Cryptocurrency markets have experienced significant volatility recently, with Bitcoin’s (BTC) price slipping below the $100,000 mark. Despite the current downturn, institutional involvement in the crypto space continues to grow, reflecting long-term confidence in digital assets. Major developments include expanded crypto trading services from US-based platforms, increased corporate Bitcoin holdings, and legislative approvals that streamline staking opportunities for institutional investors. These trends highlight the evolving landscape of crypto regulation and institutional adoption amid market fluctuations.

- Institutions now hold approximately 14% of Bitcoin’s total supply, adding to ongoing debates about centralization.

- US regulators approval for crypto staking within exchange-traded products (ETPs) aims to simplify tax reporting and boost institutional confidence.

- Major financial firms, including SoFi, are launching retail crypto trading, encouraged by policy relaxations from the OCC.

- The Singapore Exchange (SGX) introduces perpetual futures trading on Bitcoin and Ethereum, aligning with rising institutional demand.

- Hong Kong issues its third blockchain bond offering, attracting a broad spectrum of institutional investors despite market headwinds.

Markets fluctuate, but institutional engagement persists

Despite a recent downturn that saw Bitcoin’s price dip below the $100,000 level, institutional interest in digital assets continues to expand. US-based digital trading platforms and chartered banks are now opening crypto trading services to institutional clients, while the Singapore Exchange is progressing with new derivatives offerings.

Recent policy changes have paved the way for more crypto-related financial products, including exchange-traded products (ETPs), broadening access for institutional investors in the rapidly evolving DeFi and blockchain sectors. Market participants are viewing this correction as a temporary phase, with many maintaining a long-term outlook on digital asset adoption.

Corporate Bitcoin holdings reach 14%

Institutions and publicly traded companies holding Bitcoin on their balance sheets now account for roughly 14% of the total supply, excluding holdings by Bitcoin miners, sovereign nations like El Salvador, and DeFi protocols. This concentration of BTC in corporate hands has sparked discussions about potential centralization, reminiscent of gold’s “nationalization” in the 1970s.

This trend highlights a shift towards greater corporate participation, although experts like Nicolai Søndergaard of Nansen emphasize that Bitcoin’s core decentralization remains intact.

“Even if custody becomes more centralized, the network’s fundamental properties remain unaffected,” Søndergaard stated, underscoring the resilience of blockchain decentralization principles.

SoFi launches retail crypto trading in the US

Financial services company SoFi announced it will soon offer crypto trading options for retail customers in the United States, making it the only nationally chartered bank to do so. CEO Anthony Noto explained that the recent regulatory relaxations from the US Office of the Comptroller of the Currency (OCC) have made this possible.

“For two years, we couldn’t provide our customers with the ability to buy, sell, or hold cryptocurrencies as a bank,” Noto said. However, recent policy updates now permit crypto custody, stablecoin activities, and participation in distributed ledger networks, opening new opportunities for institutions and retail investors alike.

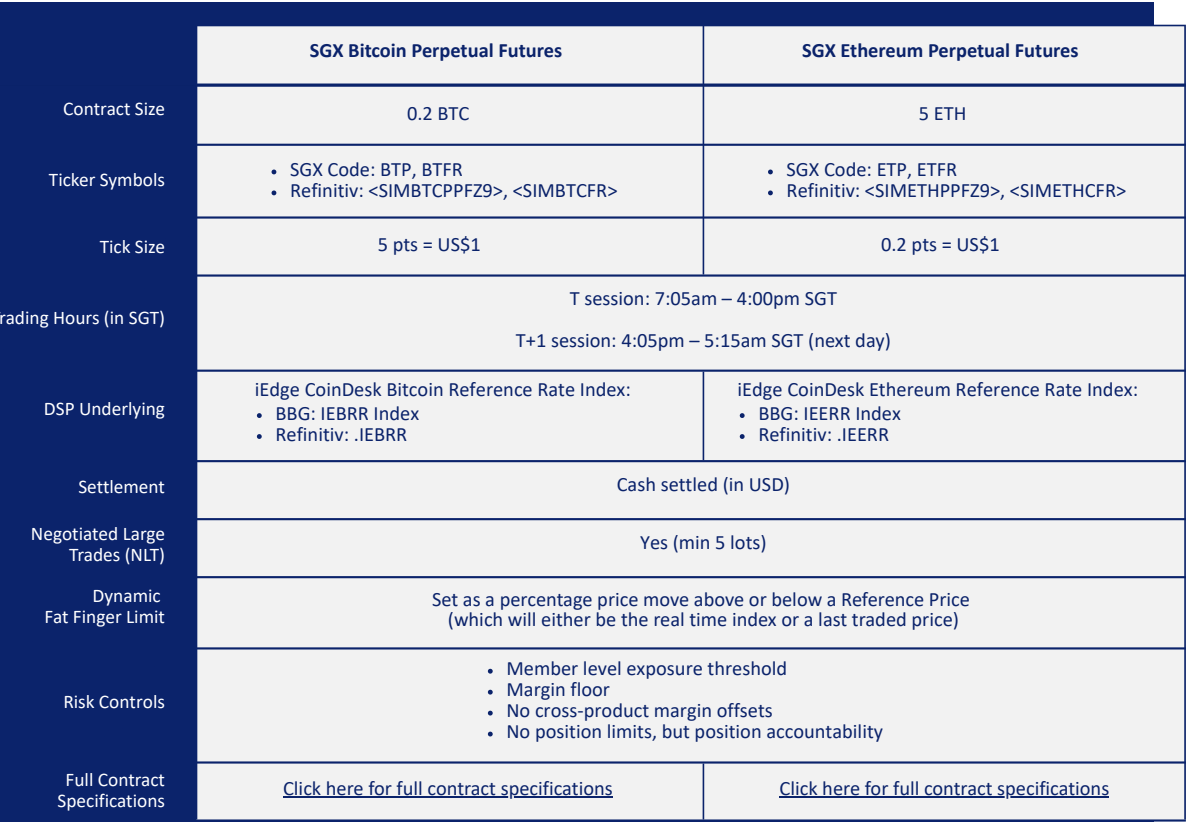

SGX launches perpetual futures trading on Bitcoin and Ether

Singapore Exchange’s derivatives division announced the launch of perpetual futures contracts on Bitcoin and Ether, set to debut on Nov. 24. The move stems from increasing institutional demand and aims to bridge traditional finance with crypto markets.

These contracts, designed for accredited and professional investors, offer high leverage options without expiry dates, making them a popular choice among global crypto traders. Singapore’s regulatory authority, MAS, oversees these new offerings, representing a significant step toward institutional integration.

IRS approves crypto staking within ETPs

The U.S. Internal Revenue Service has issued guidance allowing exchange-traded trusts that hold a single digital asset like Ethereum to earn staking rewards while maintaining their tax status as grantor trusts. This move simplifies tax reporting for institutional crypto products and encourages further innovation in crypto ETFs and ETPs.

Officials like Treasury Secretary Scott Bessent emphasize that this clarifies the tax treatment, making the U.S. more competitive in the global crypto industry. This regulatory clarity could boost institutional staking strategies and drive further participation in DeFi platforms.

Hong Kong issues blockchain bonds to institutional investors

The Hong Kong government announced the issuance of its third blockchain bond tranche valued at 10 billion Hong Kong dollars (about $1.28 billion). Denominated in multiple currencies, including HKD, RMB, USD, and EUR, the bonds have attracted a diverse range of institutional investors, including first-time participants in digital bonds.

Despite prevailing market volatility, these developments highlight the long-term institutional commitment to blockchain-based financial instruments and digital assets building the future of crypto markets worldwide.