- BlackRock has facilitated over $3 billion in conversions of Bitcoin into its spot Bitcoin ETF, IBIT.

- Major Bitcoin whales are increasingly transferring their holdings into ETFs for better integration into traditional financial systems.

- Recent SEC rule changes allowing in-kind redemptions have made large-scale conversions more efficient and tax-friendly for institutional investors.

- BlackRock’s IBIT has become the fastest ETF to surpass $70 billion in assets under management, now exceeding $88 billion.

- On-chain data suggests a potential shift from self-custody to institutionalized Bitcoin holdings, possibly impacting investor behavior.

Institutional Shift: Bitcoin Whales Moving into ETFs

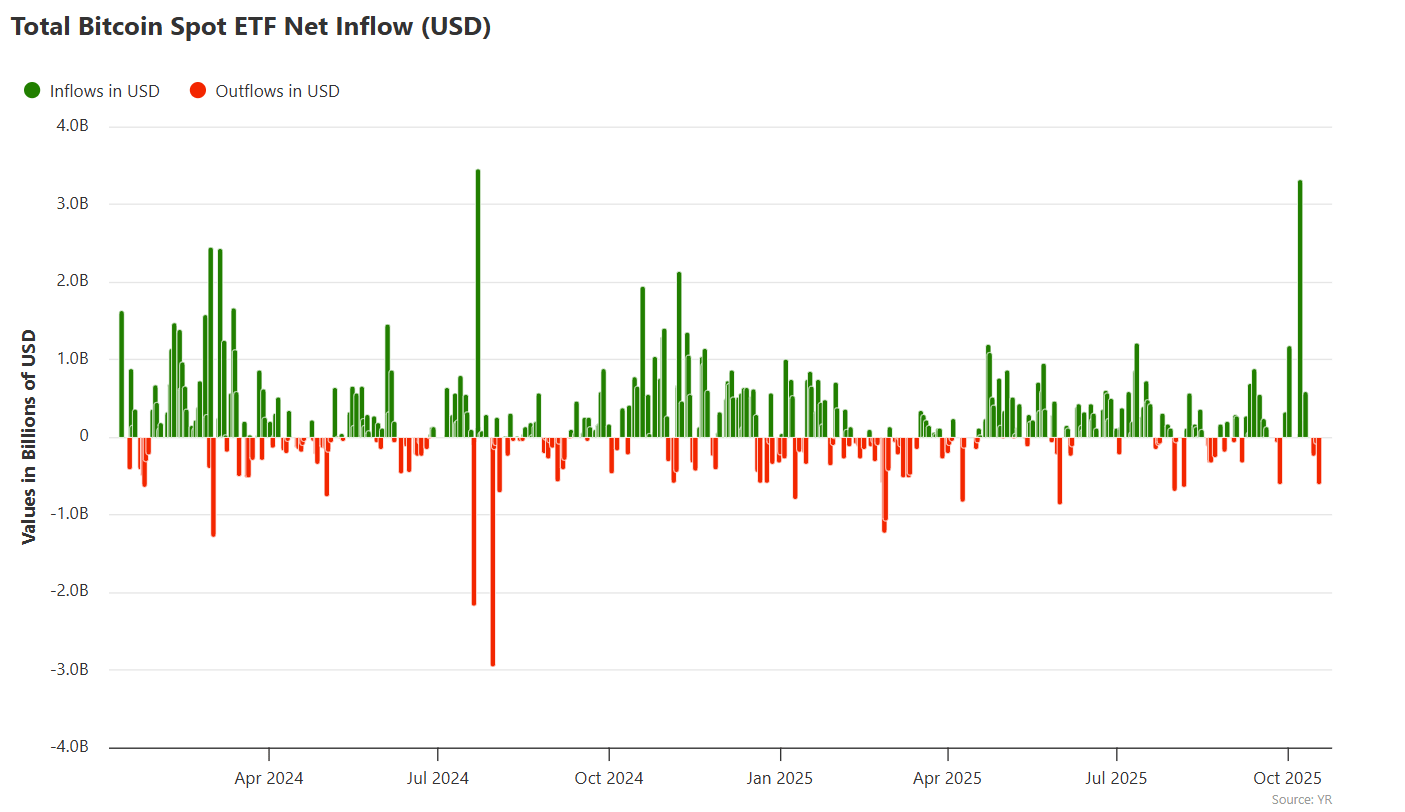

In a notable trend, some of the most prominent early Bitcoin holders—often called whales—are increasingly transitioning their holdings into exchange-traded funds (ETFs). Asset management giants like BlackRock are actively encouraging this shift, with the asset manager reporting that over $3 billion worth of Bitcoin has already been converted into their iShares spot Bitcoin ETF (IBIT).

Robbie Mitchnick, BlackRock’s head of digital assets, explained that many whales now favor the convenience of holding Bitcoin exposure through traditional financial advisors or private banks. This approach makes it easier to manage wealth within familiar financial frameworks, while still maintaining exposure to Bitcoin’s potential growth.

The recent approval by the U.S. Securities and Exchange Commission (SEC) for in-kind creation and redemption of crypto ETFs has further facilitated large conversions. This regulatory change allows authorized participants to exchange ETF shares directly for Bitcoin, making transactions more seamless and tax-efficient for institutional investors.

BlackRock’s IBIT has notably become the most successful spot Bitcoin ETF in the United States, quickly amassing assets—over $88 billion—since its launch. It was also the first ETF to surpass $70 billion in assets, demonstrating strong investor confidence amid a rising crypto bull run.

These developments highlight a broader institutionalization of Bitcoin, which once emphasized self-custody rooted in Bitcoin’s original vision of individual sovereignty. Despite the longstanding mantra, “not your keys, not your coins,” the rising popularity of crypto ETFs and corporate treasury holdings suggests a shift toward more traditional, custodial forms of ownership.

While ETFs and self-custody serve different investor segments, some analysts, like Willy Woo, warn that this has may have drawn interest away from independent holdings. On-chain data recently indicated Bitcoin self-custody has declined from its longstanding uptrend, hinting at changing investor preferences.

Nevertheless, ETFs have opened new avenues for institutional participation in Bitcoin, previously limited to direct purchases by whales or high-net-worth individuals. This change is reshaping how large investors approach the market, with many now favoring regulated products over direct custody, potentially signaling a transformation in crypto market dynamics.