Bitcoin’s 2024–2025 Price Movements Highlight Growing Discord Between Onchain Strength and Macroeconomic Constraints

Despite robust onchain fundamentals supporting Bitcoin’s rally in 2024, macroeconomic headwinds continued to impose significant valuation caps during this period. As Bitcoin advanced from around $42,000 to surpass $100,000 in Q4, external factors such as rising real yields and Federal Reserve balance sheet reductions constrained potential gains, highlighting the complex interplay between crypto market health and broader economic conditions.

Key Takeaways

- Bitcoin surged from about $42,000 to over $100,000 in 2024, driven by stablecoin inflows and exchange outflows.

- The market valuation metric, the Bitcoin market value to realized value (MVRV) ratio, increased from 1.8 to roughly 2.2 within this period, yet remained below overheating levels.

- In 2025, elevated real yields and balance sheet contraction appeared to limit further gains despite continued onchain strength.

- Market dynamics shifted, with reduced stablecoin inflows and mixed exchange netflows signaling a moderation in bullish momentum.

Onchain Strength Underpinned 2024 Rally

Bitcoin’s trajectory in 2024 was marked by a steady ascent from near $42,000, culminating in a significant breakout above $100,000 during the final quarter. This rally was underpinned by improving liquidity conditions onchain. Monthly stablecoin inflows averaged between $38 and $45 billion, indicating abundant deployable capital entering the ecosystem.

Meanwhile, correlation analysis revealed a negative 0.32 rolling relationship between stablecoin inflows and Bitcoin exchange net flows. This dynamic suggested that inflows into exchanges were associated with Bitcoin moving off exchanges, pointing to accumulation rather than distribution.

This accumulation-driven trend supported the durability of the rally, aligning with long-term institutional interest and the emergence of a spot ETF demand environment. Valuation metrics further reinforced this view. The MVRV ratio increased from 1.8 to 2.2, reflecting a valuation expansion consistent with onchain fundamentals rather than speculative overheating. High-timeframe data indicated that market strength was fundamentally driven, allowing prices to trend higher without triggering widespread profit-taking or forced liquidation.

However, macroeconomic factors diverged considerably from previous bull cycles. Throughout 2024, US 10-year real yields averaged around 1.75%, remaining positive. The Federal Reserve shrank its balance sheet from $7.6 trillion to $6.8 trillion by year-end, increasing the opportunity cost of holding non-yielding assets like Bitcoin.

Macroeconomic Headwinds Limit 2025 Returns

2025 saw Bitcoin encounter increased volatility as macro conditions tightened further. Price swings ranged between $126,000 and $75,000, and stablecoin inflows declined sharply by approximately half. While onchain metrics stayed relatively intact, the contraction of inflows suggested diminished marginal buying power and a gradual shift towards distribution.

