Introduction

Introduction

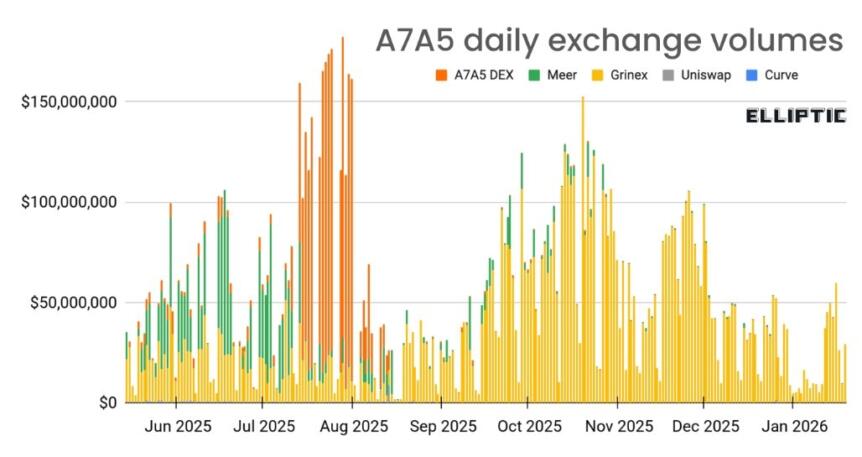

A ruble-backed stablecoin designed to operate within sanctioned Russian financial networks recorded more than $100 billion in on-chain transfers in under a year, according to a new report from Elliptic. The asset, known as A7A5, was intended to help Russian-linked businesses move value through crypto markets while reducing exposure to potential asset freezes. Its on-chain activity surged after its early-2025 launch, then cooled in the second half of the year as sanctions and exchange controls tightened. The case highlights both the ingenuity of non‑dollar stablecoins in sanctioned finance and the limits imposed by enforcement actions.

Key Takeaways

Key Takeaways

- A7A5 processed a cumulative on-chain value exceeding $100 billion across networks including Ethereum and Tron.

- Analysts describe A7A5 as a ruble-to-USDT bridge, enabling sanctioned trade while limiting wallet exposure to Western enforcement risks.

- Growth slowed mid-2025 as sanctions and compliance measures curtailed usability and liquidity limits were imposed by authorities and exchanges.

- Escalating enforcement—U.S. sanctions in August 2025, Uniswap’s blocklisting in November 2025, and EU sanctions in October 2025—reduced liquidity and trading access, underscoring the fragility of non-dollar stablecoins in a sanctions regime.

Tickers mentioned: None

Sentiment: Neutral

Price impact: Negative. Sanctions and exchange controls reduced liquidity and usability, dampening demand for the asset.

Trading idea (Not Financial Advice): Hold. The asset’s utility as a settlement bridge has diminished under enforcement pressure, though it illustrates broader dynamics in sanctioned finance.

Market context: The episode reflects how sanctions-era finance intersects with non-dollar stablecoins and the ongoing risk management challenges for on-chain settlement tools.

Rewritten article body

A7A5’s trajectory began with rapid uptake as a bridge between rubles and dollars on the blockchain. Elliptic reported that the $100 billion figure represents the aggregate value of all A7A5 transfers recorded on public networks such as Ethereum and Tron. “This is the aggregate value of all A7A5 transfers,” said Tom Robinson, founder and chief scientist at Elliptic. A7A5 was designed to enable users to move value into USDT markets while avoiding prolonged exposure to wallets that could be frozen by Western authorities, effectively sidestepping some direct dollar exposure while keeping liquidity dynamics in play.

A7A5 has primarily functioned as a bridging asset between rubles and USDT, which remains the largest dollar-pegged stablecoin globally. The structure allowed users to move value into USDT markets without maintaining prolonged exposure to wallets vulnerable to freezes by Western authorities.

Elliptic’s analysis indicates that A7A5 served as a relatively targeted settlement tool rather than a broadly adopted consumer stablecoin. Trading activity concentrated on a handful of venues, including Kyrgyzstan-based exchanges and project-linked infrastructure, reinforcing the view that the token’s role was specialized rather than transactional on a wide retail basis.

The expansion of A7A5 slowed noticeably around mid-2025. Elliptic notes that there have been no major issuances since July, and transaction volumes fell from peaks of around $1.5 billion to roughly $500 million. Robinson cited the August 2025 round of U.S. sanctions as a turning point, stating that liqudity provisions for USDT to A7A5’s decentralized exchange diminished sharply, eroding one of the stablecoin’s core advantages—easy on-chain access to USDT.

Enforcement actions intensified as the year progressed. In November 2025, Uniswap added A7A5 to its token blocklist, preventing trading via its web interface. Elliptic also documented reports of exchanges freezing USDT deposits traced to A7A5-linked wallets, underscoring how monitoring and enforcement can disrupt on-chain flows. On October 23, the European Union formally sanctioned A7A5, describing it as a tool used to bypass financial restrictions tied to Russia’s war economy. These actions collectively illustrate how a non-dollar stablecoin can offer transactional flexibility in sanctioned environments while remaining highly susceptible to policy shifts and compliance controls.

Robinson argues that A7A5’s arc helps illuminate both the potential and the limits of non-dollar stablecoins built for sanction-era finance. “While the U.S. dollar dominates the global economy, there are structural limits to how far a stablecoin such as this can grow,” he told Cointelegraph. “However, if those dynamics shift, all bets are off.”

Overall, the A7A5 episode highlights a broader tension in the crypto space: the search for innovative settlement mechanisms that can skirt restrictions, and the corresponding risk that enforcement regimes can rapidly erode their usefulness. The story remains a salient reminder of how policy, compliance, and on-chain design intersect to shape the trajectory of crypto-enabled cross-border trade.