Bitcoin has bounced roughly 17% from Friday’s $60,150 trough, but the rebound has not erased the undercurrent of caution rippling through the derivatives market. Traders remain wary of chasing fresh upside exposure as the price hovers near the $70,000 level, with liquidity dynamics painting a mixed picture. In the past five sessions, leveraged bullish futures liquidations totaled about $1.8 billion, fueling speculation that major hedge funds or market makers may have faced sizable losses. The market’s struggle to sustain momentum after Thursday’s skid highlights how fragile appetite for risk remains, even as the price attempt to reclaim ground continues.

Key takeaways

Bitcoin’s derivatives signals point to elevated caution, with the options skew measuring roughly 20% on the week as traders weigh a potential second wave of fund liquidations.

While the price retraced some of Thursday’s losses, the rally is not translating into broad demand for new long exposure, especially when compared with gold and technology equities.

Aggregate futures liquidations indicate a recent wave of forced liquidations, but open interest on major venues remains steady, suggesting mixed conviction among bulls and sellers.

The futures market shows cooling demand for bullish leverage, with the BTC futures basis rate sinking to the lowest in over a year, underscoring a cautious stance despite a price move above key levels.

Tickers mentioned: $BTC

Sentiment: Bearish

Market context: The current dynamics unfold against a backdrop of tepid leverage appetite in crypto markets, with options and futures signals diverging from spot-price gains. Investors are reevaluating risk, liquidity, and potential catalysts that could reaccelerate a broader uptrend, while systemic concerns about market-makers and liquidity have kept participants cautious.

Why it matters

The present mood in the Bitcoin market illustrates a broader tension between price action and risk appetite embedded in derivatives markets. The rally from Friday’s low has been constrained by a thinning of upside demand, suggesting that buyers are selective and selective exposure remains the name of the game. For market participants, the key takeaway is not a lack of interest in Bitcoin per se, but a hesitation to deploy fresh leverage when volatility remains high and liquidity conditions are not uniformly supportive.

The liquidation backdrop underscores how fragile liquidations can ripple through the marketplace. When approximately $1.8 billion of leveraged bullish futures contracts liquidate over a five-day window, it can prompt a reassessment of risk by major players, potentially widening bid-ask spreads and triggering protective selling pressures that outlive the immediate move. This environment makes it harder for bulls to build sustained momentum, even as the price tests and briefly surpasses notable thresholds.

On the sentiment front, the skew in options markets provides a counterpoint to price recovery. A 20% two-month options skew signals persistent fear and a premium placed on downside protection. In calmer times, a higher demand for calls—indicative of optimism—would push the skew down toward neutral readings. Instead, the market appears more attuned to the risk of further losses than to a runaway rally. The lack of a clear catalyst for a renewed surge adds to the sense that any upside may be incremental and exposed to negative surprises if liquidity tightens or macro risk shifts.

Traders will be watching whether institutions that have been operating behind the scenes—market makers, hedge funds, or proprietary desks—adjust their risk models in the near term. The fear of an unseen balance-sheet event can weigh on market psychology, particularly when combined with ongoing questions about systemic leverage in the crypto space. While some bulls have been adding exposure as prices attempt to climb toward and beyond $70,000, the overall tone remains cautious, with the derivatives landscape signaling that risk-off tendencies could reassert themselves if new liquidity concerns or regulatory headlines surface.

The current narrative also invites a closer look at the relationship between price movements and hedging behavior. The apparent dissonance between a late-week price rally and dwindling leverage demand raises questions about what comes next for Bitcoin’s trajectory. If the price can sustain its gains without drawing in a broader wave of leverage, a potential scenario could involve a gradual reaccumulation of long positions. Conversely, any renewed shock—whether from leverage unwind, a regulatory development, or macro catalysts—could accelerate a fresh wave of selling pressure, given the fragile confidence that currently characterizes the market.

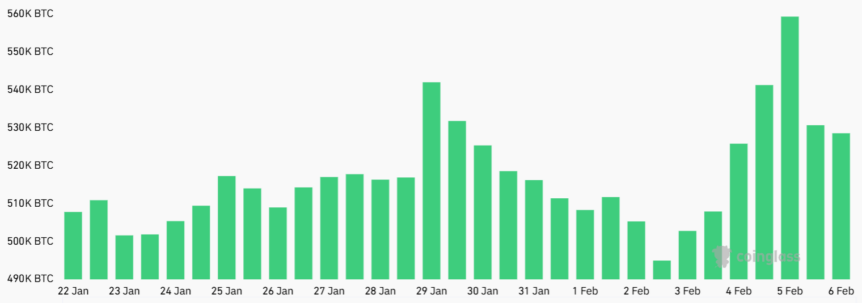

The data paints a picture of a market tentatively treading water near critical levels. The aggregated Bitcoin futures open interest across major exchanges stood at roughly 527,850 BTC on Friday, essentially flat versus the prior week, even as the notional value of those contracts declined from about $44.3 billion to $35.8 billion. The juxtaposition—steady open interest with a sharp drop in notional exposure—reflects a snapshot of risk being redistributed rather than a wholesale shift in bullish conviction. It implies that while some traders are choosing to run hedges or reduce exposure, others are still accumulating, albeit cautiously, with a renewed emphasis on margin discipline as prices move in and out of the $70,000 region.

To contextualize whether larger players are reconsidering risk, the BTC futures basis rate—an indicator of the premium paid for futures relative to spot over a set horizon—fell to about 2% on Friday, the lowest in more than a year. In neutral conditions, the annualized premium would typically sit in a 5%–10% range to compensate for the settlement lag. The decline signals a cooling appetite for bullish leverage, even as the price manages to breach the psychological threshold of $70,000. This divergence between price strength and leverage appetite helps explain why the market has yet to embark on a fresh, sustained ascent and why traders remain alert to potential pullbacks if liquidity tightens or risk sentiment worsens.

Options dynamics add another layer of caution. The BTC options market has shown a growing tendency to put protection against downside moves, a hallmark of risk-averse positioning. A prominent feature in the latest readings is the elevated put-call skew, which suggests traders were willing to pay a premium to insure against declines. The skew’s elevation aligns with periods of market stress in which fear and uncertainty dominate price action. While some participants might anticipate a sharper comeback if macro conditions stabilize, the absence of a compelling bullish catalyst leaves room for continued volatility and potential dissipations in sentiment as the market digests new information.

The current mood sits within a broader narrative where fear and uncertainty have grown even without a singular, obvious catalyst. A widely cited discussion—What’s really weighing on Bitcoin? Samson Mow breaks it down—highlights structural concerns in the market’s structure and liquidity dynamics. While there is no single event driving the downturn, the combination of forced liquidations, a fragile risk appetite, and a cautious options market reinforces a narrative of vulnerability that could persist in the near term.

Traders are likely to continue weighing the possibility that a large market maker or hedge fund could be facing distress, and this sentiment tends to erode conviction and raise the odds of downside moves. In such an environment, the probability of a durable bullish breakout remains tempered, even as Bitcoin shows signs of breaking beyond key price levels. As the market digests ongoing data and seeks stability, participants should prepare for continued volatility and carefully monitor leverage, funding dynamics, and macro headlines that could tilt sentiment anew.