Bitcoin Magazine

Is It Possible for Strategy’s MSTR Stock to Exceed $1,000 by 2025?

In a thorough video presentation, Matt Crosby, the head analyst at Bitcoin Magazine Pro, investigates the potential of Strategy’s stock (previously known as MicroStrategy, Nasdaq: MSTR) to attain or surpass the $1,000 threshold. You can view the complete analysis here: Can MicroStrategy Realistically Reach $1,000? Data-Driven Insights

Table of Contents

Strategy’s Bitcoin Accumulation Strategy: More Than 500,000 BTC

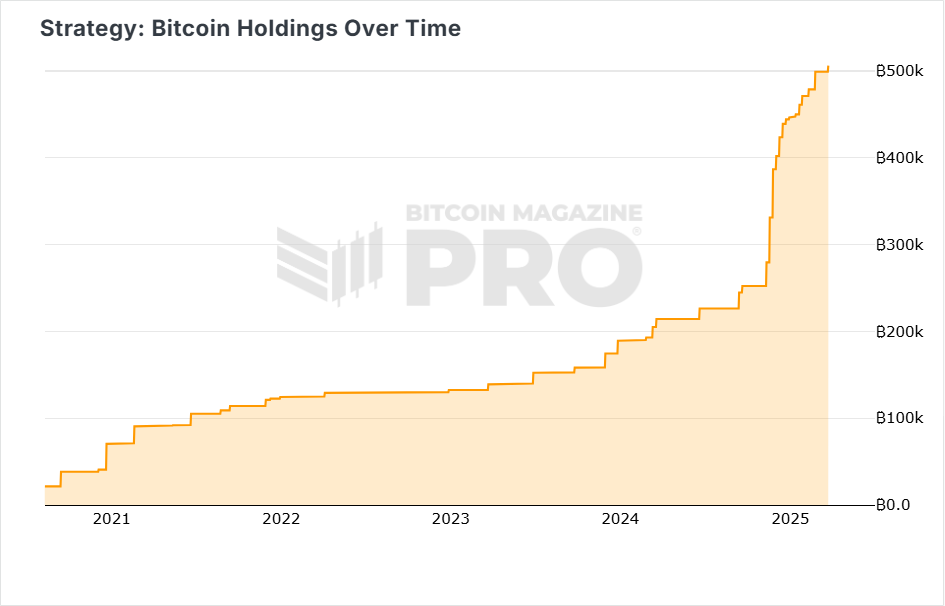

Under Michael Saylor’s leadership, Strategy has established itself as a dedicated Bitcoin corporation. Within a span of less than five years, it has amassed over 500,000 BTC, representing over 2.5% of the entire Bitcoin supply—framing its stock as a key vehicle for Bitcoin investment exposure.

Introducing the Strategy Data Dashboard from Bitcoin Magazine Pro

The recently released video showcases the Treasury Analytics dashboard on BitcoinMagazinePro.com. This innovative tool provides essential insights into Strategy’s:

- Current Bitcoin holdings

- Net Asset Value (NAV) premiums

- Stock price movements

- Historic volatility metrics

This dashboard equips investors with the capability to evaluate MSTR’s intrinsic worth and its relationship to Bitcoin’s price fluctuations.

Is $1,000 Reachable for Strategy’s MSTR? Scenarios Based on Data

Crosby reviews various valuation scenarios relying on several key assumptions:

- Bitcoin prices at $100K, $150K, and $200K

- Expanding BTC holdings up to 700K or even 800K BTC

- NAV premiums fluctuating between 2x and 3.5x

Based on these parameters, Crosby presents realistic price targets for Strategy’s stock ranging from $950 to $2,000. In incredibly optimistic scenarios, projections reach extreme figures such as $15,000 or even $25,000, although these are recognized as highly speculative.

Funding Strategies to Fuel Future BTC Accumulation

To enhance its Bitcoin acquisitions, Strategy is utilizing various financial mechanisms:

- A $2.1 billion at-the-money equity offering

- A $711 million perpetual preferred equity issuance

Such capital raising measures may enable the company to secure an additional 200K to 300K BTC.

Insightful Data on MSTR

For investors keen on monitoring MSTR, the data reveals a compelling narrative:

- Accumulating Over 500,000 BTC: Strategy’s BTC holdings represent more than 2.41% of the total Bitcoin supply, establishing it as a key public stock for BTC investment exposure.

