Bitcoin’s recent rebound has sparked renewed debate among traders and analysts about the sustainability of the current bull market. As BTC inches back from its recent lows, the market faces critical levels and uncertain macroeconomic influences, including potential shifts in US monetary policy and inflation dynamics. This week could prove pivotal in determining whether the cryptocurrency market will sustain its recovery or face a deeper correction amid heightened volatility.

- Bitcoin recovers to $116,000 following the largest liquidity wipeout in crypto history.

- Market participants are divided on whether the current rally signifies the end of a correction or the start of a new bull phase.

- On-chain data shows record low funding rates and massive liquidation events, warning of potential instability ahead.

- Upcoming US economic data and Fed Chair Powell’s speech will influence crypto and traditional markets’ direction.

- The narrative of currency debasement amplifies as gold hits new highs, supporting the ‘debasement trade’ in crypto.

“Game over” as Bitcoin, crypto rebound

Bitcoin has bounced back to $116,000 to begin the week, matching weekly close volatility forecasts. This marks a 5.7% rally from Friday’s lows of $109,700 following the historic liquidity wipeout, data from Cointelegraph Markets Pro and TradingView confirm.

The cause of such drastic movement was a single US-China trade war tariff announcement, which triggered unprecedented panic across markets. Stocks and gold also tumbled initially, but gold quickly regained ground, climbing to new all-time highs of $4,078 per ounce.

According to The Kobeissi Letter, “This has effectively erased 50% of the decline seen late-last week. Now, we await more guidance from the Trump Administration.”

Following Friday’s chaos, crypto markets added over half a billion dollars to their total capitalization. Although some traders had anticipated a quick short squeeze, co-founder Adam Kobeissi said the rally signals “game over” for bearish traders, highlighting the swift wealth transfer within crypto.

Meanwhile, former US President Donald Trump’s reassurance on Truth Social, where he wrote “Don’t worry about China, it will all be fine,” contributed to the positive sentiment shift.

