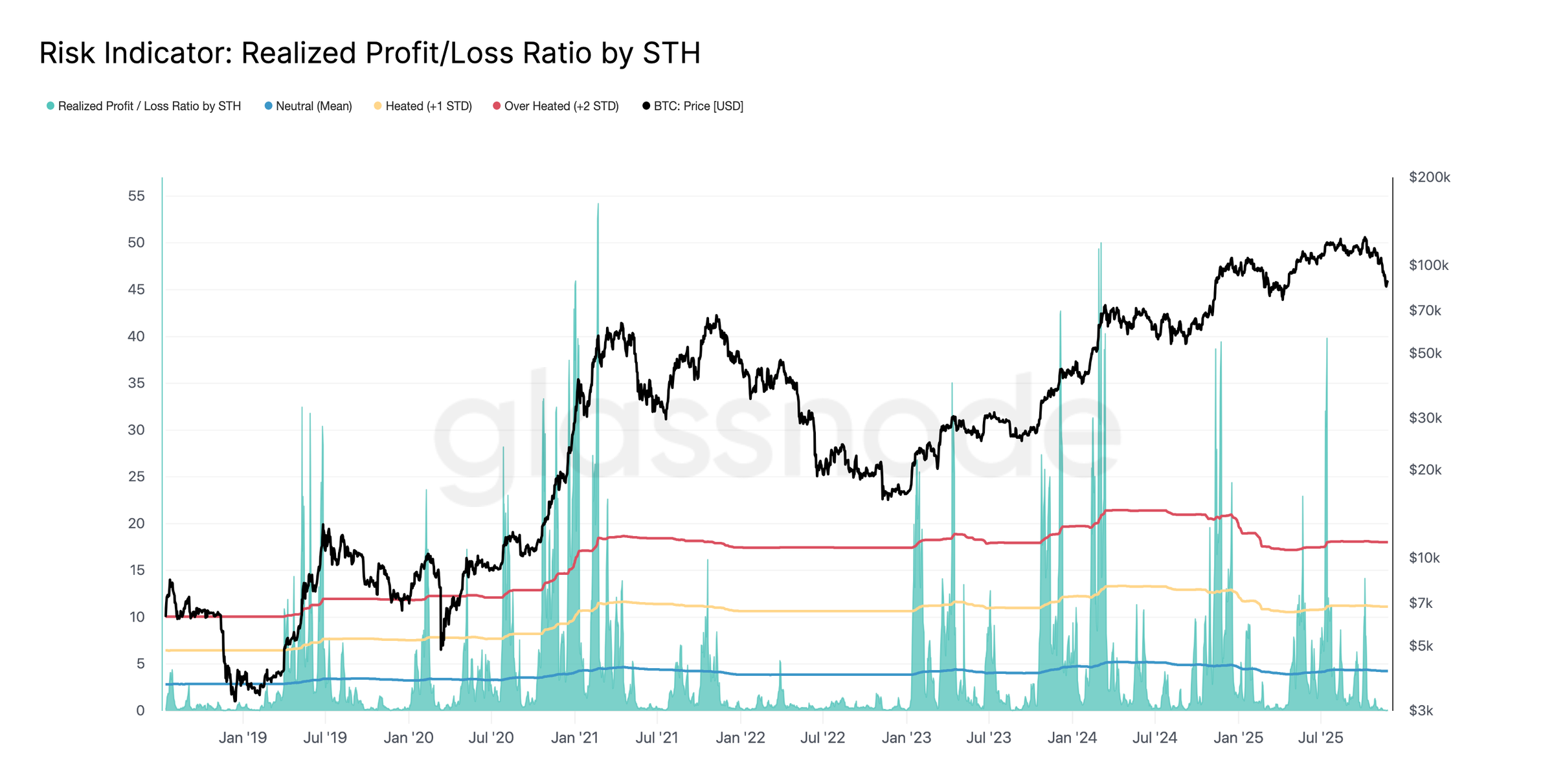

Liquidity Eroding as Short-term Holding Confidence Wanes

According to Glassnode, Bitcoin continues trading below the short-term holder (STH) cost basis of approximately $104,600, placing the market in a low-liquidity state reminiscent of the post-peak decline in early 2022. The current compression zone between $81,000 and $89,000 is characterized by realized losses averaging around $403 million daily.

