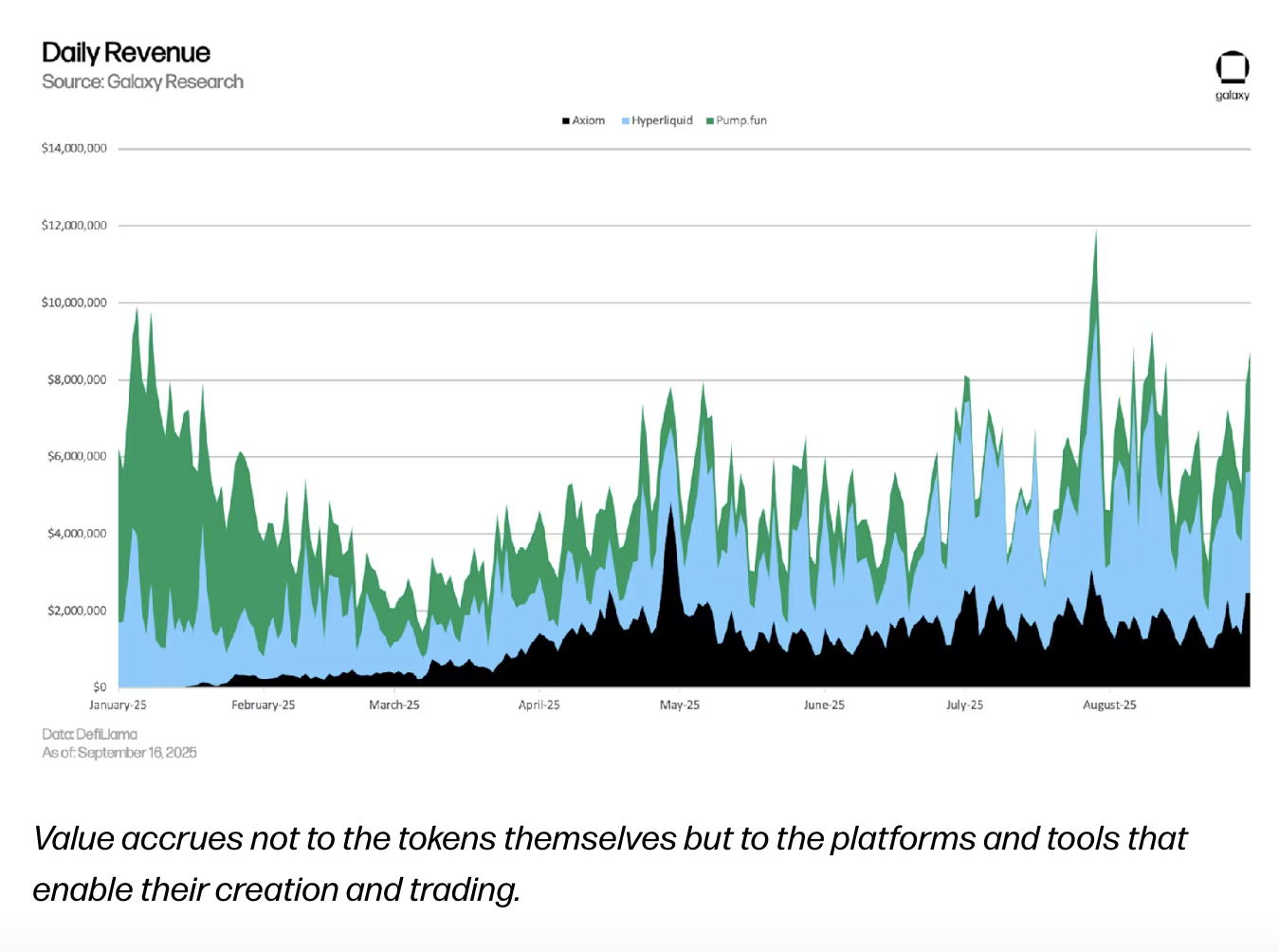

- Memecoin trading largely benefits infrastructure providers, with platforms like Pump.fun capturing millions in revenue.

- Solana’s Pump.fun has seen a dramatic increase in token launches, nearing 13 million tokens across over 32 million on the network.

- Short-term trading times for memecoins have plummeted to around 100 seconds, driven by bots and scalpers.

- Automated trading tools like Axiom, BONKbot, and Trojan have become highly profitable, with Axiom generating over $200 million in fees.

- Despite their speculative nature, memecoins continue to fuel high-volume trading activity, with recent weekly revenues surpassing $13 million for Pump.fun.

Memecoins have long been a controversial yet influential segment of the cryptocurrency markets, attracting curious investors and meme enthusiasts alike. A new report from Galaxy Research sheds light on how this booming sector is financially rewarding infrastructure providers—more than the traders themselves. While most short-term traders face losses, platforms facilitating memecoin trades have amassed significant revenue streams.

The report highlights Solana’s Pump.fun as a key player, which launched in early 2024. Now representing a combined fully diluted market value of $4.8 billion, tokens on Pump.fun have seen massive adoption, with nearly 13 million launched through the platform—an increase of nearly 300% in less than two years. “The platform has industrialized token creation on Solana,” Galaxy Research notes.

Additionally, the report reports a stark decline in the median holding time for memecoins on Solana—dropping to approximately 100 seconds from 300 seconds the previous year—underscoring the high-speed dominance of trading bots and scalpers in this space.

One prominent trading platform, Axiom, illustrates how memecoin activity translates into profits. The firm has generated over $200 million in fees with fewer than ten employees, mainly through fee collection from memecoin traders. Other tools, such as BONKbot and Trojan, earn revenue by automatically sniping new tokens at the moment of launch, capitalizing on the fast-paced trading environment.

Platform growth remains robust, with Pump.fun’s token launch on July 12 raising an impressive $500 million within minutes, and weekly revenues peaked at over $13 million. Data from DeFiLlama shows that, between August 11 and August 17, Pump.fun generated nearly $13.5 million, marking one of its strongest weeks since its inception.

In September, Pump.fun surpassed $1 billion in trading volume in a single day, with total fees collected over the last month estimated at approximately $120 million. Despite their primarily speculative character, memecoins continue to influence crypto markets significantly, fueling high-volume trading and substantial revenue for platform operators.

As the memecoin craze persists, the industry remains a vivid illustration of how blockchain infrastructure and automated trading tools profit from the speculative side of crypto markets, emphasizing the evolving landscape of crypto trading and platform monetization.