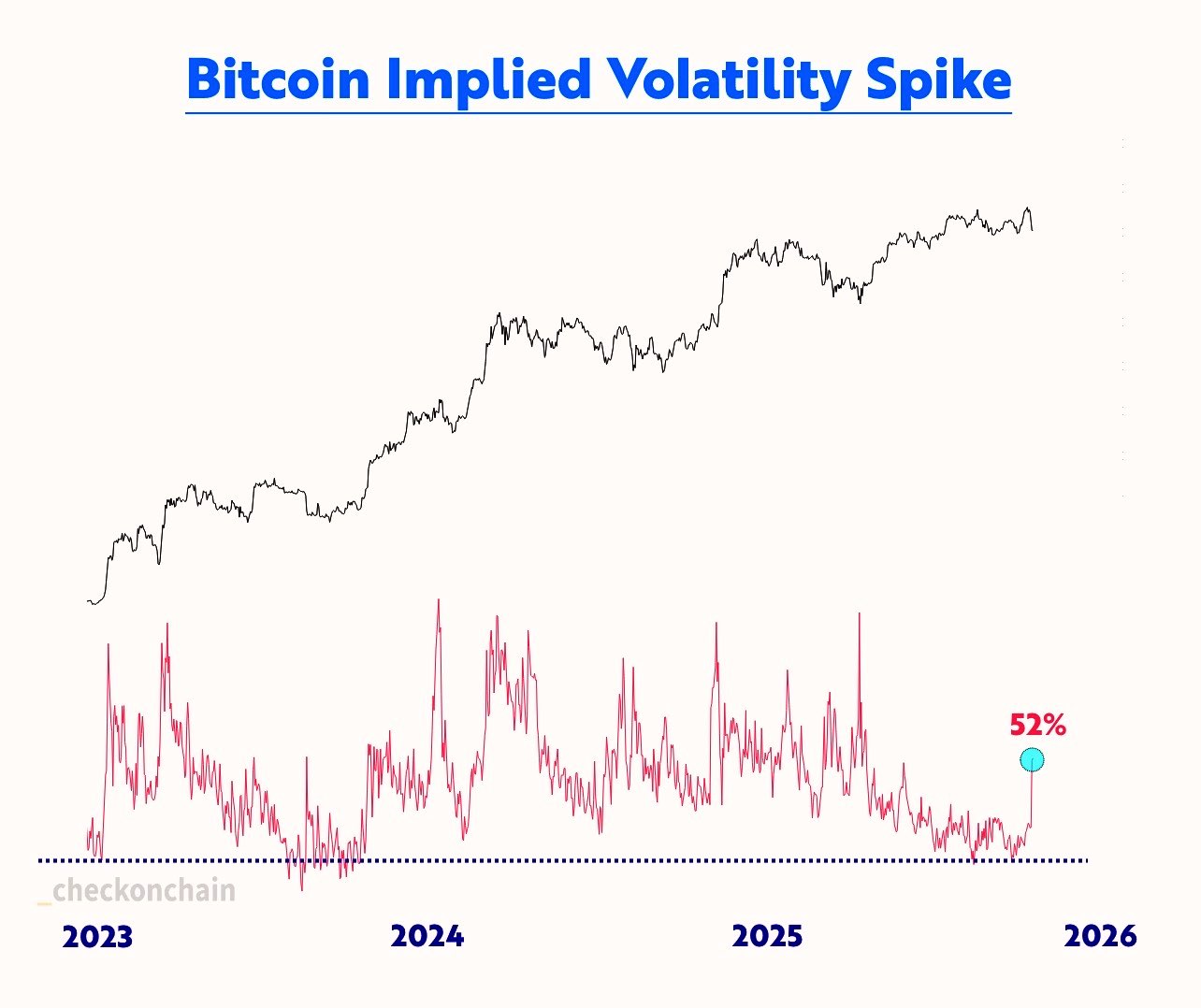

Market volatility remains elevated, with crypto quant analyst Frank A. Fetter noting that implied volatility has reached levels unseen since April, reflecting increased expectations of significant price moves. This heightened uncertainty casts doubt on whether Bitcoin will follow its typical late-year blow-off top, raising concerns among traders about the potential for a sustained correction.

Bitcoin bull market hinges on key trendline

This week’s chart analysis reveals a divided outlook among traders. While some believe the recent bounce signifies the end of the correction, others remain cautious about potential further declines. Trader Roman emphasized that the recent dip bounced off a long-term uptrend support from August 2024 at around $40,000, but warned of a possible retest of $108,000 if bearish momentum persists.

Roman cautioned that a break below this diagonal trendline would confirm a new macro downtrend, signaling a bear market. Conversely, trader Skew observed that the entry of large institutional players at the $115,000 level provides some optimism, provided key support levels hold—specifically $112,000 on the daily chart, and $120,000 remains a challenge for bulls.

