DeFi: Unleashing the Potential of Automated Trading Strategies

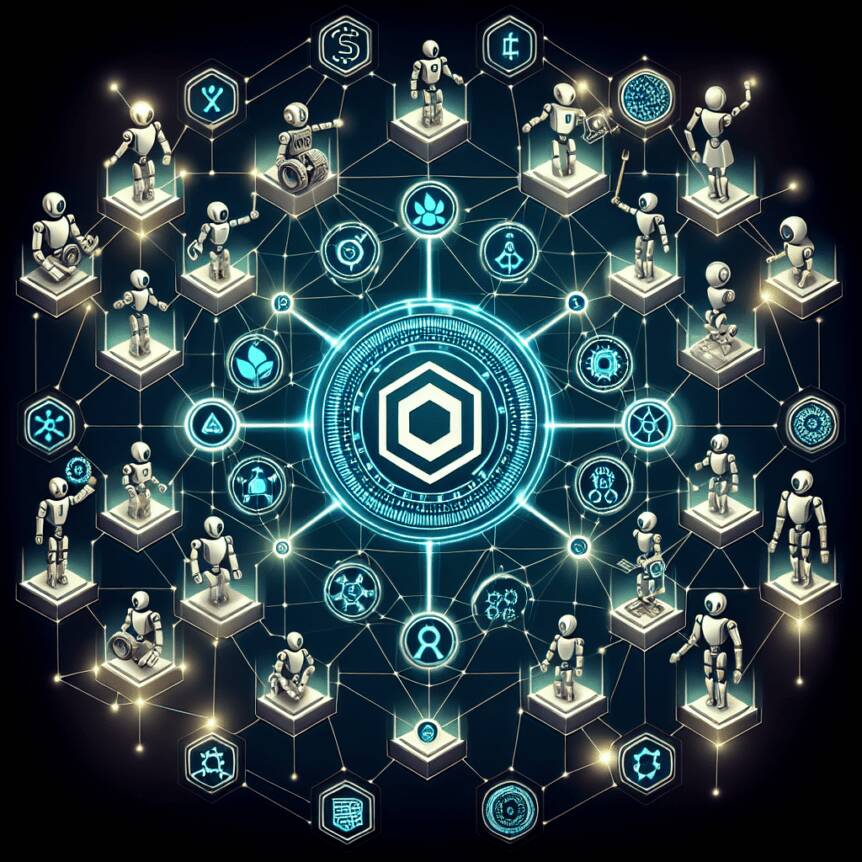

Decentralized finance (DeFi) has emerged as a revolutionary force in the world of finance, offering various opportunities to investors and traders alike. One of the most exciting applications of DeFi is its ability to facilitate automated trading strategies through smart contracts. By leveraging DeFi protocols, traders can access a wide range of trading bots and algorithms to help them navigate the complex and volatile cryptocurrency markets.

Automated trading has become increasingly popular in the crypto space due to its efficiency and ability to execute trades with precision and speed. These trading bots can be programmed to follow specific strategies and execute trades based on predefined parameters, removing the emotional aspect of trading and allowing for a more disciplined approach to investing.

One of the key benefits of using DeFi for automated trading is the transparency and security provided by blockchain technology. Smart contracts ensure that trades are executed exactly as programmed, without the risk of human error or manipulation. This level of trust and transparency is crucial in an industry where trust is often a scarce commodity.

Moreover, DeFi opens up a world of possibilities for traders to experiment with different trading strategies and algorithms. By accessing a wide range of trading bots and algorithms, traders can diversify their investment portfolios and optimize their trading strategies for maximum returns.

In conclusion, DeFi has the potential to revolutionize automated trading strategies by providing a secure, transparent, and efficient way to navigate the cryptocurrency markets. By leveraging the power of blockchain technology, traders can access a wide range of trading bots and algorithms to help them choose the best robots to enhance their investment strategies.