Ethereum’s recent development focus is centered around its upcoming network upgrade, Fusaka, which is scheduled for a tentative launch in early December. Designed to improve scalability and efficiency, the update will primarily involve a series of hard forks aimed at increasing the network’s blob capacity, a critical factor for handling larger data sets offchain and supporting the growth of layer-2 solutions and DeFi protocols.

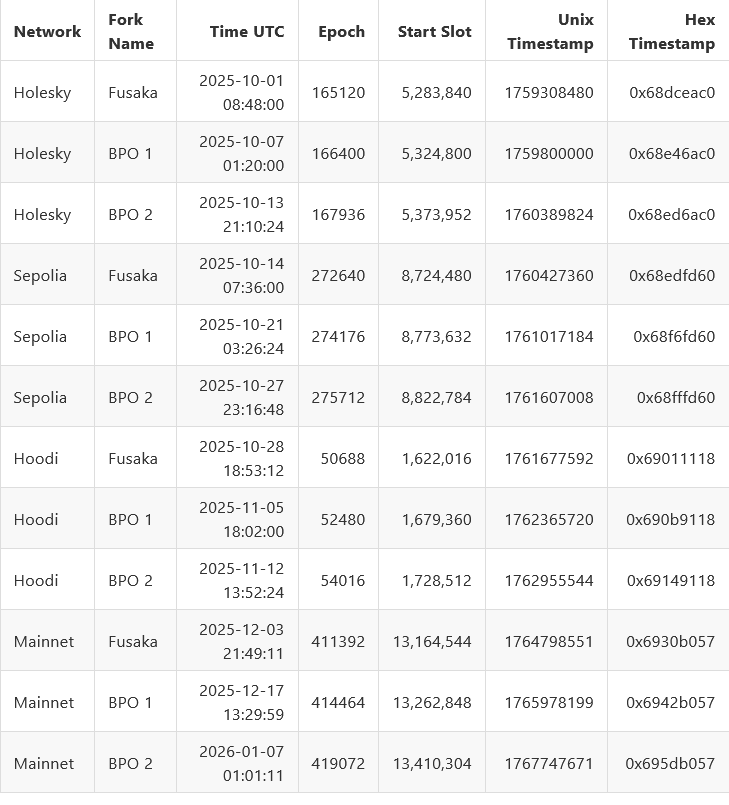

The initial deployment of Fusaka is set for December 3, followed by a significant blob capacity increase approximately two weeks later, around December 17. A subsequent hard fork targeting further blob capacity enhancement is planned for January 7, 2026. These upgrades will more than double the current blob capacity, significantly bolstering Ethereum’s ability to process and store large data offchain, thus reducing transaction costs and improving network throughput.

Prior to the mainnet rollout, three public testnets are scheduled between early October and mid-November, allowing developers to validate the updates comprehensively. Ethereum researcher Christine D. Kim confirmed that Ethereum’s community has approved configurations for the hard forks to support these capacity increases safely and efficiently, with planned parameters set to maximize network performance without compromising security.

Meanwhile, Ethereum’s development community is also focusing on safety measures, as the Foundation announced a four-week code audit program offering a $2 million reward for vulnerabilities identified during the Fusaka coding phase. This reflects a broader trend of rigorous security scrutiny amid increasing network complexity and growing adoption of smart contracts, NFTs, and decentralized finance applications.

Since the recent upgrade called Dencun, blob usage on the Ethereum network has steadily increased, with current average blob counts per block at 5.1—up from 0.9 in March 2023. This surge indicates a rising demand for onchain data storage solutions that support scaling efforts and reduce transaction costs.

Additionally, recent metrics show a record amount of ETH being unstaked, with 2.6 million ETH, worth approximately $12 billion, entering the exit queue last week. Despite this, the queue for staking deposits remains at a four-week low, highlighting cautious sentiment among validators concerned about potential selling pressure. Ethereum’s co-founder Vitalik Buterin justified the lengthy exit queue, asserting that reducing it could undermine network trust and security, underscoring ongoing debates about staking and network stability in the evolving crypto landscape.