Bitcoin’s continuous growth has led to reaching new milestones, recently surpassing an all-time high beyond the $108,000 mark. Market analytics tools like CryptoQuant and Glassnode are now offering insights into the potential future growth of Bitcoin.

Both platforms point out that there is still significant room for Bitcoin to expand. CryptoQuant forecasts a price range between $145,000 and $249,000 by 2025, with Glassnode suggesting even higher possible targets.

CryptoQuant’s Market Analysis

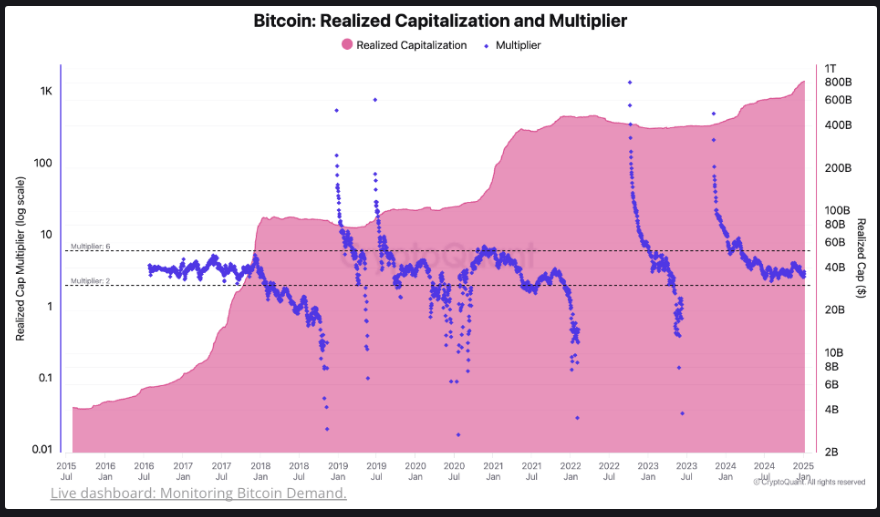

The analysis by CryptoQuant takes into account factors such as institutional capital flows, regulatory environment, and past market trends. With the expectation of increased capital inflows, Bitcoin’s price may see exponential growth, supported by a realized cap multiplier typically ranging from 2 to 6 during bullish markets.

This suggests that for each dollar invested, Bitcoin’s market value could increase by $2 to $6, indicating the potential for significant price surges. While this forecast is optimistic, it’s crucial to consider market volatility carefully.

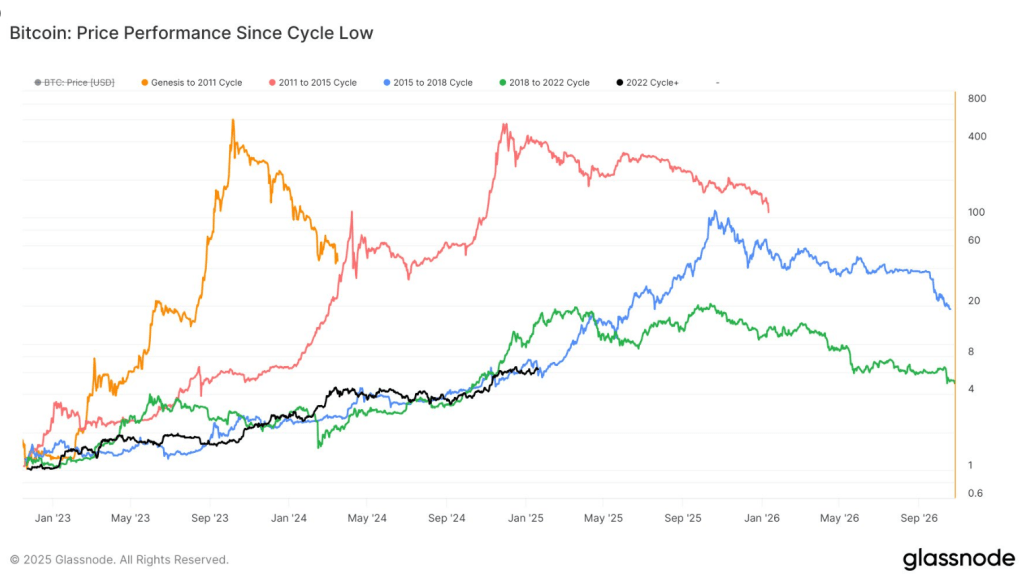

#Bitcoin‘s current cycle mirrors historical trends, echoing the 2015-2018 cycle. Performance in the current cycle stage compares to past cycles, showing significant growth.

Glassnode’s Historical Analysis

On the other hand, Glassnode highlights historical patterns, noting similarities between the current Bitcoin trajectory and the 2015–2018 cycle. If history repeats itself, Bitcoin could potentially see substantial growth.

Glassnode’s projections may suggest Bitcoin reaching $1.7 million, but these are speculative and rely on continued growth momentum. Maintaining current support levels is vital for sustaining upward momentum and investor confidence.

Technical Analysis and Market Outlook

Recent price movements indicate strong momentum for Bitcoin. Technical indicators like MACD and RSI signal further upside potential, with some experts eyeing targets above $125,000. However, maintaining support levels is crucial to sustain positive market sentiment.

Global Economic Challenges and Risks

While the outlook appears positive, global economic factors like unemployment and geopolitical tensions can impact Bitcoin’s price trajectory. Additionally, regulatory changes pose a significant risk to the cryptocurrency market’s stability.

Featured image from Pexels, chart from TradingView

https://platform.twitter.com/widgets.js