- A new proposal aims to eliminate Polygon’s 2% annual inflation and introduce a treasury-backed buyback or burn policy to support token value.

- The suggestion follows POL’s 46% decline over the past year, prompting calls for alignment with deflationary models seen in other leading cryptocurrencies.

- Community and industry leaders are actively debating the feasibility and impact of the proposed changes, amid growing competition for blockchain scalability solutions.

- Polygon continues to attract developers and expand its real-world asset tokenization, though its price performance raises concerns among investors.

A new community-led proposal to fundamentally revise Polygon’s tokenomics is gathering momentum, reflecting growing investor dissatisfaction with POL’s recent underperformance despite a generally bullish crypto market environment. The proposal, originating from activist token investor Venturefounder, suggests critical changes to the project’s supply structure to address persistent market pressures and restore confidence among stakeholders.

The focus of the proposal is to remove Polygon’s current 2% annual inflation rate, which adds roughly 200 million new POL tokens each year, thus putting downward pressure on its price. Instead, it recommends either adopting a fixed supply model or gradually tapering inflation by 0.5% quarterly until it reaches zero. Such deflationary approaches have proven beneficial for tokens like BNB, Avalanche, and Ether, which have seen their value strengthened through supply discipline.

“These changes are intended to align the supply dynamics of POL with its current technological and strategic reality, reinforce investor confidence, and prevent further token devaluation and network stagnation,” Venturefounder stated on the governance forum.

The proposal emphasizes that POL’s declining value—dipping by 46% over the year and trading below 2022 bear-market lows—is “inexcusable” during what many consider a crypto bull market driven by Bitcoin and Ethereum. The community-wide manifesto, which has garnered over 25,000 views on social media platform X, criticizes the project’s strategic missteps since 2022, calling for more transparent communication and faster delivery of infrastructure projects like AggLayer.

Polygon’s leadership has begun to acknowledge the ongoing debate. Brendan Farmer, a co-founder, responded to the discussions, while Polygon Labs CEO Marc Boiron has publicly recognized the proposal’s importance. The conversation continues on the platform’s forum as members evaluate the practicality of funding validator rewards without inflation and maintaining network security through buybacks.

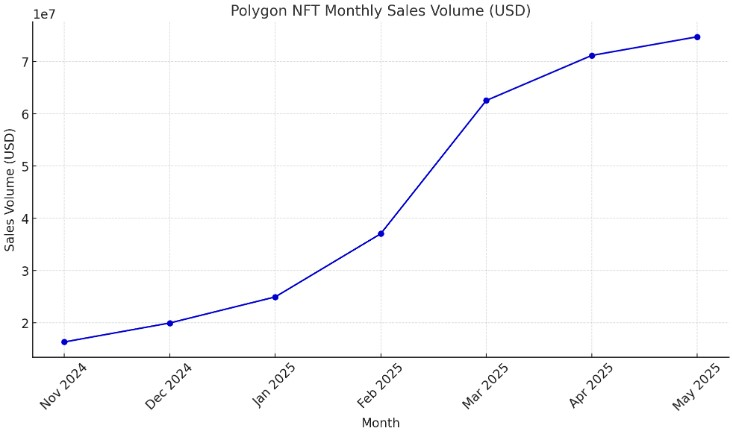

Despite recent price struggles, Polygon maintains a strong developer community, especially among builders prioritizing blockchain scalability and enterprise solutions. Additionally, the project continues to push into real-world asset tokenization, with initiatives like AlloyX’s tokenized money market fund broadening onchain activity. In particular, Polygon’s NFT sales have surpassed $2 billion, demonstrating sustained engagement and growth in its ecosystem.

As the DeFi and NFT sectors continue to expand on Polygon, the network’s strategic direction and tokenomics will remain key factors influencing investor confidence and market positioning. With growing competition from layer-2 solutions like Arbitrum and Optimism, Polygon’s ability to adapt and innovate remains crucial for its continued relevance in the competitive crypto landscape.