BlackRock continues to demonstrate a strong commitment to integrating digital assets into its financial offerings, driven by increasing institutional appetite for cryptocurrency exposure. The asset management giant’s recent quarterly results highlight not only impressive growth in traditional ETF inflows but also significant momentum behind its crypto-related ETFs, especially Bitcoin and Ethereum products. The rise underscores a broader trend of institutional investors increasingly turning to regulated crypto investment vehicles amid expanding market interest and regulatory clarity.

- BlackRock’s iShares ETFs attracted a record $205 billion in net inflows during Q3, bolstering organic fee growth.

- Digital asset ETFs, including Bitcoin and Ethereum trusts, saw robust inflows totaling $17 billion in the third quarter alone.

- The firm’s total crypto assets under management reached nearly $104 billion, about 1% of overall AUM.

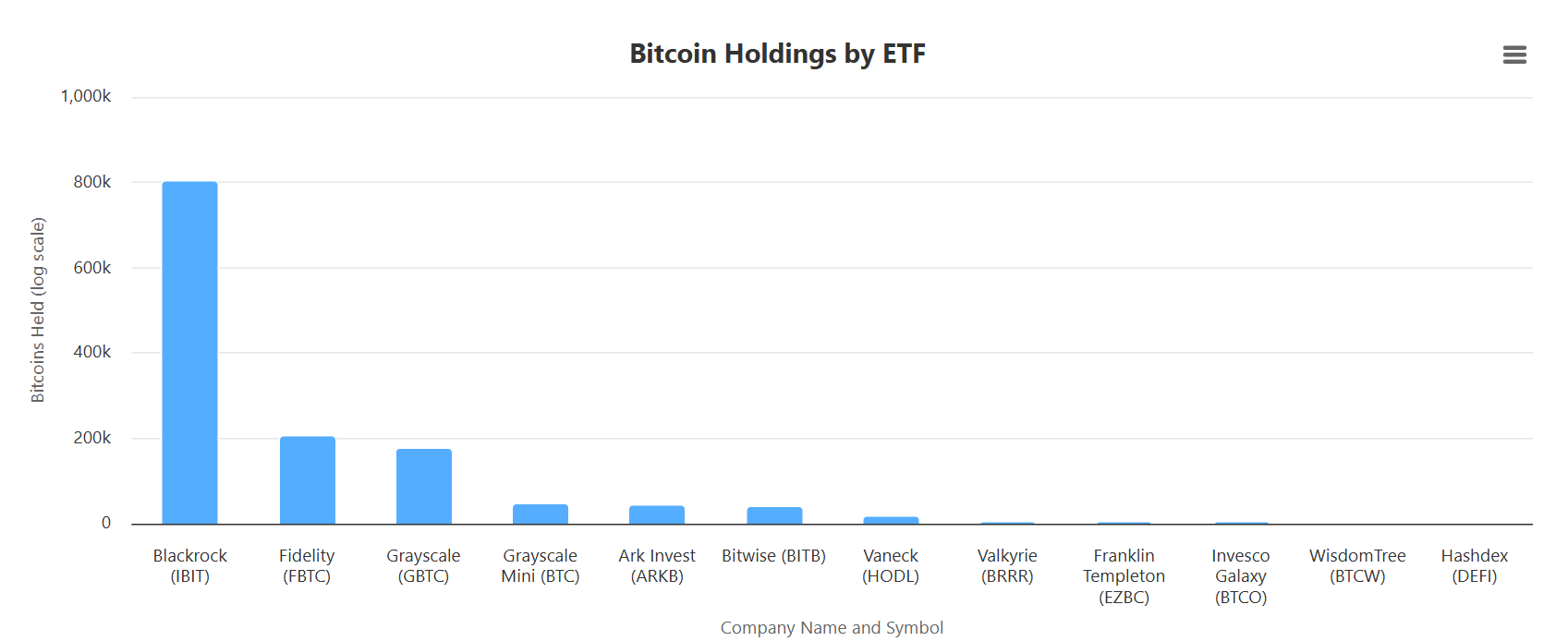

- BlackRock’s Bitcoin ETF (IBIT) remains the largest in the U.S., holding over 800,000 BTC, and approached $100 billion in net assets.

- Institutional demand and a decline in the US dollar’s value have contributed to Bitcoin’s record-breaking rally above $126,000 earlier this month.

BlackRock’s financial success in the third quarter underscores the growing sophistication of the cryptocurrency market and the increasing role of institutional investors in digital assets. With the iShares platform, which includes over 1,400 ETFs globally, recording record-breaking $205 billion in net inflows, the firm’s assets under management (AUM) now stand at an impressive $13.46 trillion — a 17% increase from the previous year. Both earnings and revenue surpassed analyst expectations, signaling continued confidence in its diverse investment products, including those tied to emerging sectors like digital assets.

BlackRock’s digital asset ETFs have become a notable force in the crypto space. The firm’s flagship Bitcoin ETF (IBIT), one of the first approved spot Bitcoin ETFs in the United States, has generated over $25 million in fees and was nearing $100 billion in net assets as of early October. Meanwhile, the Ethereum Trust (ETHA), launched later in 2024, has quickly gained traction, becoming the third-fastest fund to reach $10 billion in assets, reflecting strong investor demand for diversified crypto exposure.

These robust inflows have helped propel a fruitful quarter, with total crypto assets under management now nearing $104 billion and contributing significantly to an overall AUM of $13.46 trillion. This momentum indicates a solid institutional commitment to crypto markets, driven by increasing regulatory clarity, institutional advantages such as custodial safeguards, and streamlined access to digital assets.

Part of Bitcoin’s recent surge—breaking above $126,000—can be attributed to this inflow trend, alongside macroeconomic factors like the US dollar’s steepest decline in five decades, widest fiscal deficits, and persistent inflation. Industry data shows that Bitcoin remains the dominant holding in BlackRock’s Bitcoin ETF, holding more than 800,000 BTC, actively fueling its rally. This institutional backing signals a pivotal shift as more players recognize digital assets as a store of value and hedge against traditional financial risks.

Overall, the growing interest from institutional investors is fueling the current bullish sentiment in the cryptocurrency markets. As regulatory developments continue to unfold, institutions see regulated crypto ETFs as a viable avenue for exposure, helping bolster Bitcoin’s rally and supporting the long-term adoption of blockchain-based assets globally.