- Ethereum spot ETFs experienced $243.9 million in outflows over the past week, marking a second consecutive week of investor exit.

- Despite outflows in Ethereum funds, Bitcoin ETFs re-entered the spotlight with $446 million in net inflows, reflecting renewed institutional interest.

- BlackRock’s ETHA ETF led Ethereum withdrawals with $100.99 million, while Bitcoin funds like BlackRock’s IBIT and Fidelity’s FBTC attracted significant investments.

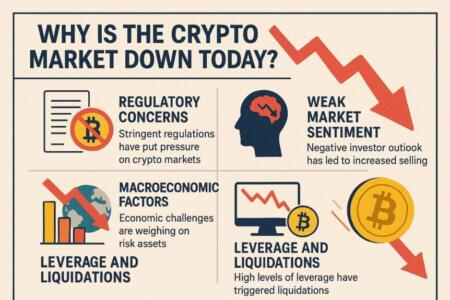

- Market analysts interpret the shifting flows as a rotation toward Bitcoin’s perceived safe-haven status amid ongoing macroeconomic concerns.

- Ethereum’s demand remains subdued, with investors waiting for new catalysts to boost on-chain activity and investment flows.

After months of robust inflows, spot Ethereum ETFs are witnessing a notable retreat, with two straight weeks of investor redemptions signaling a potential shift in market sentiment. According to data from SoSoValue, Ethereum-focused products saw net redemptions of $243.9 million in the week ending Friday, following the previous week’s $311 million outflow. Despite these declines, overall assets under management across all Ether ETFs stand at approximately $26.39 billion, representing about 5.55% of Ethereum’s total market cap.

On the same day, Bitcoin ETFs experienced renewed enthusiasm, with $446 million in net inflows, signifying a strong comeback driven by institutional investors. Friday alone saw an influx of $90.6 million, pushing total assets to nearly $150 billion. Leading the inflows were BlackRock’s iShares Bitcoin Trust (IBIT), which gained $32.68 million, and Fidelity’s FBTC, adding $57.92 million. BlackRock’s Bitcoin ETF continues to dominate the market, holding assets worth approximately $89.17 billion, underscoring Bitcoin’s appeal as a resilient store of value.

Vincent Liu, chief investment officer at Kronos Research, attributes the flow patterns to a “strong” rotation into Bitcoin, which is increasingly perceived as “digital gold” amid ongoing global economic uncertainties. Liu noted that the recent inflows reflect a broader trend where investors favor assets viewed as safe havens, especially as expectations for interest rate cuts rise.

Conversely, Ethereum’s declining on-chain activity and the recent ETF outflows signal softer demand, with institutional investors waiting for new catalysts before re-engaging. Liu expects Bitcoin inflows to remain robust in the near term, driven by market expectations of monetary easing. He added that Ethereum and other altcoins would likely regain momentum only if network activity picks up or new developments emerge to reinvigorate investor interest.

As the crypto markets evolve, these flow patterns underscore the ongoing divergence in investor sentiment towards major cryptocurrencies, highlighting Bitcoin’s resilience and Ethereum’s current cautious stance amid broader macroeconomic challenges.