Introduction

Bitcoin remained subdued just under the $90,000 level as Wall Street opened, even as gold and silver pressed toward notable milestones. The market narrative centered on whether BTC could breakout from its current range or continue trading sideways, while precious metals strengthened, highlighting a growing divergence between crypto risk assets and traditional havens. Traders scanned macro signals, CME futures dynamics, and liquidation data for clues on the next directional impulse.

Key Takeaways

- Bitcoin fails to shift its sideways trading behavior while gold approaches near record territory for a key milestone.

- Bullish BTC price outlooks become increasingly rare as safe-haven assets outperform.

- Gold targets as high as 23,000 per ounce over the next several years, fueled by macro demand and central bank accumulation.

- The macro environment suggests caution for risk assets as inflation dynamics and monetary policy shape upside and downside risks.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. No immediate breakout, with watchful liquidity dynamics and macro factors keeping a wide range in play.

Trading idea (Not Financial Advice): Hold. With BTC stuck below key resistance, traders may wait for a credible move above or below the current corridor.

Market context: The move underscores a broader risk-off tilt as precious metals continue to outperform while major crypto assets pause near key levels.

Rewritten article body

Bitcoin’s price action was characterized by a persistent lack of momentum, hovering below the $90,000 mark as traders prepared for the week’s sessions. Data from TradingView indicated subdued volatility, even as gold and silver advanced toward psychological thresholds around $5,000 per ounce and $100 respectively. The bifurcation between crypto and traditional safe havens underscored a cautious mood among market participants who are weighing whether macro catalysts will finally drive a decisive breakout for BTC or keep it anchored in a wide trading band.

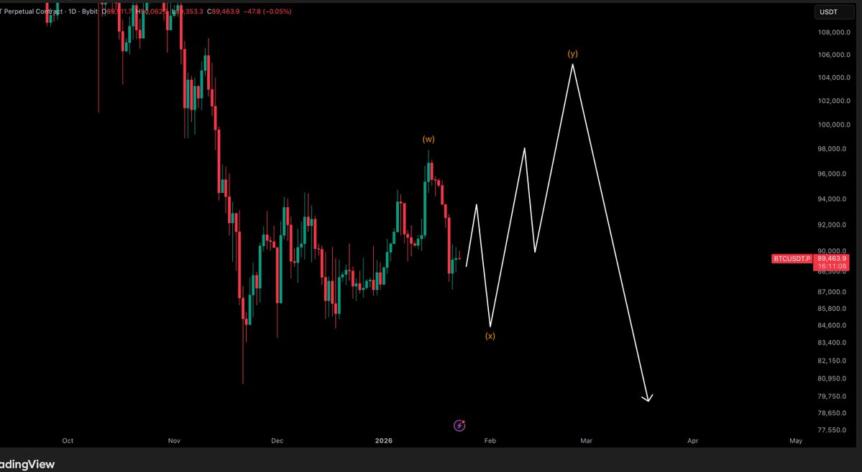

As the debate persisted about whether new macro lows for BTC/USD were on the horizon, upside targets were increasingly pinned to the 2025 yearly open near 93,500. Some traders argued that a move toward that level could align with a nearby CME Group Bitcoin futures gap, potentially acting as a price magnet if volume finally shifts in the bulls’ favor. A well-known crypto analyst noted that a push to 93,000 would be required to close the CME gap, a prerequisite in his view for a sustained rally. In the meantime, a retreat toward 85,000 was seen by many as a potentially favorable long entry, provided price action held support at that level.

“A tap of 85,000 would present the best long opportunity. IF WE HOLD.”

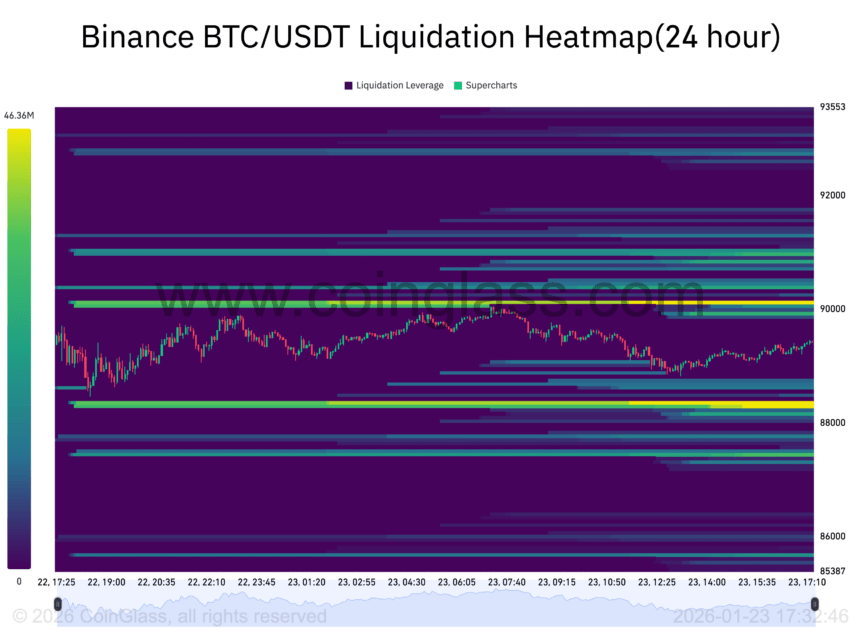

Earlier in the session, BTC/USD reportedly “filled” an open gap near 88,000 before rebounding, leaving the bulk of the remaining gaps above the current price. Monitoring resources showed that liquidation pressure thickened around 88,300 and 90,100 as the U.S. trading session approached, suggesting a concentration of leverage around those price levels and the potential for sharp moves if liquidity shifts.

