Amidst a turbulent week for the cryptocurrency markets, Ethereum has plunged to its lowest point in four months, reflecting broader macroeconomic concerns and shifting investor sentiment. Despite ongoing developments within the Ethereum ecosystem, including improvements in layer-2 solutions and increased tokenization activity, ETH’s price decline underscores the fragility of the current crypto rally and raises questions about the sector’s resilience in a rising risk environment.

Ethereum (ETH) drops below $3,000, marking a four-month low amid a sector-wide risk-off sentiment.

The recent decline is primarily driven by macroeconomic factors, including fears over global growth and geopolitical uncertainties.

Despite price struggles, on-chain activity and layer-2 scaling solutions continue to bolster Ethereum’s utility and tokenization efforts.

Market caution persists due to muted demand and unrealized losses among ETH reserve-building companies, affecting investor confidence.

Analysts suggest that if macroeconomic conditions improve, ETH could rebound towards $3,900, supported by potential liquidity injections.

Ether (ETH) experienced a sharp decline on Monday, dropping below the $3,000 mark for the first time in four months. The move signals a risk-off environment across the broader crypto markets, following a 40% correction from the August peak of $4,956. Investors appear increasingly cautious amid concerns about economic slowdown and geopolitical tensions, which have dampened appetite for digital assets.

Ethereum’s recent underperformance has mirrored that of the broader altcoin market, indicating that the decline isn’t solely asset-specific but driven by macroeconomic concerns impacting the entire crypto sector. If Ethereum faced specific issues or weakening fundamentals, it would likely lag behind other altcoins, but currently, the market seems to be reacting to systemic risks rather than company-specific factors.

Analysts attribute the downturn to mounting fears over the global economic outlook. The United States’ ongoing government shutdown, recent tariffs, and disappointing earnings from consumer sectors have compounded worries about less economic growth. Meanwhile, the artificial intelligence industry — a key driver of sector enthusiasm — remains under pressure, with data centers facing rising costs and energy constraints despite robust profitability.

Market sentiment remains cautious, with demand for bullish ETH leverage waning over the past month. The futures premium has stayed below the 5% neutral threshold, reflecting subdued enthusiasm among traders. Part of this hesitation is linked to the financial strain faced by companies holding ETH reserves, such as Bitmine Immersion, SharpLink Gaming, and The Ether Machine. These firms, which fund ETH holdings through debt and equity, now carry unrealized losses as their shares trade below net asset value, including their crypto assets. Although forced selling isn’t imminent, declining investor interest suppresses demand for new debt and dilutes existing holdings.

Falling on-chain activity weakens bullish sentiment

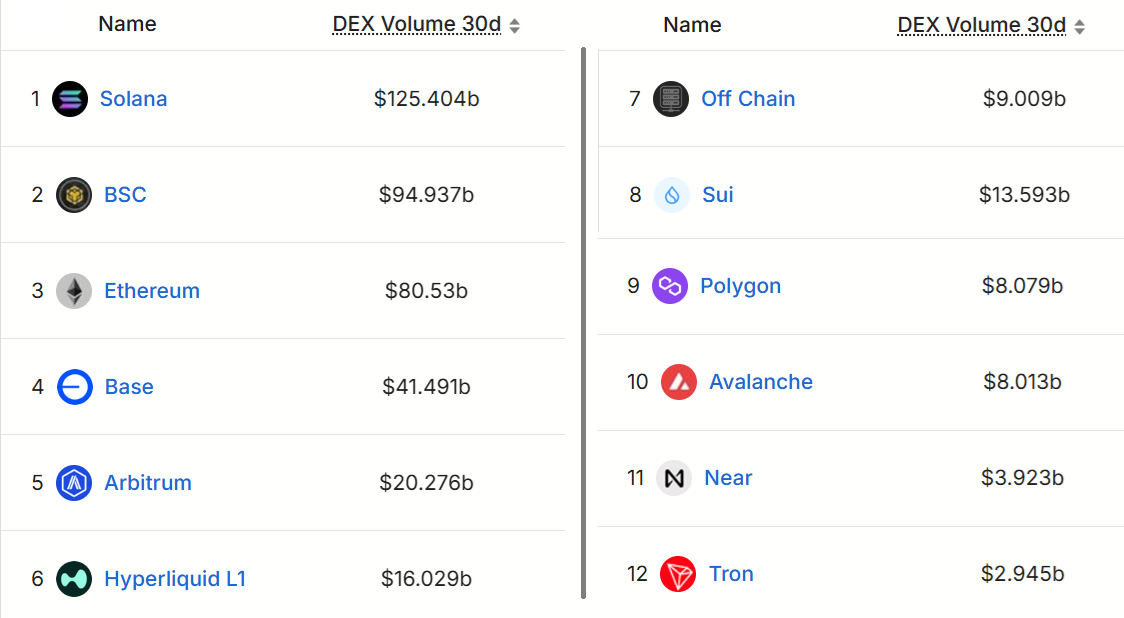

On-chain metrics further illustrate the subdued market environment. Network activity, as measured by Total Value Locked (TVL), has declined sharply, reaching a four-month low of $74 billion—a 13% drop over the past month. Decentralized exchange (DEX) trading volume has also decreased, with $17.4 billion traded in the last week, down by 27% from the previous month. While Ethereum remains the dominant platform for asset deposits and tokenization, increased competition from other blockchains and scaling solutions is challenging its dominance in trading volume.

Some critics highlight that layer-2 scaling solutions like Base, Arbitrum, and Polygon have alleviated congestion and reduced fees, but they also pose challenges by batching transactions off-chain, which diminishes demand for base-layer fees. Nonetheless, the Ethereum ecosystem continues to expand its leadership in real-world asset tokenization and decentralized stablecoin systems, with Base recording nearly 102 million transactions in recent days—comparable to networks with larger user bases.

Looking ahead, Ethereum’s price trajectory largely hinges on broader macroeconomic developments. If geopolitical tensions ease and global liquidity conditions improve, ETH could rally back toward $3,900, buoyed by the potential for central banks to inject liquidity and support economic recovery. Until then, the market remains highly sensitive to macro trends, which continue to overshadow sector-specific bullish signals.

This analysis is for informational purposes only and does not constitute investment advice. Readers should conduct their own research and consult financial professionals before making any investment decisions.