Key takeaways:

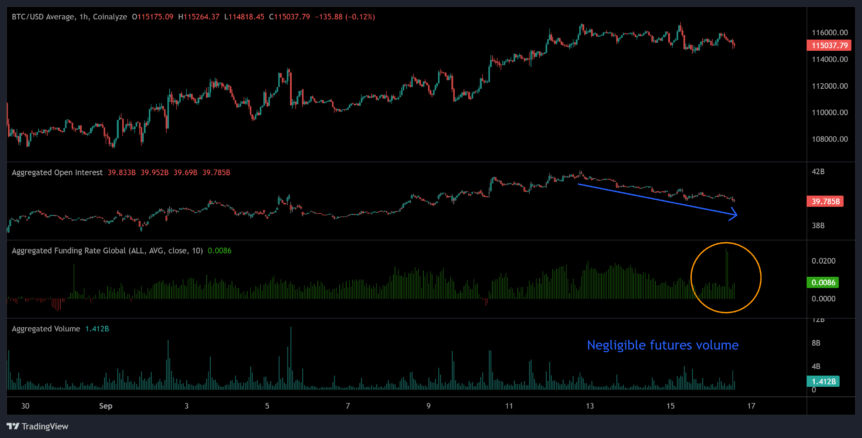

Bitcoin futures open interest has declined by $2 billion over five days, indicating growing caution among derivatives traders.

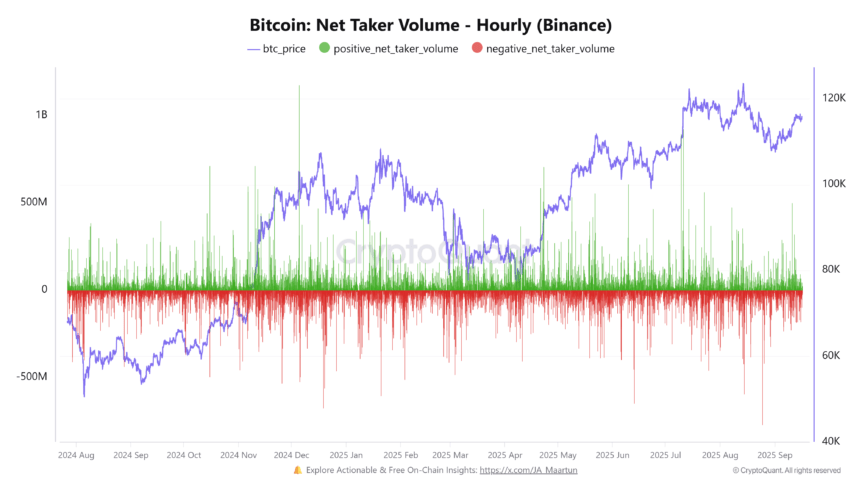

Binance taker volume has dropped to cyclical lows, as market participants await the Federal Reserve’s upcoming interest rate decision.

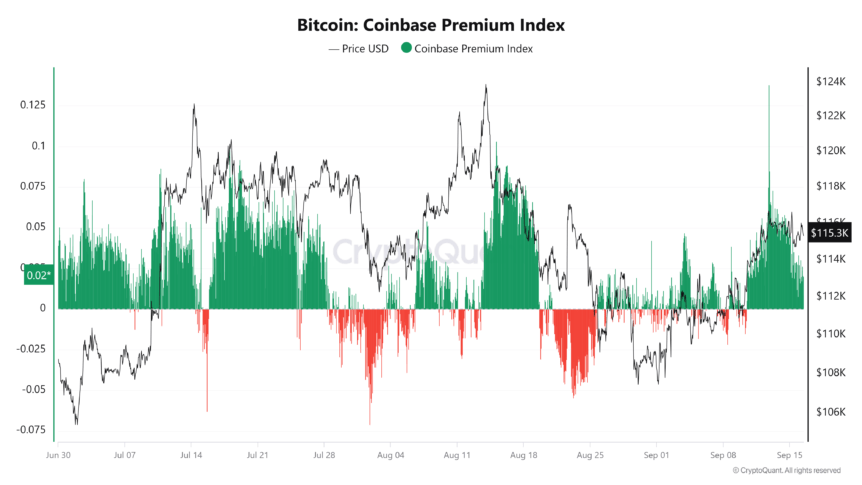

The Coinbase premium continues to suggest strong US demand, supporting Bitcoin around the $115,000 level.

