Bitcoin Faces Decline Amid Economic Uncertainty and Market Volatility

Bitcoin’s recent price action highlights the increasing cautiousness among traders as macroeconomic risks and market dynamics weigh heavily on sentiment. After failing to surpass $92,250, Bitcoin experienced a $2,650 decline, driven by a confluence of factors including geopolitical uncertainty, economic data delays, and a weakening housing market, prompting a retreat from bullish positions.

Key Takeaways

- Economic uncertainty, delayed economic data, and weakness in the housing sector are leading traders to reduce exposure to Bitcoin.

- Pro traders are paying high premiums to hedge downside risks, while stablecoins in China are being sold at discounts to exit the crypto market.

- The market’s risk perception is leaning bearish, with Bitcoin’s futures premiums below neutral levels for two weeks.

- Weak demand for bullish leverage and deteriorating macroeconomic outlooks underscore short-term bearish signals for Bitcoin.

Tickers mentioned: Bitcoin

Sentiment: Bearish

Price impact: Negative. The inability to maintain gains above key resistance levels and rising risk aversion are exerting downward pressure on Bitcoin’s price.

Trading idea (Not Financial Advice): Hold. Given the current risk-off environment and declining demand for leverage, a cautious approach is advisable until macroeconomic conditions clarify.

Market context: Broader macroeconomic headwinds and uncertainty over US monetary policy are shaping investor behavior across the markets.

Bitcoin recently declined from its attempts to breach the $92,250 level, dropping by around $2,650 amid increased risk aversion and broader market weakness. The decline was exacerbated by a forced liquidation of $92 million in bullish futures, indicating lingering bearish sentiment. The futures market remains cautious, with traders requesting a 13% premium to sell downside protection, a hallmark of bearish markets.

The weak demand for bullish leverage is reflected in Bitcoin’s futures premium, which has remained below 5%—a neutral threshold—for the past two weeks. This indicates a subdued appetite for bullish exposure despite Bitcoin’s 28% correction from its October all-time high.

In addition, macroeconomic concerns are mounting, with new data delays from the US government and a private report revealing over 71,000 layoffs in November. Meanwhile, in the real estate sector, delistings surged 38% from the previous year, and the median home price dipped slightly, highlighting economic uncertainty that influences investor confidence.

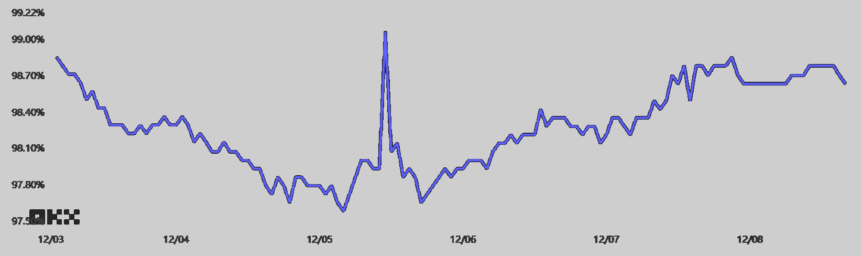

Furthermore, in China, stablecoins like Tether are trading at a discount to their peg, signaling an exit from the crypto market amid heightened risk aversion. This trend underscores mounting cross-border sell-offs and cautious positioning by regional investors, although it does not suggest a breakout below $85,000 in the near term.

The subdued inflow into US-listed Bitcoin ETFs further reflects cautious investor sentiment. The likelihood of Bitcoin reaching $100,000 depends heavily on improved macroeconomic clarity from the US, potentially taking longer than a single Federal Reserve decision to materialize. As market conditions remain fragile, traders are advised to approach with caution until more definitive economic signals emerge.