- Bitcoin has declined approximately 11% since Monday, reaching a six-month low of $94,590 amid broader risk-off sentiment.

- Weakness in the technology sector and persistent ETF outflows have exerted downward pressure on Bitcoin’s price.

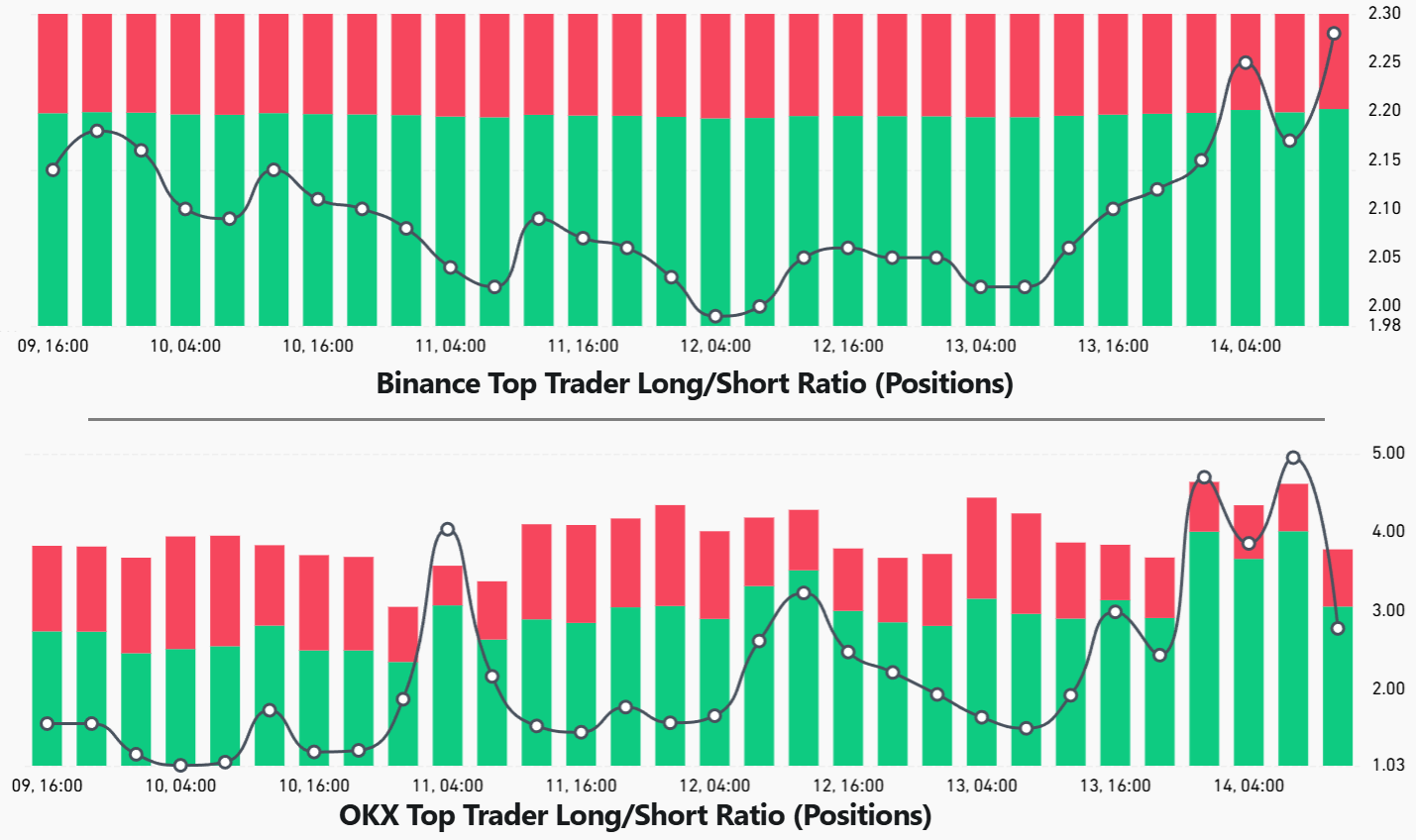

- Despite near-term volatility, institutional traders show signs of optimism, with long positions increasing on some exchanges.

- Concerns around inflation pressures intensified after US policy moves, fueling fears of recession and impacting crypto markets.

- Market sentiment remains cautious, with traders mostly derisking until clearer economic signals emerge.

Bitcoin (BTC) has seen its worst performance in months, falling by around 11% since the start of the week. The cryptocurrency reached a six-month low of $94,590 on Friday, as broader economic concerns and sector-specific worries continue to weigh on investor confidence. Despite a relatively modest liquidation of leveraged longs—totaling less than 2% of open interest—the sharp decline signals underlying fragility in the crypto markets.

The recent dip erased about $900 million in leveraged long positions, yet the broader market remained relatively resilient, unlike the cascade of liquidations seen during earlier downturns, such as October 10, when liquidity was extremely thin, and open interest plummeted by 22%. Currently, traders are monitoring whether Bitcoin has found a bottom or if further declines are imminent.

Economic concerns persist, especially after US President Donald Trump announced plans to cut tariffs to combat rising food costs. Leading economist Mohamed El-Erian highlighted increasing recession risks, noting that the “lower ends of household income” are struggling with rising costs, which could influence consumer behavior and broader economic stability.

The Bitcoin futures premium remained near 4% on Friday, indicating subdued demand for bullish leverage. Although this is below the preferred 5% neutral threshold, the rate has slightly improved from lows earlier this month. Meanwhile, professional traders display cautious optimism, with some increasing long positions while others cut exposure after support levels failed.

Notably, whales and market makers have been buying the dip, with some increasing long exposure on Binance since Wednesday, even as others, such as whales on OKX, scaled back their holdings at a loss. Overall, the sentiment among institutional players suggests a cautious but slightly more optimistic outlook, with traders closely watching macroeconomic developments for signs of a turnaround.

AI Sector Concerns and Broader Market Derisking Contribute to Bitcoin’s Correction

Part of the recent correction stems from sector-specific worries in artificial intelligence, a key growth driver for stocks, which has recently shown signs of strain. Prominent investor Michael Burry questioned whether extended depreciation schedules for computing equipment artificially inflated earnings, casting doubt on upcoming earnings reports. Amazon, notably, shortened its depreciation calendar, aligning with other companies’ cautious approach.

Furthermore, net outflows from Bitcoin spot ETFs in the U.S. — totaling approximately $1.15 billion over two days — have dampened sentiment, even though these figures represent less than 1% of assets under management. A notable sell-off from a 2011 Bitcoin holder added to market nerves. Yet analysts suggest this was an isolated event and not indicative of a broader trend.

The options market’s fear gauge, represented by the delta skew, stood at 10% on Friday, remaining resilient despite Bitcoin’s 24% drop from its all-time high. This suggests that, although risk aversion persists, options traders are still reasonably confident that further downside is limited. As uncertainty continues to cloud the macroeconomic outlook, traders are likely to remain cautious, favoring cash until more clarity emerges.

With several large firms posting significant losses recently, the trend toward risk aversion is expected to continue, potentially keeping Bitcoin under pressure in the near term. Still, the evolving macroeconomic landscape and technical signals indicate that traders are weighing the risk of further declines against the potential for a rebound.

This article is for informational purposes and does not constitute financial advice. Market conditions remain volatile, and investors should conduct thorough research before making any investment decisions.