As Bitcoin continues to attract both retail and institutional investors, recent data indicates a robust bullish trend driven by significant inflows into crypto funds, declining exchange reserves, and resilient derivatives markets. Amidst global economic uncertainties, the cryptocurrency market demonstrates signs of sustained confidence, with traders eyeing a potential surge towards new all-time highs by year’s end.

- Over $3.5 billion in weekly ETF inflows underscores growing institutional interest in Bitcoin, coupled with exchange reserves hitting a 5-year low.

- Futures markets remain healthy, with open interest and premiums supporting bullish expectations.

- Bitcoin’s year-to-date performance outpaces traditional equities, solidifying its status as digital gold amid increasing numbers of corporate reserves and asset management flows.

- Market robustness suggests traders anticipate Bitcoin reaching $150,000 by year-end, despite short-term consolidation risks.

Bitcoin (BTC) experienced a 4.2% correction on Tuesday after peaking at an all-time high of $126,219, a natural retracement after a 12.5% weekly surge. While some market participants grow cautious amid rising global economic uncertainties, derivate trading data and institutional flows remain resilient, hinting at further upside potential.

Bitcoin’s monthly futures currently trade at an 8% annualized premium over spot prices, well within the neutral 5% to 10% range. Historically, extreme confidence levels push spreads above 20%, while bearish sentiments tend to pull them below 5% or into negative territory — neither scenario applies presently. This indicates traders are cautious but generally optimistic, reducing the risk of cascading liquidations should prices dip further.

More importantly, recent inflows suggest real interest rather than speculation, with Bitcoin maintaining above $120,000 bolstering bullish momentum. The rally post the September 26 retest of $109,000 reflects increasing institutional confidence, especially as many prefer Bitcoin over traditional assets during turbulent periods.

Institutional Adoption Bolsters Bitcoin as Digital Gold

Institutional interest continues to underpin Bitcoin’s rise, cementing its reputation as digital gold. Year-to-date, Bitcoin has gained approximately 31%, outperforming the S&P 500’s 14% growth in 2025. Net flows into Bitcoin-focused ETFs and ETPs validate this trend, illustrating the increased appetite among institutional investors for the cryptocurrency as a hedge and reserve asset.

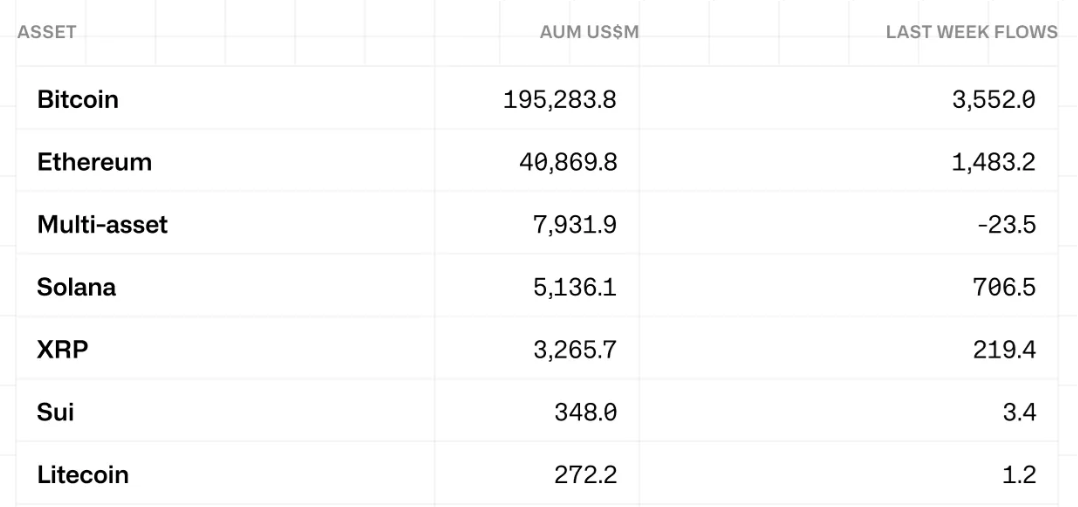

The weekly net inflows of $3.55 billion have pushed Bitcoin’s assets under management to nearly $195 billion, highlighting continued institutional confidence. Major asset managers and companies like Strategy and Metaplanet are increasing their BTC holdings, fortifying Bitcoin’s position as a standalone asset class. Notably, Brazilian company OranjeBTC has started trading on the stock market after accumulating 3,675 BTC — valued at over $445 million.

BTC Reserves on Exchanges Drop to Five-Year Low

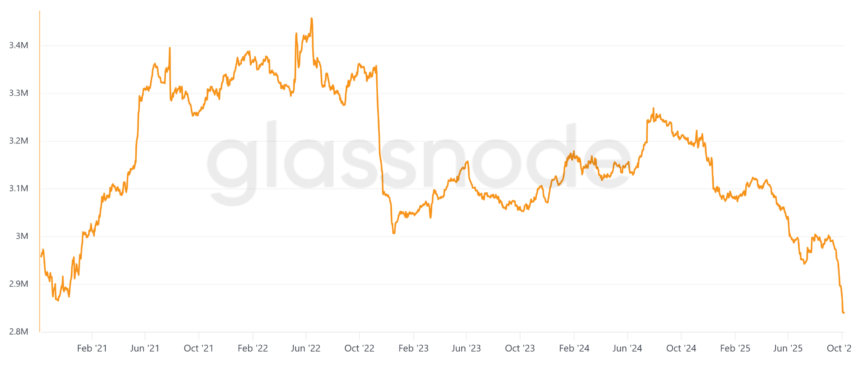

Bitcoin reserves on exchanges have fallen to their lowest point in over five years, with Glassnode reporting total exchange holdings at approximately 2.38 million BTC, down from 2.99 million just a month prior. This decline signifies a reduced supply available for immediate sale and suggests ongoing accumulation by long-term investors, even as OTC desks facilitate large trades outside public markets.

Market Resilience and Futures Open Interest Support Bullish Outlook

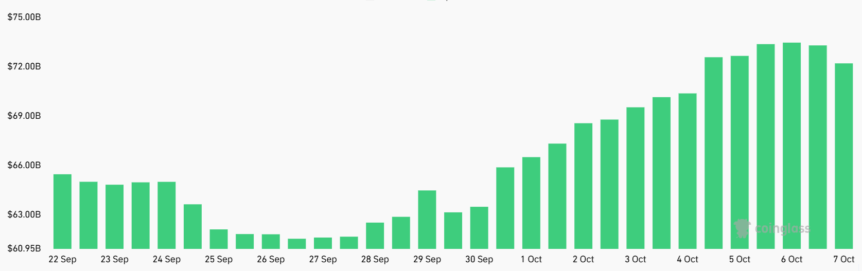

Bitcoin futures open interest currently stands at about $72 billion, a slight 2% decrease from previous levels but still indicative of robust trading activity. The healthy derivatives market plays a vital role in attracting global hedge funds and institutional flows, enabling diverse trading strategies, including shorts, which help maintain market liquidity.

Despite short-term volatility and potential consolidation, the resilience of Bitcoin’s derivatives market and accumulating institutional interest bolster bullish forecasts. Traders and analysts alike now increasingly anticipate Bitcoin reaching $150,000 or higher before year’s end, supported by strong fundamentals and sustained demand.

This article provides an overview of current market conditions and should not be considered investment advice. Cryptocurrency markets are volatile, and readers should perform their own due diligence before making investment decisions.