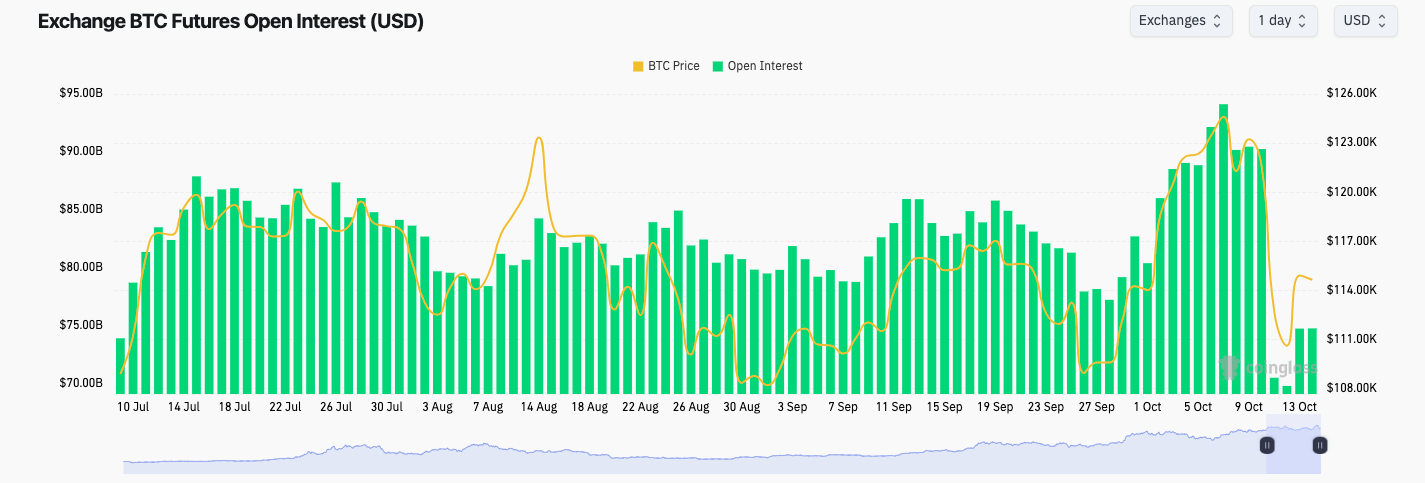

Other technical traders have pointed to order-book liquidity zones, emphasizing the importance of respecting liquidation hotspots—levels where significant open interest could prompt volatile price swings.

