Crypto Derivatives Market Shows Rising Bullish Sentiment Ahead of Year-End Movements

As 2023 nears its conclusion, the crypto derivatives market is experiencing heightened activity, signaling traders’ anticipation of significant price movements. Recent data indicate that perpetual open interest and funding rates are trending upward, reflecting increased leverage and bullish sentiment among market participants.

Key Takeaways

- Perpetual open interest rose from 304,000 to 310,000 Bitcoin, with the price briefly touching $90,000.

- The funding rate increased from 0.04% to 0.09%, suggesting heightened bullish positioning.

- Bitcoin failed to sustain above $90,000, pulling back to around $88,200 at press time.

- An upcoming $23 billion expiration of Bitcoin options contracts could amplify market volatility.

Tickers mentioned: Bitcoin

Sentiment: Bullish

Price impact: Positive. The increase in open interest and funding rates suggests strong trader confidence and potential for a price rally, although recent pullback indicates caution.

Market context: Current market activity is influenced by end-of-year options expiration and traders positioning for possible upward movements before the year closes.

Rising Derivatives Activity and Market Signals

Recent reports underscore a surge in the perpetual derivatives market, with open interest in Bitcoin futures rising from 304,000 to 310,000, coinciding with a brief spike in Bitcoin’s price to nearly $90,000. The funding rate—a periodic payment system between traders—also climbed from 0.04% to 0.09%, signaling increased bullishness. Generally, rising funding rates indicate that traders are willing to pay premiums to maintain long positions, which often precedes upward price momentum. However, rapidly increasing rates can also suggest overleveraged positions, raising the risk of corrections.

At present, Bitcoin’s price has retraced slightly from its high, trading around $88,200. Despite this, the overall market sentiment remains cautiously optimistic, supported by the derivatives data.

End-of-Year Options Expiry Could Drive Volatility

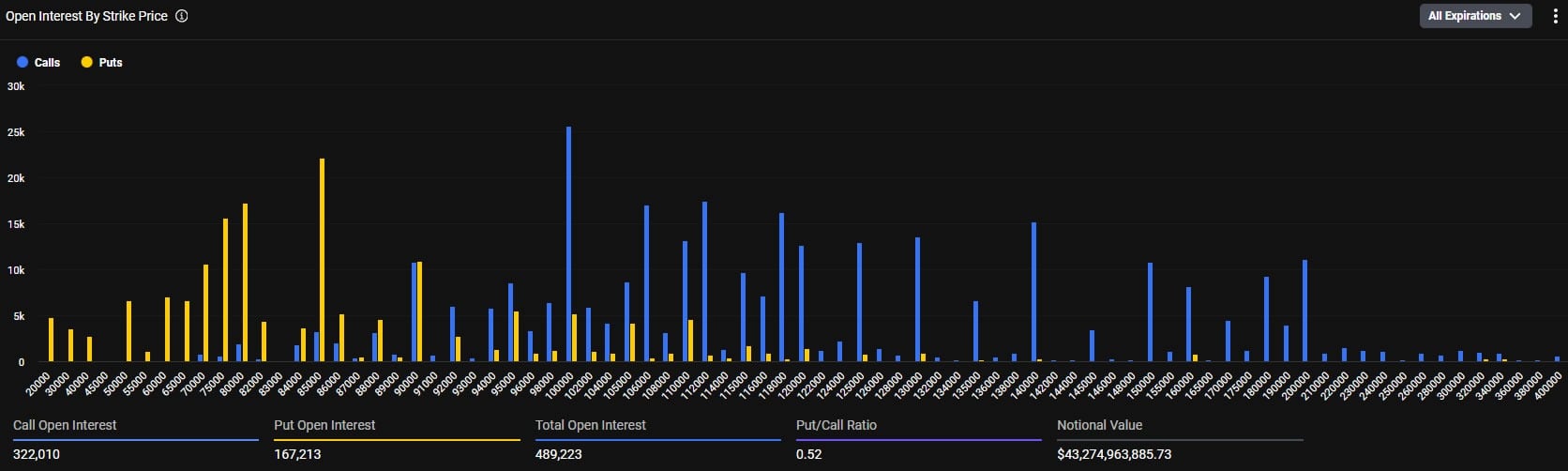

Adding to the market dynamics is the impending expiry of over $23 billion in Bitcoin options contracts scheduled for Friday, Dec. 26. These expiries are among the largest in history and tend to heighten volatility, especially during the end-of-quarter and year-end periods. Options traders are predominantly positioned around strikes of $85,000 to $120,000, with call contracts clustering at higher levels, indicating bullish expectations. Conversely, puts are concentrated near $85,000, implying some hedging activity.

The current put/call ratio stands at 0.37, indicating a dominance of long contracts expiring in the near term. The “max pain” point—a strike at which the most contracts will expire worthless—is approximately $96,000. If Bitcoin’s spot price does not rise above this level, many of these options may become worthless, potentially leading to a sell-off. This scenario suggests traders may be overly optimistic about further gains before expiry, with some bets already in the red.