Hyperliquid’s token rally captured broader attention as a rapid 60% ascent lifted the price to 34.90 from about 21.80 in a matter of days. The move came amid a confluence of on-chain activity, new balance-sheet exposures, and a wave of speculative positioning that left traders parsing whether the momentum would endure. Two events stood out in the backdrop: the staking unlock that eased selling pressure and reports that a Nasdaq-listed treasury company added HYPE to its digital-asset reserves. The price spike also coincided with a bout of liquidations on bearish leveraged bets, underscoring how quickly sentiment can flip in a market where liquidity and risk appetite ebb and flow in tandem.

Key takeaways

- HYPE surged about 60% to 34.90 in a two-day rally, with more than $20 million in liquidations tied to bearish, leveraged positions as the move unfolded.

- An ARK Invest Big Ideas report highlighted Hyperliquid as a potentially revenue-efficient player in DeFi derivatives, contributing to a broader institutional关注 despite flat perpetual volumes.

- Purported on-chain activity linked to a Nasdaq-listed treasury firm, PURR, adding HYPE to its balance sheet helped intensify the narrative around HYPE’s legitimacy and demand.

- On-chain transfers and staking activity overshadowed by large holders; substantial inflows cited from major venues, but overall open interest remained robust yet concentrated, leaving questions about sustainability.

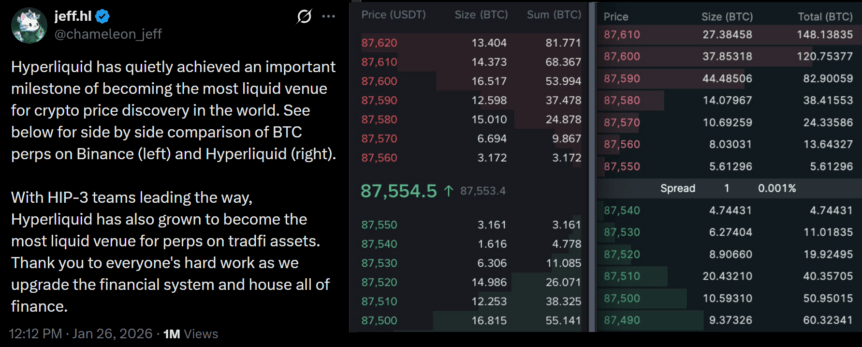

- Unfolding staking unlock events and trader debates around market maker flows added a dynamic that could influence near-term price action, with some observers noting renewed attention on Hyperliquid’s role in price discovery.

Tickers mentioned: $HYPE, $BTC, $USDT

Sentiment: Neutral

Price impact: Positive. The rally pushed HYPE higher on renewed interest, though the trajectory remains uncertain without corroborating sustained participation.

Trading idea (Not Financial Advice): Hold. Near-term momentum favors the upside, but the absence of clear catalysts beyond one-off inflows warrants caution.

Market context: The move unfolds amid a broader crypto-derivatives landscape where on-chain activity and institutional interest intersect with exchange dynamics, reinforcing the importance of liquidity and risk sentiment in price formation.

Why it matters

The recent price action around Hyperliquid underscores how a niche platform can become a focal point for price discovery even when, in aggregate, major centralized venues still claim outsized influence. Hyperliquid’s gains followed a period of reported on-chain inflows and a notable staking unlock, suggesting that both new capital and the unblocking of previously illiquid stakes can push a token into the spotlight. While the rally appears buoyed by specific events rather than organic, broad-based adoption, the episode highlights how on-chain activity and cross-market flows can temporarily tilt the supply-demand balance in favor of a token with a dedicated user base.

ARK Invest’s framing of Hyperliquid as a potentially revenue-efficient DeFi derivatives participant adds a layer of institutional credibility to the narrative. The analysis emphasizes that the market’s evolution could tilt toward using blockchain infrastructures as monetary assets, a perspective that could attract more capital if supported by measurable profitability and scalable platforms. Yet the critique remains: price momentum in such setups can be fragile if outsized inflows recede or if large holders begin to unwind positions. In that context, the ARK report serves as a reminder that fundamentals and market mechanics—rather than hype alone—should guide long-term expectations for a token tied to a complex derivatives ecosystem.

On-chain activity and treasury-related moves are central to this episode. Reports of PURR adding HYPE to its balance sheet and the 3.6 million HYPE accumulation on December 12, 2025—followed by staking via Anchorage—signal a governance of risk and capital that blends traditional treasury management with crypto-native strategies. The narrative around PURR traces back to its roots in a SPAC-backed merger with Rorschach, positioning the venture as a bridge between conventional markets and DeFi liquidity provisioning. While such corporate actions can magnify a token’s legitimacy in the eyes of investors, they also invite scrutiny of counterparty risk and the durability of a token’s price trend outside pure market dynamics.

