Institutional Scrutiny Casts Shadow Over Pepe Meme Coin’s Launch

Blockchain analysis indicates that Pepe, the meme coin branded as a “coin for the people,” may have diverged from its grassroots narrative. Nearly one-third of its initial supply was held by a single wallet, fueling concerns about market manipulation and early sell-offs that dampened its growth prospects.

Key Takeaways

- Approximately 30% of Pepe’s tokens were concentrated in one wallet at launch, contradicting its claim of a stealth, no-presale rollout.

- This large holder liquidated $2 million worth of tokens shortly after launch, exerting substantial selling pressure.

- Despite its community-centric branding, Pepe’s price has declined over 81% in the past year, with recent drops intensifying investor anxiety.

- Forensic tools like Bubblemaps’ Time Travel have been instrumental in revealing insider activities in the memecoin space, highlighting risks associated with centralized token holdings.

Tickers mentioned: None

Sentiment: Negative

Price impact: Negative. The heavy accumulation by a single entity and subsequent sell-offs have contributed to declining prices and investor skepticism.

Market context: Rising scrutiny over token distribution is reflective of broader concerns about transparency and security in memecoin launches amid market volatility.

Analyzing the Early Distribution and Market Impact of Pepe

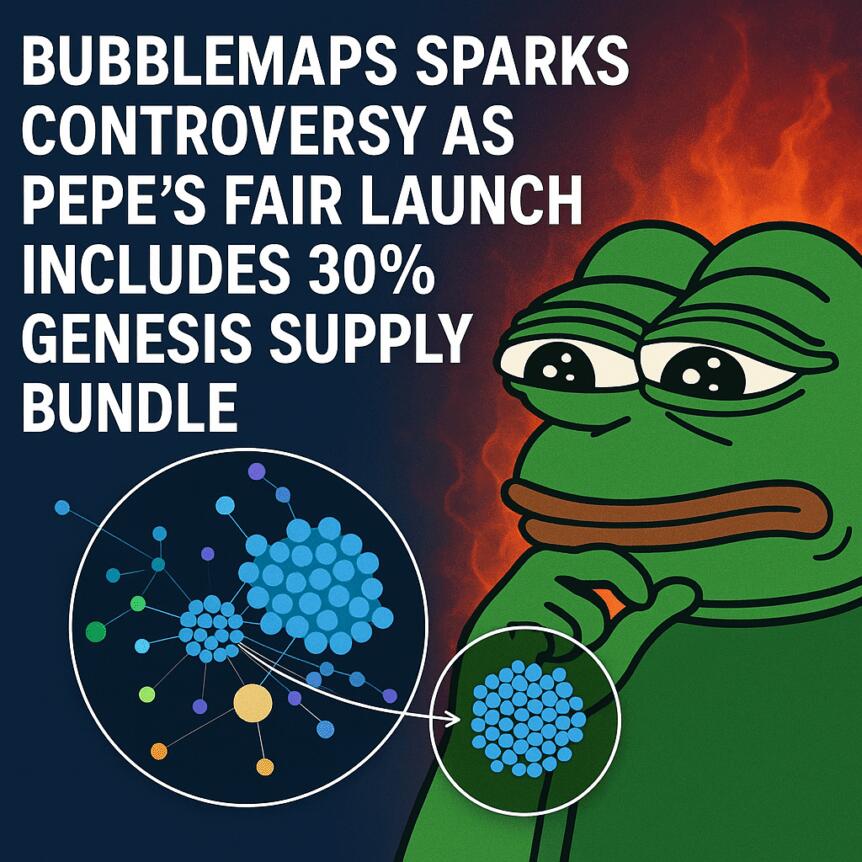

Launched in April 2023, Pepe entered the market with an ambitious branding as a decentralized “coin for the people,” emphasizing its stealth launch with no presale allocations. However, recent blockchain data visualized by Bubblemaps challenges this narrative. The platform’s analysis reveals that about 30% of Pepe’s supply was held across a single wallet cluster, which sold $2 million worth of tokens the day after the launch. This immediate liquidation created significant sell pressure, preventing the token from surpassing a market cap of $12 billion and prompting fears of potential market manipulation.

This high concentration of tokens contrasts sharply with Pepe’s community-oriented branding, raising alarms regarding insider influence and potential rug pulls, where insiders drain liquidity to profit at investors’ expense. The controversy around token distribution is further amplified by recent security breaches, including Pepe’s official website being compromised earlier in December and redirecting visitors to malicious sites designed for phishing and wallet draining.

Despite these concerns, some traders have amassed considerable gains. For instance, a trader reportedly turned a $2,000 investment into $43 million by holding Pepe through its decline, cashing out a $10 million profit despite the overall downturn.

Such events are tracked using advanced forensic tools like Bubblemaps’ Time Travel, introduced earlier in May. This platform allows Web3 users to analyze historical token distributions and identify suspicious activity, including insider accumulation points. These insights help safeguard investors from scams like rug pulls, which have historically wiped out millions of dollars in the memecoin space, exemplified by the 99% collapse of the WOLF token earlier this year.

The emerging pattern underscores the need for more transparency and due diligence in the memecoin ecosystem, especially as industry players continue to grapple with the balance between rapid gains and security concerns.