The fluctuations in Bitcoin’s price have consistently sparked discussions among investors and financial experts. With the recent market pullbacks, a growing number of individuals are speculating whether Bitcoin has reached its maximum potential in this current bullish trend. This article delves into key data points and on-chain analytics to evaluate Bitcoin’s positioning in the market and what future movements may entail.

For a thorough examination, check out the complete Has The Bitcoin Price Already Peaked? presentation on Bitcoin Magazine Pro‘s YouTube channel.

Bitcoin’s Recent Market Behavior

Bitcoin has recently seen a decline of 10% from its historic high, raising worries about a potential end to the bullish phase. Nonetheless, historical patterns reveal that such corrections are commonplace during bullish cycles. Typically, Bitcoin endures pullbacks ranging between 20% to 40% several times before hitting its peak for the cycle.

Evaluating On-Chain Indicators

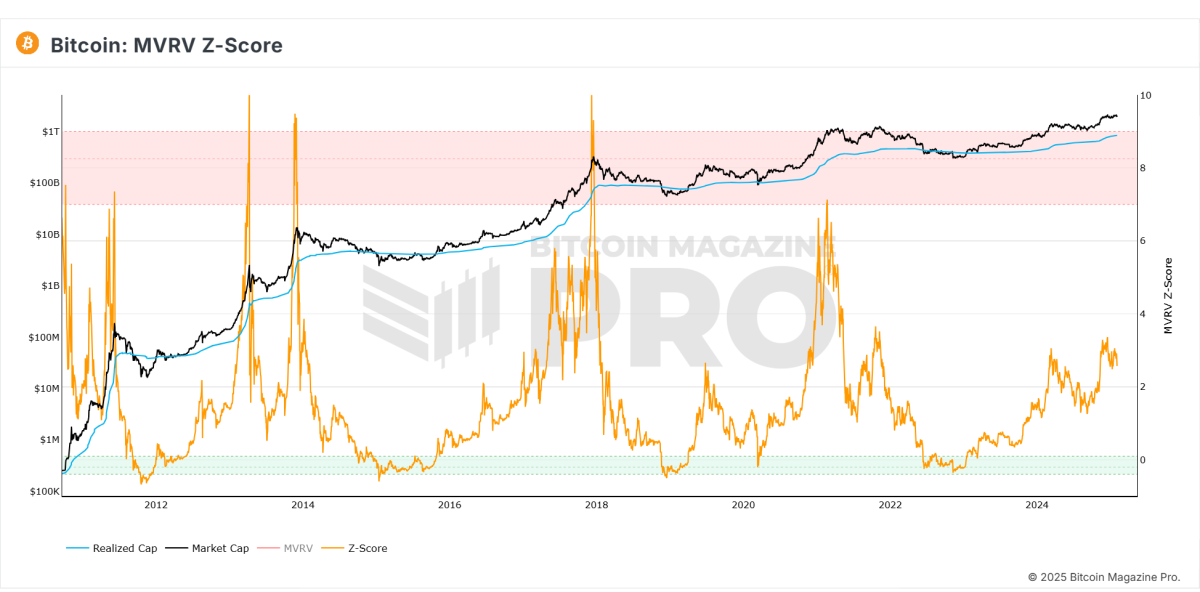

MVRV Z-Score

The MVRV Z-Score, which assesses the ratio of market value to realized value, currently suggests that there is still significant room for price appreciation in Bitcoin. Historically, peaks in Bitcoin’s price are observed when this metric enters the overbought red zone, which is not the present scenario.

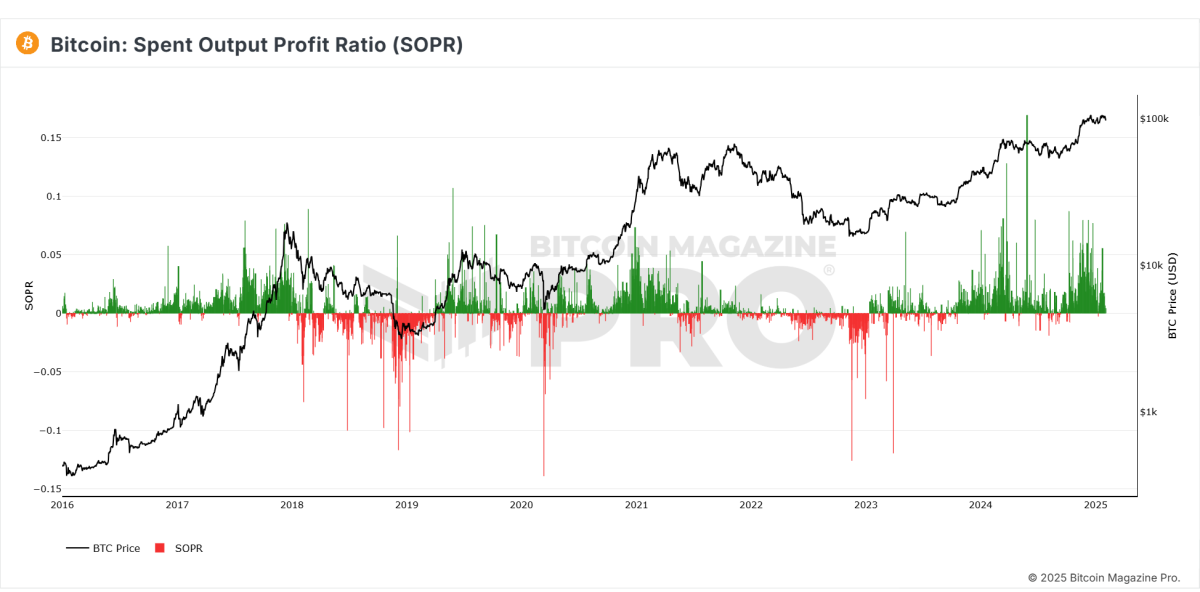

Spent Output Profit Ratio (SOPR)

