Bitcoin remains at a pivotal moment as traders await the weekly close, with critical support levels looming and market sentiment divided over whether the cryptocurrency can sustain its current bullish momentum. As macroeconomic factors and technical signals intertwine, renewed optimism hinges on progress in U.S. political negotiations and positive developments in global trade policies.

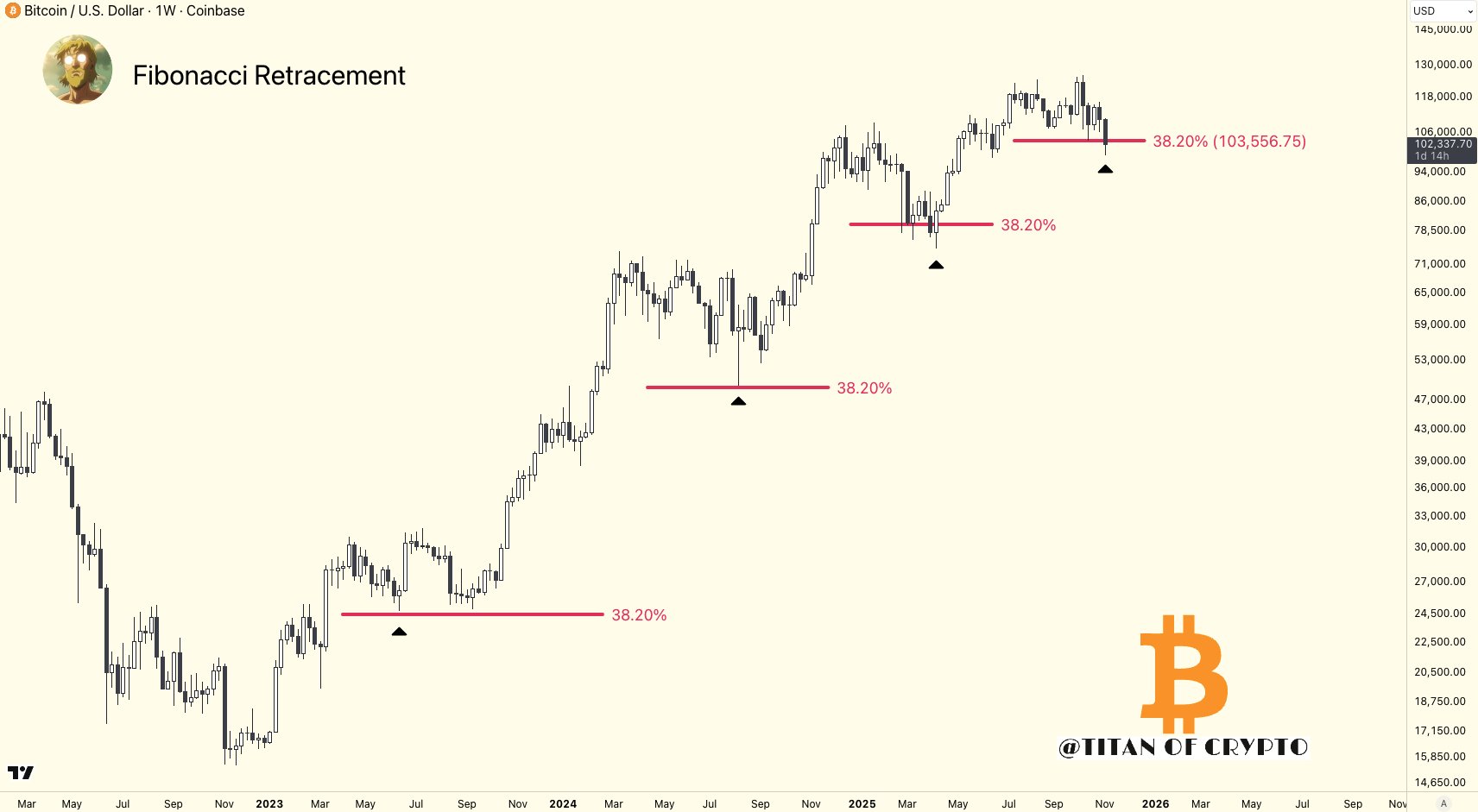

- Bitcoin is approaching a crucial weekly close, with $103.5K as a significant threshold based on Fibonacci retracement levels.

- Market experts warn that a weekly close below key support could signal the end of the recent bull run, though an optimistic outlook remains.

- Hopes for a market boost are tied to potential resolution of the U.S. government shutdown and potential relief on international trade tariffs.

Bitcoin (BTC) is trading within a narrow range as traders eye a critical weekly closing price, with $100,000 acting as a psychological and technical support level. The market has experienced low volatility over the weekend, with investors closely watching how the weekly candle will shape up in the coming days.

BTC price counts down to major weekly close

Data from Markets Pro and TradingView reveal subdued price activity ahead of significant weekly settlement. The key focus remains on whether Bitcoin can close above the $103,500 level, a mark rooted in Fibonacci retracement analysis, which could uphold the ongoing bull cycle.

Trader Titan of Crypto emphasizes the significance of the $103,500 threshold: “Key level of the week: $103.5K,” he posted on X, highlighting its foundation at Fibonacci levels. A weekly close below this could hint at the end of the current bull run, though he notes, “A breakdown next week would signal the bull market is likely over. Not there yet.”

Meanwhile, the 50-week exponential moving average (EMA), sitting at $100,940, is viewed as a vital indicator of strength. Traders warn that closing below this level could undermine the current bullish outlook, with Max Crypto noting, “We don’t want a weekly close below this at any cost.”

On the technical front, a “death cross” — when the 50-day SMA crosses below the 200-day SMA — is nearing, raising concerns among analysts like SuperBro, who recalls previous instances of such patterns that led to market bottoming phases.

“The 4th ‘death cross’ of the bull cycle is approaching. Each time we’ve seen reversion to the mean and a sustained bottom,” he observed. “But so far, a lukewarm reaction at the 365 SMA. Let’s see if bulls can rally and reclaim the Q3 low for the weekly close.”

Market outlook hinges on U.S. political developments

Beyond technical analysis, the broader market sentiment is influenced by potential macroeconomic developments. Expectations around the resolution of the ongoing U.S. government shutdown are mounting, with hopes that an agreement could catalyze a broader market expansion.

Additionally, a Supreme Court ruling anticipated soon could strike down international trade tariffs, which many believe might immediately boost stocks and, by extension, benefit crypto markets.

Crypto analyst Cas Abbe suggests that if the shutdown ends, Bitcoin could see a surge, noting on X that the phase of market manipulation might be coming to an end.

However, some analysts remain cautious. Crypto investor Ted Pillows warns that if market expectations do not materialize quickly, Bitcoin could retest lower levels, especially as large whales and institutional investors continue to cash out.

“BTC is still consolidating around $102,000. The markets expected the shutdown to end this weekend, but that didn’t happen,” he said, adding, “I still think Bitcoin could go a bit lower, given that institutional demand has waned and OG whales are selling.”

As whale activity persists, the overall sentiment suggests continued volatility, underscoring the importance of macroeconomic factors and political movements shaping the future of cryptocurrency markets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research before making decisions.