In a move that bridges traditional finance and the booming world of cryptocurrency derivatives, former FTX US President Brett Harrison is launching Architect Financial Technologies, a startup poised to bring perpetual futures contracts—a popular yet controversial trading instrument—into the realm of traditional finance. The platform recently received regulatory approval in Bermuda to offer these complex products tied to a range of conventional assets, signaling a notable shift for crypto-influenced financial markets.

- Brett Harrison’s Architect Financial Technologies secured Bermuda approval to launch perpetual futures contracts linked to equities, commodities, and currencies.

- The new platform aims to introduce leveraged trading of traditional assets through crypto-style perpetual contracts, a tool traditionally associated with crypto markets.

- Perpetual futures, originally popularized by crypto exchanges like BitMEX and FTX, enable traders to speculate without expiry, but are considered high-risk.

- The move highlights growing crossover and institutional interest in integrating DeFi-inspired instruments into mainstream finance.

- Regulators continue to scrutinize perpetual futures due to their complexity and the risks they pose to retail traders.

Transforming TradFi with Crypto-Style Derivatives

Former FTX US President Brett Harrison’s latest venture, Architect Financial Technologies, is breaking new ground by offering perpetual futures contracts tied to traditional assets such as stocks, indexes, commodities, foreign currencies, and interest rates. The Bermuda regulatory approval marks a significant step toward integrating innovative crypto derivatives into mainstream finance, bringing a new level of leverage and complexity to traditional markets.

Perpetual futures, or “perps,” grant traders the ability to maintain leveraged long or short positions without expiration dates. To ensure market stability and price accuracy, exchanges employ a funding rate mechanism, involving periodic payments between longs and shorts designed to keep prices aligned with spot markets.

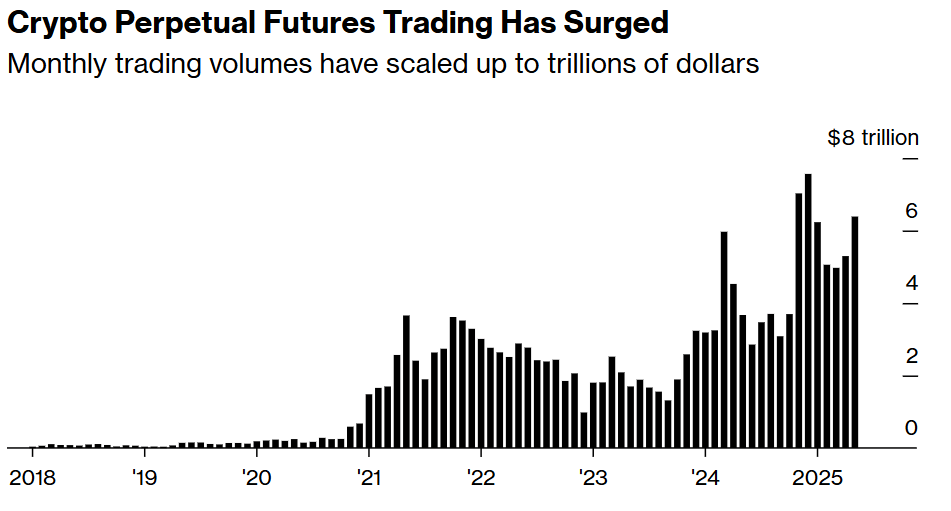

Initially popularized by crypto platforms such as BitMEX and later by FTX, these products fueled explosive growth in crypto trading. In 2025, monthly volumes surged to approximately $6.4 trillion—up from $35 billion in 2018—highlighting their significance in crypto markets. While FTX Global offered highly leveraged crypto perps, FTX US, under Harrison’s leadership, operated as a regulated, separate entity that did not provide such high-leverage options.

Both entities collapsed in November 2022 amid liquidity crises, exposing the risks intrinsic to these complex derivatives. Harrison’s move into traditional assets via perpetual contracts signals a potential new chapter for the asset class, blending crypto innovation with conventional markets.

Balancing Innovation and Risk

Though highly popular among traders, perpetual futures are increasingly scrutinized for their high-risk nature. Industry insiders warn that many inexperienced traders overuse margin, which can lead to rapid and devastating liquidations during volatile market conditions. Expert Fenni Kang cautioned in May that “perps can be a ticking time bomb” for unprepared traders.

Additionally, regulators like the U.S. Commodity Futures Trading Commission (CFTC) have expressed concern over inadequate safeguards surrounding these instruments, emphasizing the need for stronger oversight as the products become more widespread in traditional finance contexts.

Despite these concerns, perpetual futures remain integral to major crypto exchanges like Binance, OKX, and Bybit, continually shaping the landscape of digital asset trading. Harrison’s entry indicates an ongoing trend of expanding these derivatives into traditional markets, potentially increasing institutional participation but also raising questions about regulation and risk mitigation in the broader financial ecosystem.