Crypto traders are temporarily pulling back on their exposure to Bitcoin (BTC), as onchain and derivatives data point to a cautious market ahead of the Federal Reserve’s policy announcement this week. Notably, Bitcoin’s open interest has fallen by roughly $2 billion since last Friday, slipping below the $40 billion mark after reaching a high of around $42 billion. This decline followed a brief rally that saw Bitcoin approach $116,700 on Monday. Meanwhile, trading volume in Bitcoin futures has been subdued, indicating a lack of aggressive positioning—and perhaps a wait-and-see approach among traders.

In addition, the funding rate—costs incurred to hold perpetual futures positions—has been declining. The Tuesday London session saw the sharpest hourly funding spike since August 14, which previously coincided with a local top in the Bitcoin price.

Crypto analyst Maartunn notes that hourly net taker volume on Binance has dipped below $50 million, significantly below the typical $150 million average. Such muted activity indicates that market participants are waiting for hints from the Fed before making new commitments.

Coinbase premium signals resilient US demand around $115,000

On the spot market, the Coinbase premium—indicative of the price difference between Bitcoin on Coinbase and other exchanges—has been steadily rising since last Tuesday. This pattern reflects strong investor interest in the US, with buying activity near its highest since early August. The sustained premium suggests that buyers are actively defending the $115,000 support level.

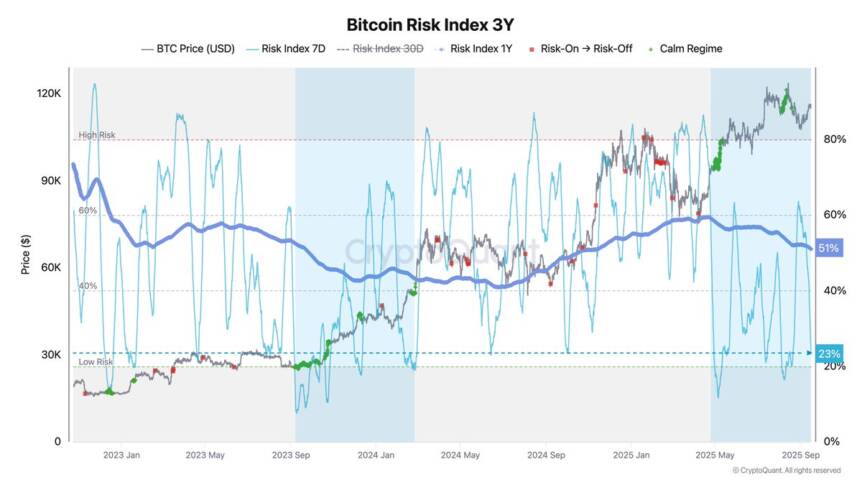

Broader sentiment indicators also point to a balanced market. The Bitcoin Bull Score, which tracks momentum shifts, has risen back to a neutral 50 from a bearish 20 in recent days, signaling easing selling pressure as traders await the Fed’s decision. Similarly, the Bitcoin Risk Index, monitored by analyst Axel Adler Jr., currently stands at 23%, near cycle lows. This measure assesses the risk of sharp declines, with low readings indicating calmer market conditions—paralleling phases earlier this year when Bitcoin traded steadily before a renewed uptrend.

This combination of cautious derivatives activity and resilient spot demand underscores a market waiting for clearer signals from the Federal Reserve. While traders remain cautious, underlying fundamentals suggest some steadiness beneath the surface as the crypto markets prepare for upcoming macro developments.