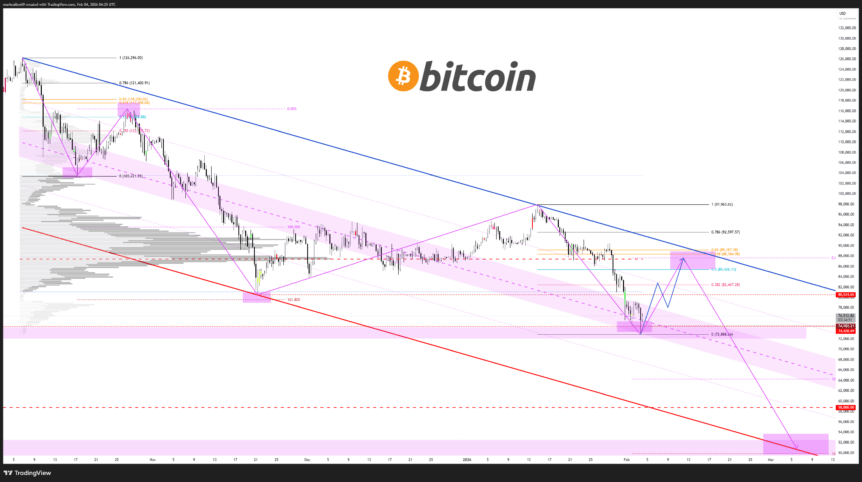

Bitcoin’s struggle to sustain a move above $70,000 intensified midweek, fueling speculation about a potential retreat toward the $60,000 area. The price pressure arrived alongside a wave of futures liquidations and a notable contraction in open interest, while exchange inflows nudged higher, underscoring a broader mix of leverage unwinding and tactical positioning. The net effect has traders weighing whether the catalysts are crypto-specific or part of broader macro dynamics shaping risk assets. As BTC hovered in the mid-$70,000s, the market faced a confluence of on-chain signals and liquidity shifts that could influence the near-term path.

Key takeaways

- Around 744,000 BTC exited major exchanges in 30 days, equating to roughly $55 billion at current prices.

- BTC futures cumulative volume delta (CVD) declined by about $40 billion over the past six months, signaling intensified deleveraging.

- Exchange reserves rose by 34,000 BTC since mid-January, increasing near-term supply risk as inventories accumulate on-chain.

- January inflows to exchanges totaled about 756,000 BTC, led by Binance and Coinbase, with inflows surpassing 137,000 BTC since early February.

- Open-interest dynamics point to widespread position closures rather than pure new shorts, with notable declines across major venues such as Binance, Bybit, and OKX.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The data show a broad deleveraging cycle that coincided with a move below key psychological and technical levels.

Trading idea (Not Financial Advice): Hold. The combination of rising inflows, depleted open interest, and on-chain supply dynamics suggests a cautious stance as traders await clearer liquidity and price signals.

Market context: The recent waves of exchange activity and leverage unwind come amid a broader risk-off posture in crypto markets, shaped by macro rate expectations, liquidity conditions, and ongoing ETF and futures dynamics that influence institutional participation.

Why it matters

The current backdrop—marked by a large-scale unwinding of positions on futures platforms and rising exchange inventories—highlights a transitional phase for BTC liquidity and price discovery. The sheer scale of the open-interest decline, reported across multiple venues, indicates that traders are actively closing longstanding bets rather than simply rolling into fresh shorts. This deleveraging can prolong volatility in the near term, as market participants reassess risk appetite and hedge coverage in response to shifting macro cues and evolving liquidity profiles.

From a supply-and-demand perspective, the uptick in exchange reserves presents a potential source of selling pressure should market participants decide to liquidate or redistribute risk. While the exact implications depend on whether reserves are held for liquidity management, arbitrage, or preparatory takedowns, the net effect is an increase in near-term supply resilience, particularly if price action continues to probe lower levels. On the demand side, persistent inflows into exchanges—especially in January and into February—signal ongoing trader activity and repositioning rather than a wholesale exit from the market. This dynamic can create a tug-of-war between short-term selling pressure and longer-term capitulation or consolidation phases.

Analysts have emphasized that bottoms in crypto markets rarely form in a single day. Consolidation, often spanning two to three months, tends to precede durable trend reversals. With BTC trading in a zone above and around major supports, traders will be watching whether longer-horizon indicators align with a multi-week or multi-month reset. Some strategists argue that a retest of the mid-$60,000s or even the low-$50,000s is plausible under adverse macro scenarios, while others anticipate a corrective rebound as liquidity returns and risk sentiment stabilizes. The nuanced view underscores that the path forward is likely to be range-bound for a period, punctuated by episodic spikes tied to macro data, regulatory developments, or ETF-related flows.