- Stock Surge from $9 to $543: Since 2020, MSTR has experienced a dramatic rise from approximately $9 to exceeding $543 (adjusted for stock splits), predominantly attributed to its Bitcoin accumulation strategy.

- Comparative Revenue vs. BTC Valuation: In 2024, Strategy generated $463 million in software revenue, while its Bitcoin holdings surged to an estimated $43 billion—indicating it would require a century of software sales to equal its BTC portfolio value.

- Funding for Further BTC Acquisitions: The firm is raising $2.1 billion through stock offerings and has already attracted $711 million via preferred shares, funding that could increase its BTC holdings by another 200K–300K.

- Importance of NAV Premiums: MSTR has previously traded at a premium of 3.4x its net asset value. Currently, this premium stands at about 1.7x, with potential for growth in a bullish market.

- Greater Volatility Compared to BTC: MSTR’s volatility has outpaced that of Bitcoin, with its three-month volatility peaking at 7.56%, whereas Bitcoin’s was 3.32%.

- Deeper Losses During Market Declines: Historically, while BTC has seen a retracement of around 80% during bear markets, MSTR has plummeted by as much as 90%, indicating that it magnifies Bitcoin’s movement trends.

These statistics underscore the substantial upside potential alongside the heightened risk of volatility inherent in investing in Strategy.

Volatility and Correlation: Comparing Strategy and Bitcoin

Crosby emphasizes that Strategy’s price fluctuations tend to exceed those of Bitcoin. In recent months, Bitcoin’s average volatility hovered around 3.32%, while MSTR’s climbed to 7.56%, nearly double.

Examining historical bear markets, Bitcoin has typically retreated about 80%, whereas Strategy’s stock has declined closer to 90%. This trend illustrates that Strategy amplifies Bitcoin’s movements, leading to higher profits in bullish periods but also steeper declines during downturns.

Limitations: Can Strategy Compete with Apple’s Market Cap?

While the positive indicators may suggest lofty stock price potentials, achieving those heights is a different matter. For Strategy to genuinely compete with major technology players like Apple, it would need to:

- Accumulate between 850,000 and 1 million BTC

- Witness Bitcoin’s total market cap surpass that of gold at $20 trillion

- Consistently maintain a net asset value (NAV) premium of 3x to 4x

Even if those conditions were met, Strategy’s market capitalization would have to expand 45-fold to equal Apple’s current valuation of $3.3 trillion. Such a dramatic transformation appears highly improbable in this cycle, leaning more towards a speculative, long-term scenario.

Conclusion: A Bullish Yet Speculative Future for Strategy’s MSTR Price

Through Matt Crosby’s analysis, the prospect of Strategy’s MSTR price reaching $1,000 or even $2,000 seems feasible in this market cycle—assuming Bitcoin continues its upward momentum and investor confidence remains strong. These projections are underpinned by data-driven models that take into account current BTC holdings, potential future purchases, and historical NAV premiums.

Nevertheless, this opportunity carries notable risks. Strategy’s stock is recognized for its increased volatility, often surpassing Bitcoin’s fluctuations, positioning it as a high-beta, high-risk investment choice. Investors looking into MSTR should be equipped for considerable price variances and extended drawdowns, particularly during Bitcoin market corrections.

For those with a long-term belief in Bitcoin and a higher risk appetite, Strategy presents an enticing leveraged approach to the broader cryptocurrency market. Through its persistent accumulation strategy and solid institutional support, MSTR remains a data-driven and high-conviction avenue to access Bitcoin’s potential growth.

As always, it is essential for prospective investors to conduct thorough research, implement risk management strategies, and align investment choices with their individual financial objectives and timelines.

If you’re seeking additional detailed analyses and up-to-the-minute data, consider visiting Bitcoin Magazine Pro for valuable insights into the Bitcoin landscape.

Disclaimer: This article is intended for informational purposes and does not constitute financial advice. Always perform your own due diligence prior to making investment decisions.

This post Is It Possible for Strategy’s MSTR Stock to Exceed $1,000 by 2025? originally appeared on Bitcoin Magazine and is authored by Mark Mason.

We’re thrilled to launch Complete Treasury Analytics for

We’re thrilled to launch Complete Treasury Analytics for