- Paul Tudor Jones foresees substantial upside in US equities and cryptocurrencies, emphasizing the need for more retail and institutional participation to reach a market peak.

- US fiscal challenges — including a record-breaking debt outlook and rising deficits — are creating a conducive environment for assets like Bitcoin to prosper as safe havens and inflation hedges.

- Market dynamics differ from 1999, with current monetary policies favoring continued growth rather than tightening, boosting speculative momentum.

- Market valuation remains moderate—the S&P 500’s price-to-earnings ratio suggests room for further expansion before reaching bubble territory.

- Bitcoin’s market cap and potential inflows position it as an attractive investment, with even modest capital shifts capable of impacting its price significantly.

Billionaire investor Paul Tudor Jones maintains a bullish outlook for US markets, underscoring the role of the government’s expanding fiscal deficit and accommodative monetary policies in fueling risk-on assets like Bitcoin (BTC). Jones believes these macroeconomic factors could propel markets toward a new bullish cycle, provided retail and institutional investors increase their participation.

US fiscal debt issues bolster interest in risk assets like Bitcoin

In July, President Donald Trump signed the “One Big Beautiful Bill,” extending tax cuts and raising the debt ceiling, which is projected to create a $2.1 trillion deficit impact by 2029, according to the Congressional Budget Office. The US debt level is expected to surpass $1 trillion in new annual borrowing for the first time, raising concerns about the country’s ability to service its debt amid mounting fiscal stress. Experts warn of the potential for inflation or currency devaluation as investors become wary of the US dollar’s long-term stability.

Interest in US debt securities is expected to decline as yields on 10-year Treasurys rise, while foreign holdings—comprising about a third of Treasurys—seek alternatives amid concerns over inflation and dollar devaluation. Such shifts are likely to pressure demand for Treasurys, potentially weakening the dollar and liming the Treasury market’s ability to finance the growing deficit.

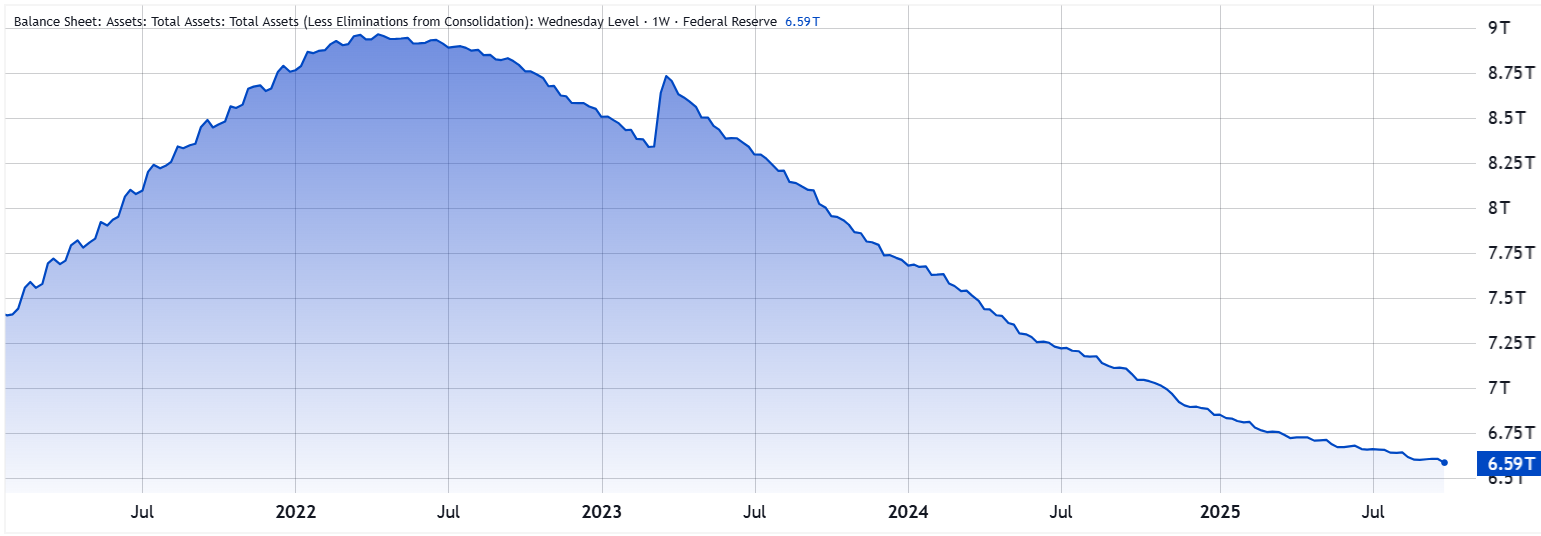

Jones draws parallels with 1999, a period marked by rapid Nasdaq gains before the dot-com bust, but notes that current conditions are more favorable. Unlike 1999, when the Fed tightened monetary policy, today’s environment involves continued accommodative policies, with the central bank unlikely to reduce its balance sheet anytime soon, despite signs of softening labor markets.

Market prospects and the potential for continued growth

Jones anticipates a “massive rally” in the markets, potentially surpassing the explosive gains of 1999, but emphasizes that a speculative frenzy is not yet underway. He believes more retail investment and institutional “real money” are needed before reaching a typical “blow-off” top. Despite current valuations, the stock market remains in a zone conducive to further expansion; the S&P 500’s forward price-to-earnings ratio is around 23, below the peak of 25 seen in 2000, indicating room for multiple expansion under optimistic sentiment.

While caution is warranted, Tudor Jones argues that Bitcoin, with its $2.5 trillion market cap, remains an attractive hedge against inflation and fiscal instability. Given that gold’s market capitalization stands at $26 trillion and stocks at around $57 trillion, even modest inflows into Bitcoin could substantially impact its price, especially if investors seek alternative assets amidst rising inflation fears.

This analysis provides an overview of macroeconomic trends influencing markets and digital assets. It does not constitute financial advice, and investors should conduct their own research before making any decisions. The views expressed are solely those of the author.