- Bitcoin surges past $120,000 amid a US government shutdown, extending its October rally.

- Legal authorities conduct the largest cryptocurrency seizure in history, with over 61,000 BTC linked to a major fraud case.

- Brazilian energy firms embrace crypto mining as a solution to excess power, contrasting with stricter regulations in New York.

- European regulators tighten restrictions on private stablecoins, advancing their own digital euro project.

- Major European banks collaborate on a euro-pegged stablecoin, while the ECB accelerates digital euro development.

Bitcoin has crossed the $120,000 mark, defying the ongoing US government shutdown, which has entered its third day. The political impasse has not only boosted Bitcoin’s October performance—often called “Uptober”—but also highlighted its resilience as traditional markets remain relatively stable, although with more modest gains. Market observers see Bitcoin outperforming stocks as a safe haven amid uncertainty, reinforcing its appeal in the broader financial ecosystem.

The shutdown delays key economic data, such as the US nonfarm payroll report scheduled for October 6, which investors monitor to gauge Federal Reserve policy directions. Historically, October downturns have followed political standoffs, notably the 2018 shutdown that briefly knocked Bitcoin from $3,900 to $3,550—a period marked by increased regulatory scrutiny from the Financial Action Task Force (FATF). Despite recent delays, analysts remain optimistic about continued positive performance for Bitcoin and other cryptocurrencies.

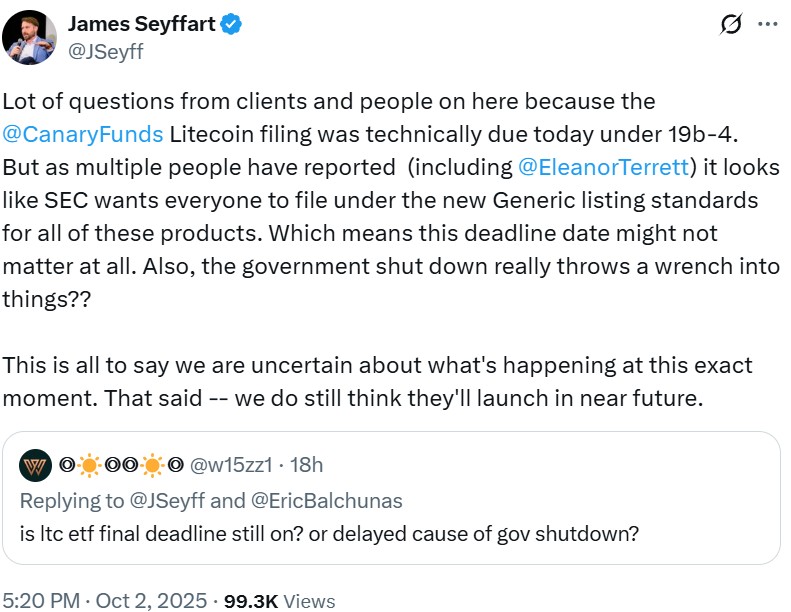

However, the shutdown is likely to impede the SEC’s review of key crypto ETF proposals, including those involving Litecoin, Solana, and XRP. While analysts express confidence that altcoin ETFs will eventually gain approval, approval processes are expected to slow until the government resumes normal operations.

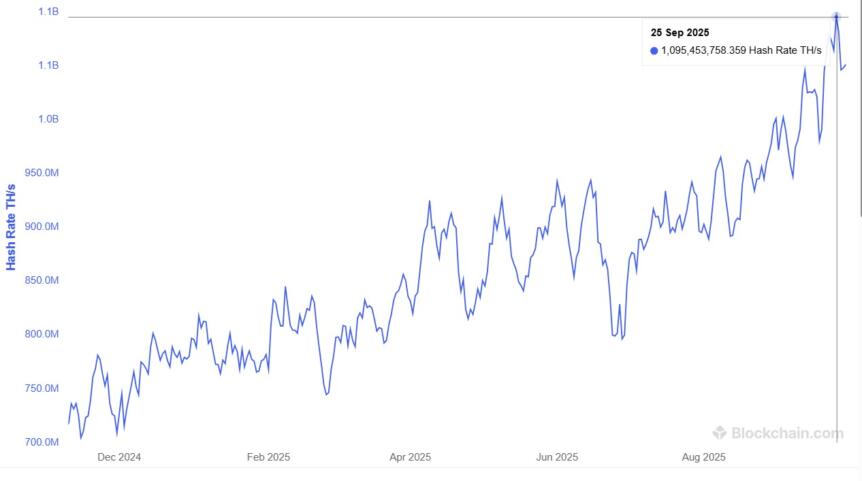

Brazil Welcomes Hashrate – Miners Find Opportunities

Brazil is emerging as an unlikely hub for crypto mining, with energy companies actively seeking to partner with miners. With some local power plants reporting up to 70% of surplus energy, miners are being invited to absorb this excess, creating a symbiotic relationship that contrasts sharply with China’s 2021 ban, which caused a major exodus of hash power abroad. Similar initiatives in Laos utilize hydropower to manage electricity surpluses, transforming what was once a challenge into an opportunity for the industry.

Meanwhile, in New York, authorities are considering new taxes on crypto mining, with a bill proposing a tiered excise tax that could challenge existing operations, especially those relying on nonrenewable energy sources. The law aims to scale from $0.02 per kilowatt-hour for smaller miners to $0.05 for the largest entities, with exemptions for fully renewable-powered operations.

Legal Crackdown: Largest Bitcoin Seizure

In a major legal development, Chinese-born fraudster Zhimin Qian and her partner Hok Seng Ling pleaded guilty in London to laundering proceeds from a colossal Ponzi scheme. The UK police confiscated over 61,000 BTC—valued at more than $7.24 billion—making it the largest cryptocurrency seizure in history. The assets include Bitcoin, cash, gold, and encrypted devices linked to her scam that defrauded over 128,000 investors in China between 2014 and 2017.

The seized Bitcoin is now under government control, sparking debate on whether victims will be compensated based on the original investment value or at recent market prices. Discussions revolve around the legal complexities of restitution, with some suggesting that a portion of the recovered assets could bolster public funds amid rising fiscal pressures.

European Stability and Digital Euro Progress

European authorities are increasingly wary of private stablecoins, with the ESRB recommending a ban on stablecoins issued by firms inside and outside the EU. This move, although non-binding, signals a cautious approach, reinforced by concerns over non-EU stablecoins like Tether’s USDT, which have faced delistings in the EU after refusal to comply with regional regulations.

Progress continues on the digital euro, with major banks partnering with technology providers to establish infrastructure for a centrally issued digital currency. The European Central Bank anticipates a mid-2029 launch, aligning with efforts to ensure financial stability and secure digital transactions across the region.

As the digital euro takes shape, the ECB’s ongoing partnerships with technology firms focus on creating secure, offline-capable payment systems, marking another step toward a fully operational digital currency within the European Union.