Despite recent turbulence in the cryptocurrency markets, Ethereum’s (ETH) price exhibits signs of resilience, steadily recovering from a sharp flash crash. While derivatives markets have shown unusual distortions, current indicators suggest that Ethereum remains poised for a potential rebound, bolstered by strong institutional interest and balanced options activity. This stability amidst broader market uncertainty reinforces ETH’s position as the leading altcoin and a key asset within the evolving blockchain ecosystem.

- ETH’s perpetual futures market distortions are receding, with monthly futures indicating a neutral stance and diminished short-term fear.

- Options trading activity points to a balanced demand for both bullish and bearish strategies, illustrating a healthy derivatives environment.

- Ethereum outperformed many altcoins in the recent market crash, demonstrating its stronger market footing and investor confidence.

Ether (ETH) reclaimed the crucial $4,100 level on Sunday, bouncing back from Friday’s dramatic 20.7% plunge. The incident, fueled by over $3.82 billion in liquidations of leveraged long positions, cast a shadow over ETH’s derivatives landscape. However, four key factors hint that the recent rebound from the $3,750 support zone might mark the end of the short-term correction.

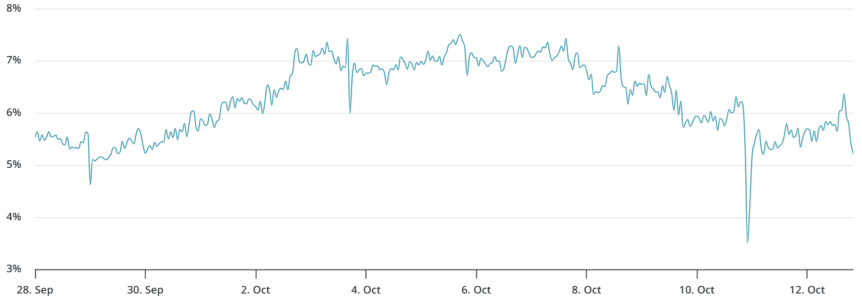

The funding rate on ETH perpetual futures fell to -14%, indicating that bearish traders are paying to maintain their short positions, an unsustainable scenario over the longer term. This steep negative rate suggests widespread fears of potential solvency issues among market makers or exchanges, prompting traders to adopt a more cautious approach until confidence is restored.

ETH derivatives signal return to market stability amid ongoing uncertainty

Questions persist concerning whether exchanges will fully reimburse clients affected by mismanagement of cross-collateral margin or oracle pricing errors. Binance announced $283 million in compensation and noted ongoing reviews of other cases, but traders remain cautious until comprehensive assessments are completed. During the turmoil, wrapped tokens and synthetic stablecoins experienced severe parity losses, leading to margin drops of up to 50% in minutes.

Within hours, ETH monthly futures absorbed the shock and reclaimed the minimum 5% premium, indicating that the decline was more driven by product design issues within derivatives rather than fundamental market bearishness. This temporary distortion is expected to persist until confidence among market makers is restored, a process that could take weeks or even months, but does not necessarily spell long-term trouble for ETH’s momentum.

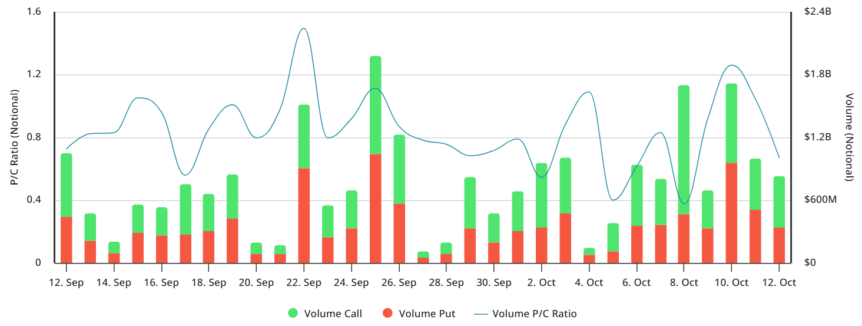

Deribit’s options markets showed no signs of stress or heightened demand for bearish strategies, with trading volumes remaining stable over the weekend. The slightly lower volume of put options compared to call options indicates traders’ confidence in ETH’s resilience, countering fears of a coordinated market collapse. The recent cascade of liquidations appears to have caught the market off guard, rather than being the result of premeditated bearish positioning.

Ethereum’s outperformance and institutional appeal sustain long-term optimism

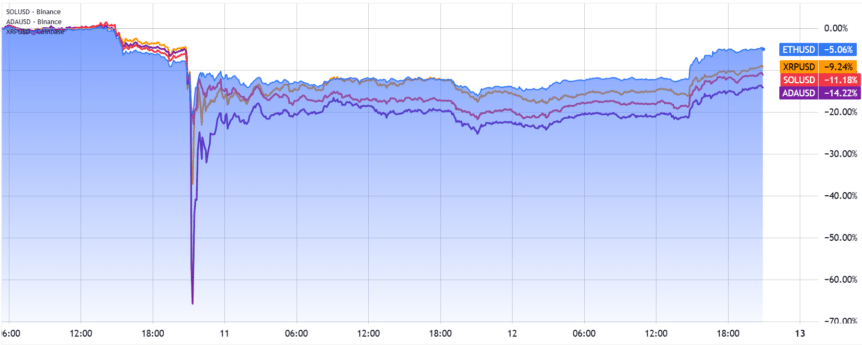

Despite the recent volatility, Ethereum’s decline of around 5% over the past two days has been minor compared to other altcoins, with tokens like SUI, AVAX, and ADA experiencing declines of 66% or more during the same period. ETH’s relative strength is underpinned by its substantial spot ETF holdings totaling $23.5 billion and open interest in options markets reaching $15.5 billion, reinforcing its standing as a preferred choice among institutional investors.

While competitors like Solana may attempt to join the spot ETF race, Ethereum’s established network effects and resilience through volatile periods continue to solidify its dominance. Analysts remain optimistic about a potential rally toward the $4,500 resistance level, supported by renewed confidence in derivatives structures and institutional interest.

This overview aims to provide an informed perspective on Ethereum’s recent price movements and derivatives activity, reflecting current market conditions. It is not financial advice and should not be construed as such. Readers are encouraged to conduct their own research before making investment decisions.