Bitmine Immersion Technologies is accelerating its exposure to Ethereum (CRYPTO: ETH) by converting a growing share of its Ether holdings into on-chain stake. In the latest disclosures, the company reported a weekly addition of 40,302 ETH, lifting its total ETH holdings to roughly 4,243,338 ETH, and increasing its staked ETH balance by 171,264 ETH to 2,009,267 ETH. Based on a 2.81% Composite Ethereum Staking Rate (CESR) cited by the firm, that stake could generate about $164 million in annualized revenue at the current ETH price. The numbers underscore a broader push among large treasuries to monetize idle crypto assets through staking within the Ethereum ecosystem.

Key takeaways

- Bitmine’s Ether treasury stands at approximately 4.24 million ETH after adding 40,302 ETH in the last week, with 2.01 million ETH staked, highlighting a substantial on-chain yield engine for the company.

- The staking tranche, using CESR as a baseline, implies around $164 million in annualized revenue at prevailing prices, illustrating the scale of potential returns from a sizeable stake.

- Management notes that if all Ether were staked, annual revenue could approach $374 million, or more than $1 million per day, under the same benchmark assumptions.

- Bitmine plans to launch a US-based validator infrastructure in 2026 to internalize staking operations, signaling a shift from externally managed to in-house validation.

- Beyond Ether, Bitmine’s balance sheet includes $682 million in cash and 193 Bitcoin, contributing to a total crypto and cash position of about $12.8 billion.

Tickers mentioned: $ETH, $BTC

Market context: The move to expand staking aligns with a broader industry pattern where large Ether treasuries seek steady yield streams from on-chain activities. As demand for staking remains robust, more treasury holders are weighing internalization of validator operations against outsourcing arrangements, a trend reinforced by public disclosures from major players in the sector.

Why it matters

The growing focus on Ethereum staking by corporate treasuries reflects a maturation of crypto balance sheets. For Bitmine, the ability to convert a larger portion of its Ether holdings into validated on-chain activity with predictable rewards could materially alter its revenue profile and financial visibility. The firm’s stated plan to internalize staking operations through a US-based validator infrastructure in 2026 is a notable strategic shift that could reduce external counterparty risk, improve governance control, and capture additional staking economics over time.

From a market perspective, the trend underscores a broader shift in crypto asset management: treasuries are treating digital assets as cash-flow generators rather than mere speculative holdings. The simultaneous growth in ETH exposure and the diversification into cash and BTC positions suggest a holistic approach to liquidity management and risk allocation that mirrors conventional corporate treasury practices, albeit in a highly volatile asset class.

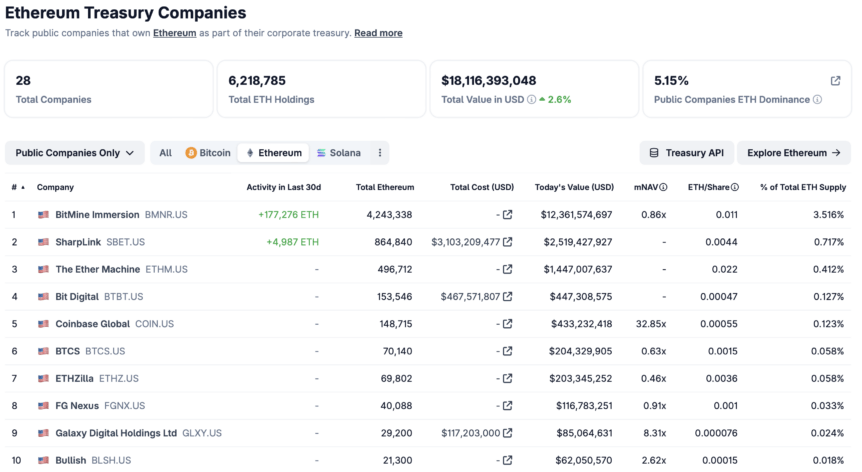

The ETH holdings remain a central piece of Bitmine’s portfolio. The company disclosed that its Ether position now accounts for about 3.52% of circulating supply—based on an estimate of roughly 120.7 million ETH outstanding—and reiterated a long-term aim to reach or exceed a 5% stake in the total ETH supply. The consolidation of such a large stake amplifies the potential influence Bitmine could wield across ecosystem dynamics, including validator participation, network security, and governance signals, though such influence comes with heightened regulatory and operational considerations.

In addition to Ether, Bitmine reported a diversified crypto and cash trove totaling $12.8 billion, anchored by $682 million in cash and a notable holding of 193 Bitcoin (CRYPTO: BTC). The inclusion of BTC alongside a robust ETH stake illustrates a broad, multi-asset treasury strategy that seeks to balance yield-generating deployments with liquidity and hedging considerations in a volatile market environment.