Analyst: “Stay cautious” after crypto liquidity flush

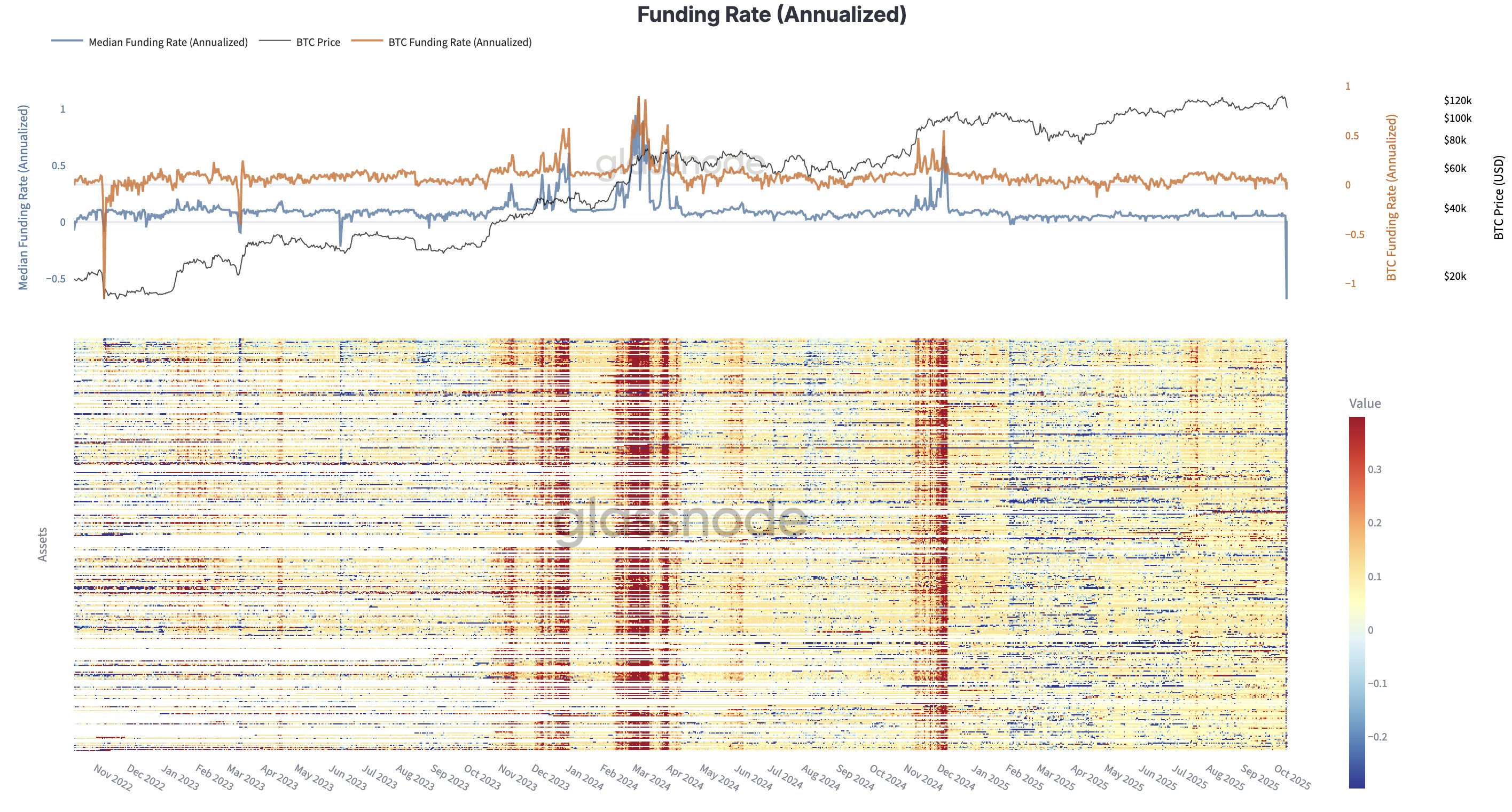

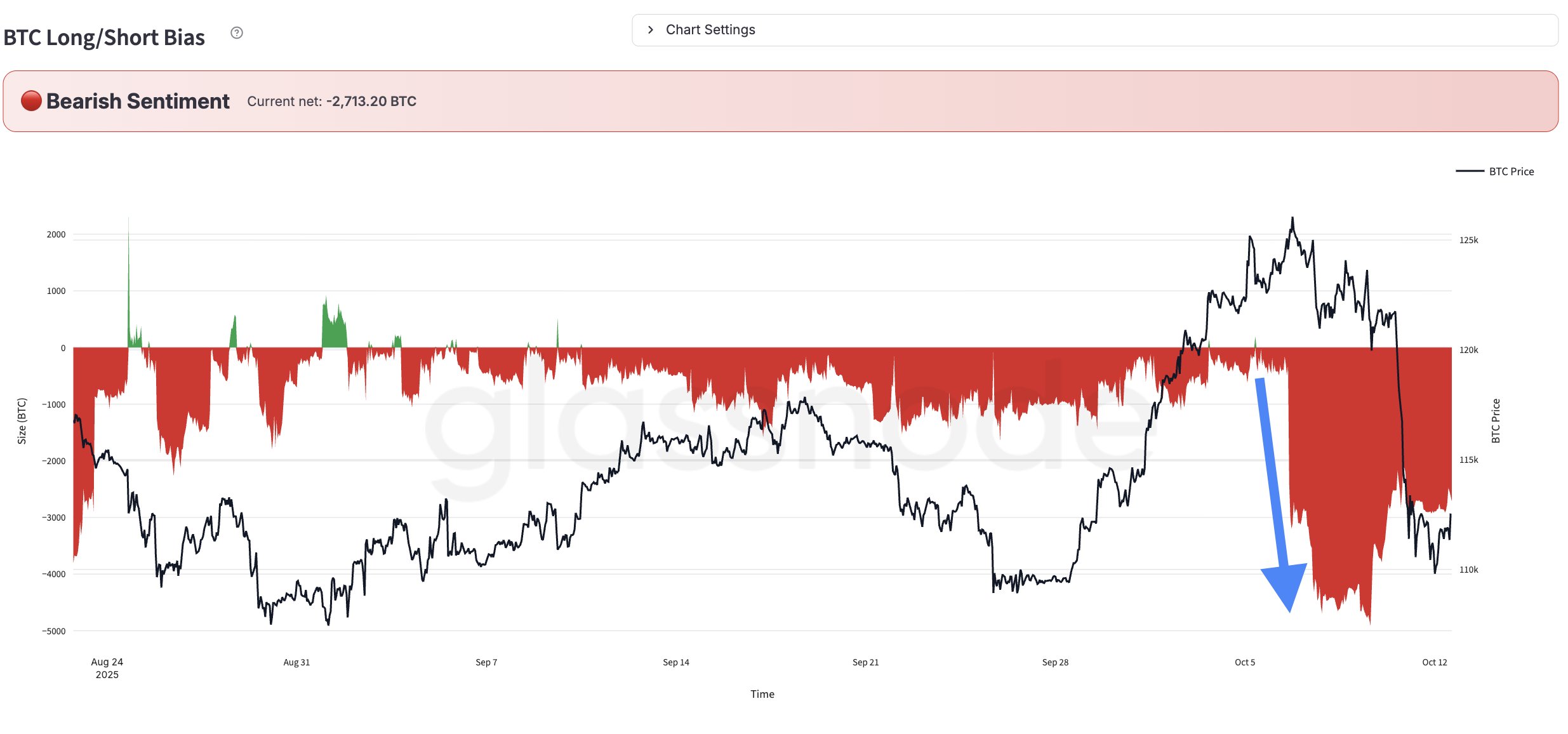

The recent liquidity cascade—marked by record-breaking liquidations and margin calls—has reset the crypto market’s structure. Data from Glassnode indicates funding rates across derivatives exchanges hit their lowest points since 2022, suggesting a significant deleveraging phase.

“Funding rates across the crypto market have plunged to their lowest levels since the depths of the 2022 bear market. This is one of the most severe leverage resets in crypto history,”

In addition, open interest across major exchanges declined by over $20 billion from Friday to Sunday, before rebounding slightly. Rafael Schultze-Kraft of Glassnode highlighted that the largest open interest wipeout in crypto history was underway—over $10 billion for Bitcoin alone—underscoring heightened risks and the necessity for caution among traders.

Further, net short positions among large traders have surged since October 6, emphasizing a cautious stance as the market remains volatile and unpredictable.

“While levels have recovered, traders should remain cautious,”

Missing data puts focus on Fed’s Powell

Due to the ongoing government shutdown, key U.S. economic data, including inflation metrics and the Producer Price Index, may be delayed. This uncertainty shifts focus to Federal Reserve Chair Jerome Powell’s upcoming speech, where investors will scrutinize his remarks for clues on future interest rate policy.

Markets widely expect the Fed to cut rates by 0.25% at its October 29 meeting, but debates continue within the central bank about the timing and necessity of further easing. Powell’s comments could be a decisive factor in the crypto markets’ direction, especially given the sensitive macroeconomic backdrop.