This indicator illustrates the percentage of spent outputs that are profitable. Recently, the SOPR has indicated decreasing realized profits, implying that a smaller number of investors are selling their assets, which supports market stability.

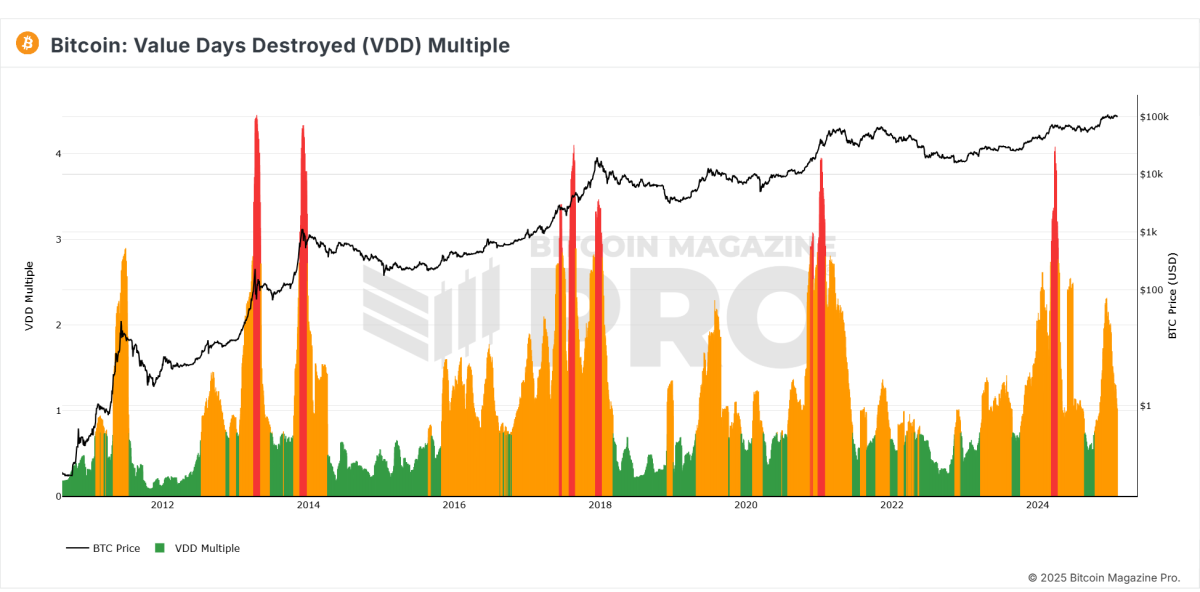

Value Days Destroyed (VDD)

The VDD metric tracks sell-offs by long-term holders. It has shown a decrease in selling activity, indicating that Bitcoin is solidifying at elevated levels instead of entering a prolonged decline.

Market and Institutional Sentiment

- Major institutional players like MicroStrategy have continued their accumulation of Bitcoin, reflecting a strong belief in its long-term prospects.

- Sentiment in the derivatives markets has turned sour, which historically signals a potential bottom in prices as over-leveraged traders who short Bitcoin could face liquidation.

Macroeconomic Influences

- Quantitative Tightening: Central banks are tightening liquidity, which has contributed to the recent drop in Bitcoin’s price.

- Global M2 Money Supply: A decrease in money supply has had widespread effects on risk assets, Bitcoin included.

- Federal Reserve Policy: Major financial institutions, such as JP Morgan, hint at a return to quantitative easing around mid-2025, which could positively impact Bitcoin’s valuation.

Related: Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Projections for the Future

- Current price actions of Bitcoin show the potential to enter a consolidation phase ahead of another rally.

- On-chain analyses indicate that there remains substantial potential for growth before reaching the peaks experienced in earlier bullish cycles.

- If Bitcoin sees further declines to around $92,000, this could become a compelling buying opportunity for long-term stakeholders.

Final Thoughts

Despite Bitcoin undergoing a temporary decline, data from on-chain metrics and historical trends imply that the bullish cycle is far from over. Institutional interest in Bitcoin persists, and macroeconomic dynamics could shift favorably. As always, it is critical for investors to thoroughly analyze data and consider long-term trends prior to making investment choices.

For more insightful analysis and up-to-the-minute information, consider visiting Bitcoin Magazine Pro for essential insights into the Bitcoin market.

Disclaimer: This article is intended for informational purposes only and should not be perceived as financial advice. Always conduct your own research before making any investment decisions.