Staking, the act of locking tokens to support network security in exchange for rewards, has become a central strategy for Ether-focused treasuries. The trend is underscored by industry data showing rising validator queue demand and increasing participation by large holders in active staking programs. As the infrastructure for staking matures, the economics of treasury-driven staking are likely to attract continued scrutiny from investors and regulators alike.

Other prominent players have echoed similar strategies. For instance, SharpLink Gaming disclosed that it generated 10,657 ETH in staking rewards over the past seven months, reflecting about $33 million in yield according to its dashboard data. That figure places SharpLink among the larger Ether treasuries, reinforcing the argument that staking is becoming a mainstream revenue driver for well-capitalized crypto companies. The company currently sits behind Bitmine as one of the larger Ether treasuries, underscoring the ongoing race to scale on-chain revenue.

As Ethereum’s validator ecosystem tightens and more capital seeks yield, the appetite for staking among treasuries is likely to remain a meaningful driver of on-chain activity and liquidity. While the CESR provides a useful yardstick for estimating earnings, the actual realized revenue will hinge on ETH price movements, validator performance, and the pace of network upgrades that affect staking efficiency and rewards. In that light, Bitmine’s 2026 internalization plan could serve as a blueprint for other large holders aiming to optimize staking economics while maintaining robust risk controls and governance oversight.

What to watch next

- Progress of Bitmine’s US-based validator infrastructure development and any interim partnerships or pilot deployments ahead of the 2026 launch.

- Updates to the CESR benchmark accuracy and how market price changes influence reported staking revenue.

- Any shifts in Bitmine’s ETH share toward the 5% target, and how that impacts liquidity and risk management.

- Regulatory developments affecting staking, treasury management, and corporate disclosures for large crypto holders.

Sources & verification

- Official Bitmine press release via PR Newswire announcing ETH holdings reach 4.243 million and total crypto/cash holdings of about $12.8 billion.

- SharpLink Gaming dashboard data showing 10,657 ETH earned in staking rewards over seven months and the company’s ETH treasury size.

- CoinGecko treasury data documenting top Ether treasury companies and the 3.52% circulating supply share referenced for Bitmine.

- Cointelegraph coverage of Ethereum’s validator exit queue dynamics and related staking demand data.

- Announcement from Ether Machine regarding plans for a yield-focused Ether vehicle for institutional investors and its ETH holdings.]

Bitmine ramps up Ethereum staking as revenue engine

Bitmine Immersion Technologies is accelerating its exposure to Ethereum (CRYPTO: ETH) by converting a growing share of its Ether holdings into on-chain stake. In the latest disclosures, the company reported a weekly addition of 40,302 ETH, lifting its total ETH holdings to roughly 4,243,338 ETH, and increasing its staked ETH balance by 171,264 ETH to 2,009,267 ETH. Based on a 2.81% CESR cited by the firm, that stake could generate about $164 million in annualized revenue at the current ETH price. The numbers reflect a broader push among large treasuries to monetize idle crypto assets through staking within the Ethereum ecosystem.

The company’s chairman highlighted that if all Ether were staked, annual revenue could approach $374 million under the same benchmark, translating to more than $1 million per day. This projection underscores the earnings potential of scaled staking operations, even as actual returns depend on price levels and validator performance. Bitmine’s strategy centers on expanding staking capacity and gradually internalizing operations to capture greater staking economics and governance control.

The plan to launch a US-based validator infrastructure in 2026 signals a shift from reliance on external staking partners toward in-house execution. By bringing validator ops in-house, Bitmine aims to optimize uptime, security, and compliance while potentially improving margins through direct access to staking rewards and related incentives. The company has stated it is working with multiple staking providers during the transition period, maintaining a diversified approach as it contemplates full internalization.

Alongside its ETH holdings, Bitmine reports a broader balance sheet comprising $682 million in cash, 193 Bitcoin (CRYPTO: BTC), and minority equity investments, amounting to a total crypto and cash position of $12.8 billion. The ETH stake itself represents about 3.52% of the token’s circulating supply, based on an estimated 120.7 million ETH outstanding. The company’s longer-term ambition is to reach roughly a 5% share of the total ETH supply, a target that would equate to a substantial uptick in staking revenue and on-chain participation should market conditions remain favorable.

Staking has emerged as a core strategy for Ether treasuries, with companies like SharpLink Gaming illustrating the scale at which such yields are becoming material to corporate finance plays. The visible demand in Ethereum’s validator queue, along with the growing size of treasury-driven staking programs, underscores a broader trend toward productive use of crypto reserves. As Bitmine and peers pursue further expansion, the landscape for Ether staking is likely to attract continued investor attention and scrutiny from regulators seeking to understand how treasury-driven staking impacts market dynamics and governance.