The collapse of the STH profit/loss ratio to 0.07x indicates waning demand momentum, with investors largely exiting rather than accumulating during recent price strength. Without a liquidity reset—where losses begin to recede and profitability improves—the market risks gravitating back toward the $81,000 level.

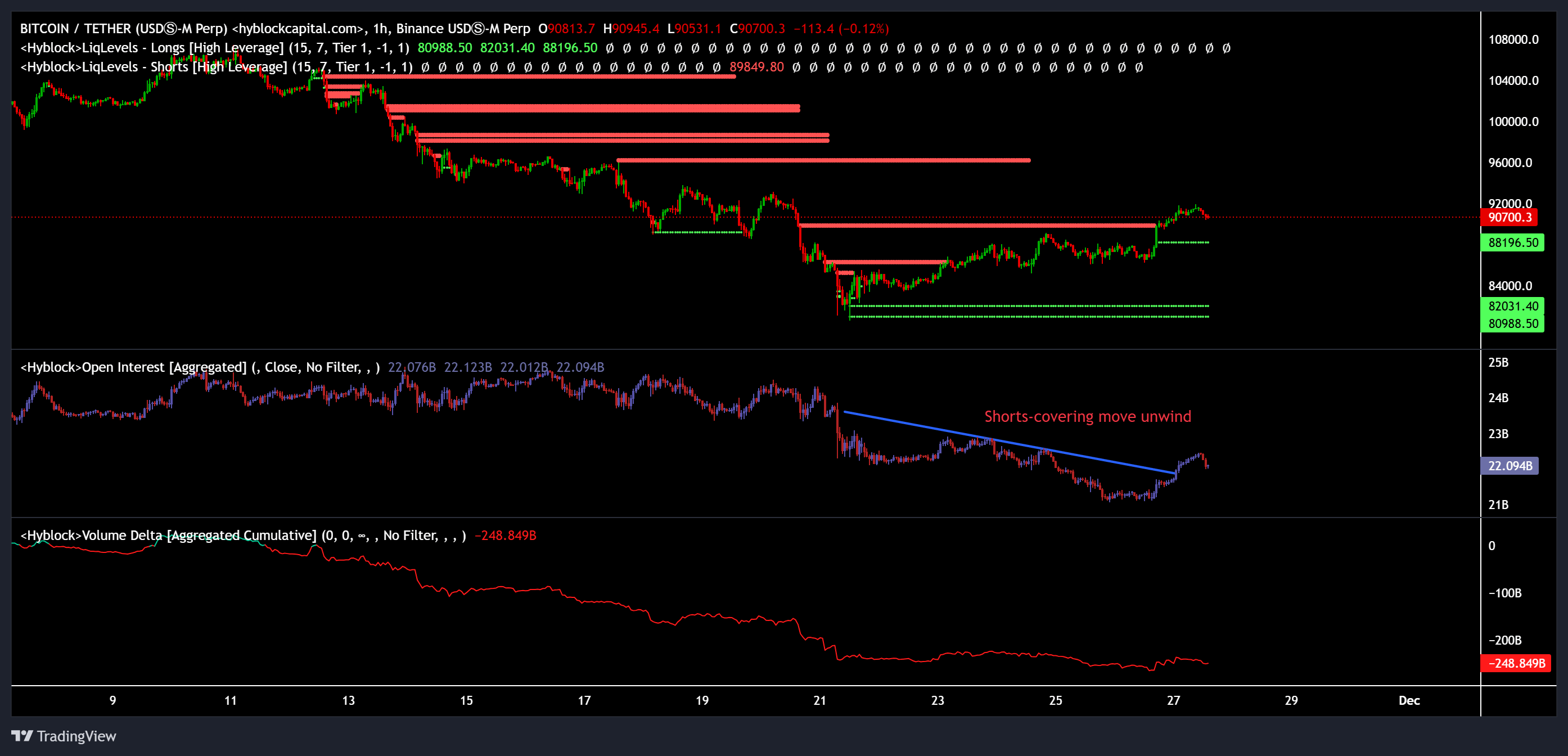

Futures Market Shows Cautious Sentiment

The recent push to $91,000 was primarily driven by short covering, rather than fresh long positions. Open interest continues to decline, and the volume delta remains flat, indicating a cautious environment among derivatives traders. Funding rates near neutrality further underscore the lack of conviction among buyers.

For a sustained upward trend, increasing open interest on the long side coupled with positive funding driven by real demand – rather than forced short covering – will be essential. Until then, the market remains susceptible to volatile corrections as leverage is gradually unwound.