The recent crypto market crash on October 10 marks the largest liquidation event in the history of digital asset trading, with over $19 billion forcibly liquidated in a matter of minutes. This unprecedented event triggered a cascade of liquidations, causing a dramatic $65 billion decline in open interest and highlighting vulnerabilities in crypto infrastructure and market stability. As the industry grapples with the fallout, experts point to technical flaws and possible coordinated attack vectors as key contributing factors to this historic downturn.

- October 10 saw the largest liquidation event in crypto history, with over $19 billion liquidated in a single day.

- The event caused a $65 billion decrease in open interest, dwarfing past crises like the COVID-19 crash and FTX collapse.

- Investigations point to vulnerabilities in Binance’s pricing oracles, especially concerning pegged tokens like USDE, bnSOL, and wBETH.

- Unusual market activity, including rapid liquidity withdrawal and anomalous trading patterns, preceded the crash.

- The incident exposes systemic fragility, underscoring risks in DeFi platforms and the importance of better market oversight.

A Market Collapse of Historic Proportions

The crash on October 10 shattered previous records for liquidation volume, with more than $19 billion wiped out in a matter of minutes, according to market data. The liquidation wave resulted in a $65 billion drop in open interest across derivatives markets, exceeding past liquidity crises such as the COVID-19 crash and the collapse of FTX.

Market analysts have identified vulnerabilities in Binance’s pricing oracles as a potential catalyst. These oracles, which determine the value of certain pegged tokens like USDE, bnSOL, and wBETH, relied on internal data — not external oracles — increasing risk during market stress. These internal valuations are central to Binance’s “Unified Accounts” feature, making users susceptible to liquidation during irregular trading conditions.

While evidence of a coordinated attack remains inconclusive, the data indicates suspicious behavior. Notably, USDE experienced substantial liquidations, accounting for about $346 million, with other tokens like wBETH and bnSOL also heavily affected. The mass withdrawal of liquidity on stablecoin pairs adds a layer of suspicion, hinting at possible manipulation or strategic market moves.

Unprecedented Market Dislocation and Anomaly Detection

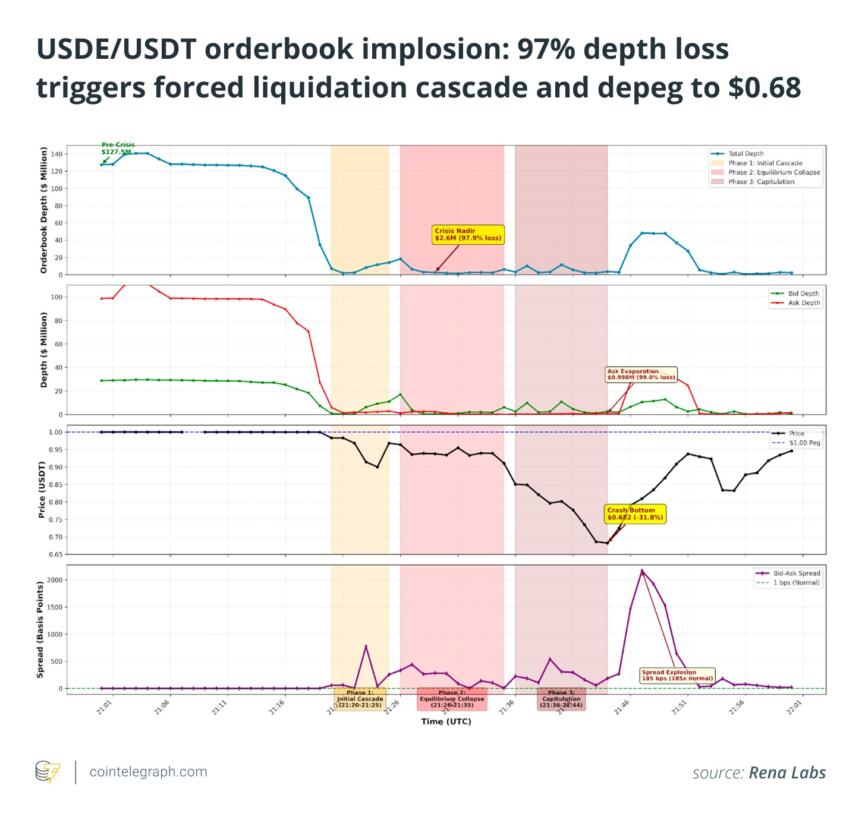

Using detailed analytics from Rena Labs, a leading AI-driven market analysis firm, researchers detected one of the most severe and complex dislocations ever observed in stablecoin trading. Despite the USDE peg being intact, liquidity evaporated rapidly. Total liquidity on Binance declined from an average of $89 million to just $2 million in under 20 minutes, with bid-ask spreads widening to 22%, and nearly complete market depth disappearing.

During the crisis, trading activity surged exponentially — nearly 16 times higher than normal — with almost 3,000 trades per minute, predominantly sell orders. This panic-driven trading, combined with stop-loss triggers and forced liquidations, accelerated the liquidity collapse.

Signs of Pre-Crisis Anomalies

Rena’s anomaly detection system identified unusual activity hours before the liquidity crisis. At around 21:00 UTC, it recorded 28 anomalies, including spikes in volume, price deviations, and suspicious trade patterns such as spoofing — where traders manipulate markets by placing deceptive orders to influence prices.

Order book analysis revealed three large-volume order “volleys” just before the collapse, hinting at targeted manipulation when Bitcoin was already declining but before USDE liquidity vanished. These events underscore the fragility of crypto markets, where leverage and leverage-fueled liquidations can wipe out seemingly stable trades and expose systemic weaknesses, especially where market makers like Wintermute are absent.

This incident emphasizes the importance of robust risk management and reliable oracles in blockchain-based finance. As the crypto industry faces increasing scrutiny over its infrastructure, the October 10 crash serves as a stark reminder of the ongoing vulnerabilities within digital asset markets.

This article does not constitute investment advice. Every trading decision involves risk, and readers should conduct thorough research before engaging in crypto markets.