Market observers weighed how losses could unfold if the 86.8k support were breached and not quickly reclaimed. A prolific analyst described the level as a critical fulcrum; a break below could prompt a test of the recent lows, while a firm reclaiming above 91,000 opened the door to a stronger rally. The sense among commentators was that a sustained price move above the 91k hurdle could unleash a more meaningful upside, whereas failing to hold key supports kept the downside risk intact within a broad range.

“On the other hand, a crucial level is found at 91K. Break that & we’ll see a strong surge.”

Gold price trajectory and macro optimism

The spotlight extended beyond Bitcoin as gold and silver climbed on optimism about inflation trends and monetary policy. Gold neared the 5,000 level, while silver pressed toward the 100 mark against the U.S. dollar. The market narrative reflected a broader risk-off sentiment that often favors precious metals when monetary authorities signal sustained liquidity support and inflation remains a concern.

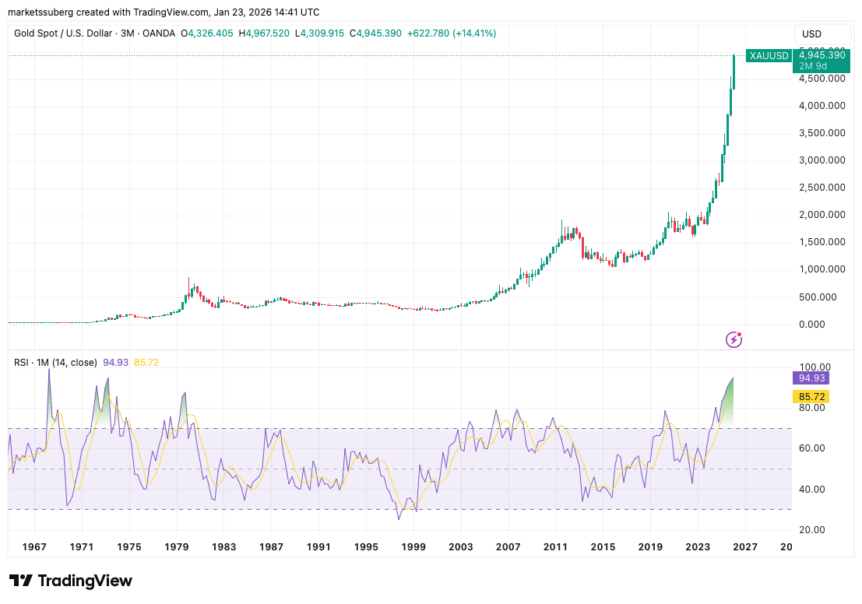

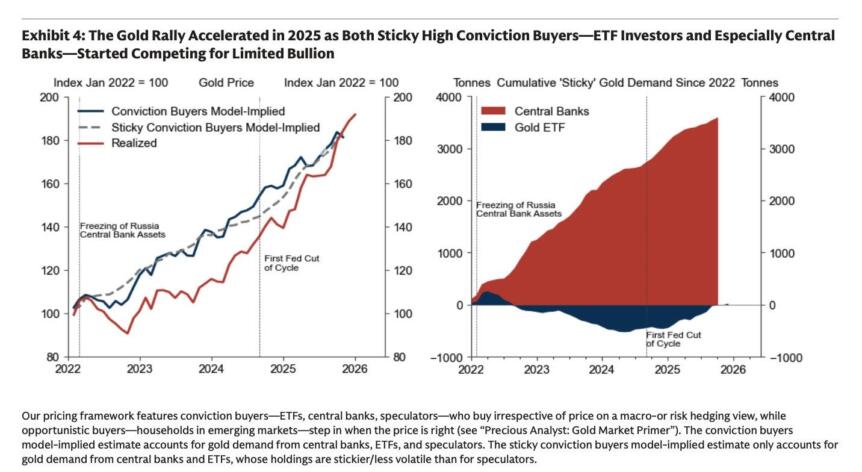

Analysts noted that gold’s momentum was accompanied by a rising RSI in a context of historically high levels of central bank gold accumulation. China and other holders have expanded their gold stacks in recent years, underscoring the asset’s appeal as a monetary hedge in an era of contested fiat debasement. A prominent investor suggested that the macro environment could propel gold toward substantial appreciation, arguing that inflationary pressures and broad monetary expansion could support a long-term rally well beyond current levels.

“We have record high Central bank gold accumulation. China has 10Xed their gold stack in the last 2 years alone,”

The analyst highlighted that inflation remains a dominant force, with the fiat money supply continuing to expand at elevated rates. The expectation is that this dynamic could drive asset prices higher across commodities and equities, with gold potentially moving into a higher-range regime over multi-year horizons. The discussion touched on historical parallels, suggesting that the current bull run could follow expansive periods of the 20th century, should the macro backdrop remain favorable. The takeaway was cautiously optimistic about a long-duration upside for precious metals, even as the immediate BTC price action remained indecisive.

In sum, the market narrative at the moment centers on a tug-of-war between BTC’s lack of a decisive breakout and gold’s continuing ascent, a dynamic that emphasizes the evolving role of macro drivers in crypto markets. Investors remain attentive to liquidity, CME gaps, and key level tests as the week unfolds, ready to react to any shift in risk sentiment or changes in central bank policy signals.