Trade analyst Mosaic Asset notes that “deep divisions” among Fed officials about rate cuts reflect ongoing uncertainty, especially as labor market data remains a significant concern—one that the Fed has prioritized in its decision-making process.

As previously reported, the macroeconomic outlook and the timing of Fed policy moves are expected to heavily influence both traditional and crypto markets in the coming weeks.

All aboard the “debasement trade” train

Despite the recent turbulence, the broader macroeconomic environment suggests that the shift away from US dollar dominance and currency devaluation concerns may reinforce the case for Bitcoin and other cryptocurrencies. The ongoing “debasement trade” — a bet on currency devaluation driven by expansionary monetary policies — continues to attract investors seeking refuge in assets less vulnerable to inflation.

Data from Mosaic highlights that Bitcoin has led the rally among cryptocurrencies, reaching as high as $125,000, paralleling gold’s new record highs during this period. Both assets are viewed as hedges against monetary debasement, with rising global money supply and expanding government debt fueling inflation fears.

Market watchers warn that inflation could accelerate if currency devaluation persists, with the Fed’s recent data hinting at inflationary pressures ahead. The “prices paid” indicator, a key metric in assessing upcoming inflation trends, has increased, signaling potential macroeconomic shifts that could further support risk assets.

This year’s macro-driven market behavior, exemplified by the historic US-China trade response, reveals a new level of market reactionism—highlighted by record liquidation waves and heightened leverage. Traders are advised to remain cautious amidst these volatile conditions as macro events could shape the crypto landscape in unpredictable ways.

This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own research before engaging in trading or investing decisions.