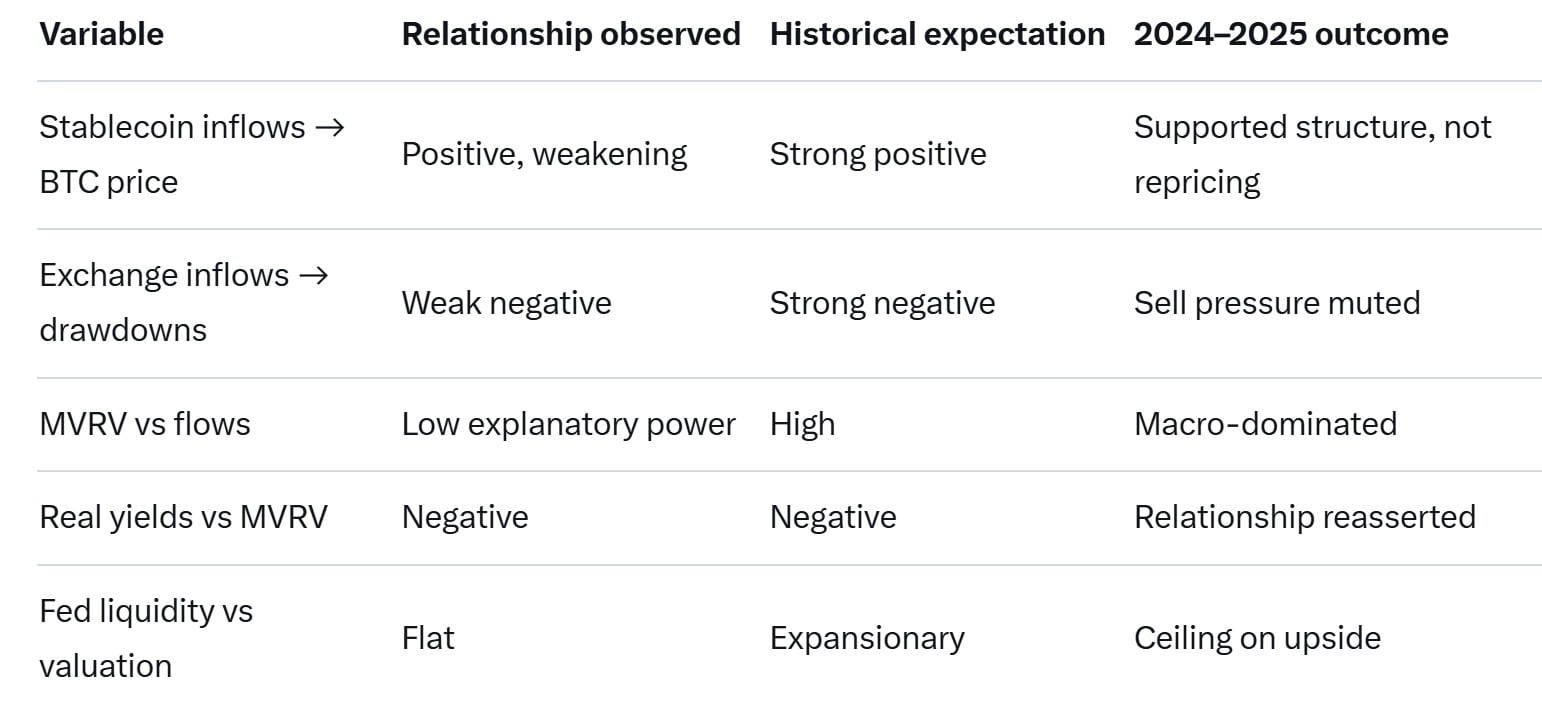

Valuation metrics reflected a stabilized yet subdued environment. The MVRV 365-day SMA hovered between 1.8 and 2.2, remaining above bear-market levels but lacking the expansion needed for new bullish cycles. Regression analyses indicated that stablecoin inflows and exchange netflows accounted for less than 6% of valuation variance, emphasizing the diminished influence of onchain flows in macro-constrained conditions.

The macro environment persisted as a key determinant. US real yields remained elevated, averaging between 1.6% and 2.1%, while the Fed further reduced its balance sheet, removing an additional $300 billion of systemic liquidity. Unlike previous bull markets characterized by falling yields and easing liquidity, the 2025 landscape remained structurally restrictive, stalling major price gains despite solid onchain fundamentals.

Implications for Future Market Movements

From this analysis, Bitcoin appears to have settled into a regime where onchain metrics define market structure, but macroeconomic factors set valuation ceilings. Continual liquidity contraction and rising yields suggest that future rallies may depend more on easing macro conditions—such as falling real yields or renewed global liquidity—rather than just onchain activity alone.

For investors, it underscores the importance of monitoring macroeconomic indicators alongside onchain data. While accumulation persists, substantial price discovery remains contingent upon broader financial conditions easing, signaling that macro factors will likely continue to play a decisive role in Bitcoin’s next move.