Key Insights:

- India mandates selfies, GPS tracking, and penny drops for crypto exchange onboarding.

- Bitcoin, Zcash, Bittensor, and Solana see short-term gains amid regulatory updates.

- ICOs, ITOs, and anonymous token transactions face strict restrictions under FIU guidelines.

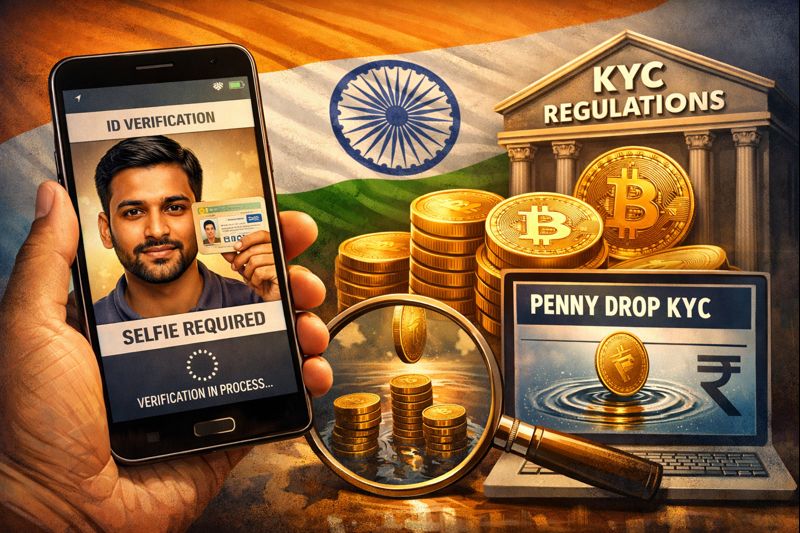

India has strengthened crypto rules, mandating selfies, penny drops, and extensive KYC checks for exchanges. The new measures aim to curb money laundering and terrorism financing. Exchanges must now follow strict onboarding protocols while updating compliance systems.

The Financial Intelligence Unit (FIU) issued the guidelines, expanding the regulatory scope for all virtual digital asset service providers. Exchanges are required to register with the FIU and maintain detailed customer records. Authorities emphasized strict enforcement against unverified transactions and anonymous token use.

The updated rules follow three years of regulatory developments, including initial KYC and reporting standards in 2023. India is intensifying oversight amid growing crypto adoption and potential misuse risks. The measures highlight a shift toward more structured digital asset regulation.

Bitcoin Gains Amid Regulatory Updates

Bitcoin rose 1.8% to $92,054 as markets reacted to broader financial uncertainty. The cryptocurrency led a market capitalization increase to $3.2 trillion. Trading volume showed rising interest despite lingering market caution.

BREAKING 🇮🇳

India just tightened crypto rules.

Exchanges must now use

Live selfie KYC

Location and IP checks

Bank account verification

Govt ID plus phone and emailAt the same time, tax officials say crypto and DeFi make tax collection harder.

India is one of the world’s… pic.twitter.com/R8LPZcqrZ7

— BlockchainedIndia (@blockchainedind) January 12, 2026

The Crypto Fear & Greed Index stayed in the “Fear” zone at 27, reflecting ongoing uncertainty. Liquidations jumped 136% to $165 million while open interest slightly increased to $139 billion. Price movements indicate speculative activity driven by external market events.

Bitcoin faces resistance near $98,000, and short-term gains may not translate to sustained long-term trends. Analysts suggest liquidity recovery supports potential momentum in January and February. Market volatility remains elevated due to political and financial pressures globally.

Altcoins See Mixed Performance

Zcash surged 10% to $414, showing strong short-term demand. Investors increased exposure amid crypto market fluctuations. Zcash’s momentum reflects targeted buying rather than broader market confidence.

Bittensor rose 3.2% to $290, attracting attention from niche crypto participants. Its trading volume remains moderate compared to leading assets. The token’s growth coincides with overall market recovery signals.

Solana increased 5.2% to $142, benefiting from renewed trading interest. Network activity and adoption metrics have improved, supporting price gains. Market participants remain alert to potential shifts in momentum.

FIU Enforces Onboarding and Transaction Rules

Exchanges must collect PAN, selfies with liveness detection, and GPS coordinates of users. Verification also includes email, mobile OTP, and additional identity documents. These measures aim to ensure genuine user presence and prevent fraud.

The penny drop method now mandates recording of bank account verification and location timestamps. FIU emphasized preventing anonymous transactions and crypto mixers from operating within India. ICOs and ITOs are restricted due to high money laundering and terrorism financing risks.

Exchanges must update KYC every six months for high-risk users and yearly for others. Regulatory oversight now includes real-time monitoring of suspicious transactions. The FIU’s measures aim to strengthen India’s digital asset compliance framework.