New York Stock Exchange Hosts Satoshi Nakamoto Statue, Signaling Mainstream Acceptance

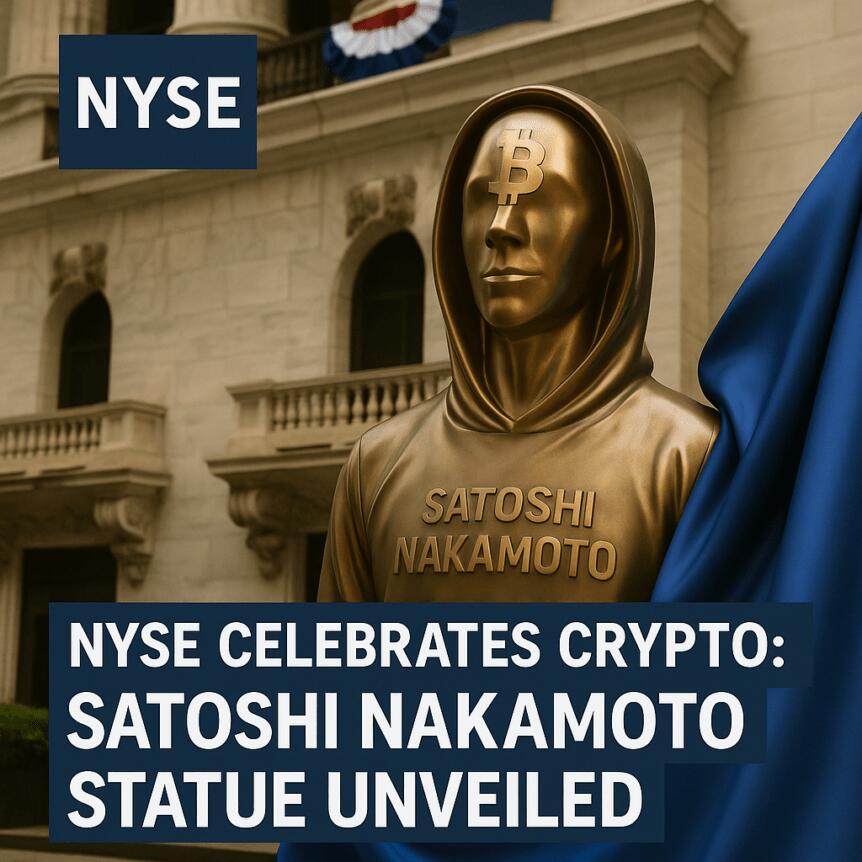

The New York Stock Exchange has become the latest high-profile venue to display Valentina Picozzi’s “disappearing” Satoshi Nakamoto statue, marking a significant milestone for cryptocurrency recognition on Wall Street. This installation, now in its sixth location, highlights the growing institutional acknowledgment of Bitcoin’s cultural significance and the shifting perception of digital assets from fringe technology to mainstream financial instruments.

Key Takeaways

- The NYSE’s endorsement elevates Bitcoin’s status within traditional finance circles.

- The statue, created by Picozzi, symbolizes the elusive and pioneering spirit of Nakamoto, the pseudonymous creator of Bitcoin.

- The installation coincides with the anniversary of Bitcoin’s inception and the Bitcoin mailing list launch in 2008.

- Picozzi plans to place a total of 21 statues worldwide, representing Bitcoin’s maximum supply.

Tickers mentioned: Bitcoin

Sentiment: Bullish

Price impact: Positive; the symbolic gesture signifies increasing institutional acceptance of Bitcoin.

Trading idea (Not Financial Advice): Hold; ongoing institutional interest suggests strong fundamentals for long-term investors.

Market context: Bitcoin’s transition from a niche cryptocurrency to a recognized asset class reflects broader mainstream adoption trends amid growing institutional participation.

Bitcoin’s Journey to Mainstream Recognition

Satoshi Nakamoto mined the inaugural block of Bitcoin on January 3, 2009, which contained the first 50 coins and laid the foundation for the entire cryptocurrency industry. The journey from a revolutionary concept to a valuable asset has been marked by both skepticism and innovation. The earliest real-world transaction occurred on May 22, 2010, when programmer Laszlo Hanyecz famously paid 10,000 Bitcoin for two pizzas, illustrating Bitcoin’s potential as a medium of exchange.

Despite initial resistance from traditional financial institutions and regulatory bodies, Bitcoin has gradually gained legitimacy. Notable figures like BlackRock CEO Larry Fink have acknowledged its potential, with many major corporations increasingly integrating Bitcoin into their treasury management, ETFs, and investment portfolios. Today, over 3.7 million Bitcoin, valued at more than $336 billion, are held by public and private entities worldwide.

Public Display of Nakamoto’s Legacy

Picozzi’s statues aim to honor Nakamoto, with additional sculptures located in Switzerland, El Salvador, Japan, Vietnam, and Miami. Her vision is to place a total of 21 statues around the globe—symbolic of Bitcoin’s capped supply—each representing a tribute to innovation, transparency, and decentralization. The statues evoke Nakamoto’s enigmatic persona: sitting with a laptop, embodying the pioneer hacker and programmer who introduced a paradigm shift in the financial world.

Picozzi notes that her art seeks to evoke Nakamoto’s elusive presence, emphasizing that Satoshi exists within the lines of Bitcoin’s code, a testament to the decentralized and invisible nature of the technology. Her work underscores the ongoing cultural and technological influence of Bitcoin, transforming it from an abstract idea into a tangible symbol of financial freedom and transparency.