Market participants also highlighted the complexity of on-chain signals. A sharp decline in the cumulative volume delta suggests that market sell orders continue to dominate in certain venues, with the strongest readings appearing on major futures platforms. Yet other exchanges have shown more muted reactions, illustrating bifurcated dynamics across the ecosystem. The differing trajectories underscore the importance of cross-exchange monitoring and a careful reading of CVD trends as part of a broader analytical framework for BTC price action.

Interpreting these indicators within a broader macro context remains critical. The convergence of rising exchange inflows, expanding inventories, and outsized open-interest declines points to a market that is actively reweighting risk and adjusting leverage exposure. Traders and investors will need to track how these elements interact with potential catalysts—ranging from macro data releases to regulatory developments and ETF-related inflows—to gauge whether the next leg of BTC’s journey will be a deeper retracement or a sustained consolidation before a new cycle takes shape.

What to watch next

- BTC price stability around major support zones in the high-$60,000s to low-$70,000s, with attention to a potential test of multi-month trendlines.

- Changes in open interest across key futures venues (Binance, Bybit, OKX) to assess whether deleveraging is cooling or intensifying.

- On-chain reserve movements: any sustained rise beyond the 2.76 million BTC threshold could indicate growing near-term selling risk.

- Pricing response to January and February exchange inflows, and whether inflows translate into price pressure or are offset by demand from buyers at lower levels.

- Macro indicators and ETF-related activity that could influence liquidity and risk sentiment across the crypto market.

Sources & verification

- CryptoQuant data on 30-day open-interest changes across major exchanges

- CryptoQuant notes on BTC inflows to exchanges in January and February

- Reserves data and commentary from Axel Adler Jr. regarding exchange supply dynamics

- On-chain commentary and analysis from market observers referencing CVD trends on Binance, Bybit, and HTX

Market reaction and key details

Bitcoin (CRYPTO: BTC) faced renewed selling pressure as the market failed to sustain a move above $70,000, with a broad deleveraging wave intensifying in tandem with price action. Over the last 30 days, roughly 744,000 BTC moved off major exchanges, translating to about $55 billion at prevailing prices and underscoring a substantial reduction in the available balance for speculative leverage. This exodus occurred as BTC traded below the $75,000 neckline, a level that had previously served as a psychological and technical barrier for bulls.

On the futures front, the open-interest unwind was pronounced. Data from CryptoQuant show a sharp contraction in 30-day open interest across the ecosystem, with Binance reporting a notably steep decline: 276,869 BTC. Bybit recorded the largest single-session decrease at 330,828 BTC, while OKX trimmed positions by 136,732 BTC in the most recent window. Taken together, the approximately 744,000 BTC of closed positions amounted to more than $55 billion at current prices, signaling a broad deleveraging cycle rather than a simple spike in spot selling.

Onchain commentators highlighted the persistence of selling pressure as indicated by the cumulative volume delta (CVD). Market sell orders have dominated, especially on the dominant venue for derivatives trading, where the CVD sits near -$38 billion over the past six months. Other exchanges showed divergent patterns: Bybit’s CVD had flattened near $100 million after a December liquidation wave, while HTX’s CVD held around -$200 million as price consolidated near $74,000.

In January, exchange inflows surged, with roughly 756,000 BTC flowing onto trading venues, led by major players such as Binance and Coinbase. This dynamic continued into February, with inflows exceeding 137,000 BTC since early February, signaling ongoing repositioning among market participants. On the supply side, exchanges reported reserves rising from about 2.718 million BTC to 2.752 million BTC since January 19, a development that could impose additional near-term selling pressure if reserves continue to accrue and market participants convert those holdings into bids. Analysts cautioned that a spike beyond the 2.76 million BTC threshold could complicate the supply-demand balance further.

Analysts have stressed that bottoms in crypto markets typically require extended periods of consolidation. For BTC, experts like Scient suggest that durable bottoms may emerge only after two to three months of sideways movement near major support zones and with confirmatory signals from higher-timeframe indicators. In a broader macro frame, some traders argue that negative scenarios could push BTC toward the mid- to low-$50,000s, while others anticipate a rebound once near-term liquidity conditions stabilize and risk appetite improves. Traders such as Mark Cullen have pointed to potential downside toward $50,000 in a stressed macro scenario, but also expect a corrective reversion toward a local high-volume area around $86,000–$89,000 should a short-term bounce occur after the latest dip below $74,000.

As the market awaits clearer signals, observers emphasize the importance of watching the evolving balance between exchange inflows, reserve levels, and open-interest momentum. The confluence of these factors will help determine whether BTC can stabilize within the current range or face a more extended retracement into lower price territories. While some scenarios warn of further downside, others maintain that a stabilization phase could set the stage for a broader recovery once liquidity and risk sentiment coalesce around higher timeframes.

https://platform.twitter.com/widgets.js