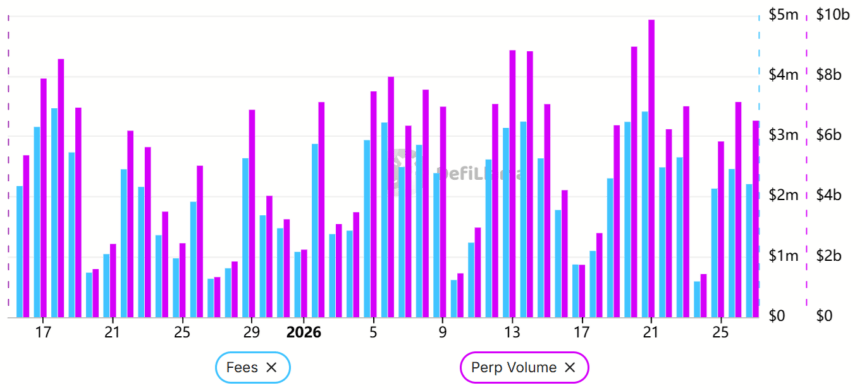

Another dimension of the discussion centers on on-chain versus exchange-driven activity. While some observers pointed to a surge in on-chain activity as a driver of price gains, metrics such as synthetic perpetual volumes and total open interest suggest a more nuanced picture. Hyperliquid’s open interest reached notable levels, but it did not instantaneously eclipse the broader BTC open-interest landscape on centralized venues. The BTC futures market remains significantly larger on major exchanges, underscoring that a single venue’s day-to-day, on-chain pivots are unlikely to redefine a market’s entire price discovery process. The comparison to Binance’s BTC perpetual book—though highlighting relative strengths—also serves as a cautionary note that liquidity can concentrate unevenly across venues, often amplifying volatility during rapid price moves.

In the background, the market also dealt with substantial staking unlocks and historic inflows from large holders. Notable transfers and unlocks—such as a January 21 unlock of 1.47 million HYPE and a separate 1.5 million HYPE unlocked by wallets linked to a Tornado Cash cluster—underline how supply dynamics can shift quickly as large positions become eligible for sale or redistribution. Earlier, Continue Capital was reported to have sold significant quantities of HYPE—an element that complicates the narrative of sustainable demand, since selling pressure can reassert itself even after rallies driven by technical or flow-driven catalysts. Taken together, these developments illustrate how a confluence of corporate actions, on-chain activity, and external investor commentary can generate short-term volatility without necessarily signaling a structural shift in the token’s long-run trajectory.

Beyond the immediate price action, the broader market context matters. The ARK Invest assessment framed Hyperliquid as a participant in an ecosystem where DeFi derivatives could rival traditional exchanges on revenue efficiency, painting a picture of a market that is evolving toward more automated, decentralized liquidity provision. If that trend continues, investors may increasingly assess tokens not just by price momentum but by the resilience of their revenue models, the quality of on-chain activity, and the ability to sustain liquidity across multiple market regimes. As with any nascent crypto-asset narrative, a critical eye toward risk, counterparties, and regulatory developments remains essential for navigating the next phase of movement in HYPE or similar tokens.

What to watch next

- Follow PURR’s treasury disclosures and any new corporate filings to assess whether HYPE remains a deliberate reserve asset or simply a transient inflow.

- Monitor upcoming staking unlocks and related liquidity events to gauge potential selling pressure versus new demand from strategic holders.

- Track on-chain flow shifts and open-interest dynamics across Hyperliquid versus larger venues like Binance, with attention to BTC perpetuals and related markets.

- Watch for additional institutional coverage, particularly from research houses similar to ARK Invest, that may influence risk sentiment and flows into DeFi derivatives.

- Be alert for further on-chain transfers associated with major market makers or custody providers that could signal evolving liquidity provision strategies.

Sources & verification

- Hyperliquid price index and the price move to 34.90 from 21.80 within a two-day window (Cointelegraph).

- Details on staking unlocks and price impact linked to HYPE (Cointelegraph).

- Hyperliquid open-interest and volume context, including comparisons to other venues (DefiLlama-based data referenced in reporting).

- ARK Invest Big Ideas 2026 report citing Hyperliquid as a revenue-efficient DeFi derivatives player (ARK Invest).

What the article changes the conversation about

Hyperliquid’s recent activity spotlights how on-chain flow, treasury partnerships, and institutional analysis can converge to spark a short-term price narrative even when broader market liquidity remains fragmented. The episode emphasizes the need to distinguish between transient catalysts and sustainable demand, especially in a market where large holders, staking unlocks, and cross-venue competition shape price trajectories. For traders, risk managers, and developers alike, the event underscores the ongoing importance of monitoring on-chain activity, counterparty exposure, and macro think pieces that frame DeFi derivatives within a broader finance ecosystem.

Source: X/ lukecannon727

Hyperliquid daily fees and perpetual volumes, USD. Source: DefiLlama

Source: X/ chameleon_jeff